Three years ago, I decided to give my oldest daughter a credit card. She was in 10th grade then. I debated between a Visa card and an American Express card. Ultimately, I added her as authorized user under my American Express Everyday® Preferred Card. Looking back, I strongly believed that I made the right call. I think the Amex Everyday® card is the best credit card for teenagers.

[READ ABOUT American Express Everyday Cards]

The best credit card for teenagers

I doubt 10th graders can get their own credit card. But even if they could, why would you let them do that? Adding them as authorized users under your name would be a safer bet and provides many benefits. I set very specific rules for my daughter for using the credit card – what can be charged and how much, and I monitor her usages closely! There are five reasons why I think the American Express Everyday card is the best credit card for teenagers.

I doubt 10th graders can get their own credit card. But even if they could, why would you let them do that? Adding them as authorized users under your name would be a safer bet and provides many benefits. I set very specific rules for my daughter for using the credit card – what can be charged and how much, and I monitor her usages closely! There are five reasons why I think the American Express Everyday card is the best credit card for teenagers.

#1: Different card numbers for easy tracking

Unlike Visa or Mastercard, American Express assigns a different number for each cardholder. This was the ultimate reason why I went with American Express for my daughter’s card. Different card numbers makes tracking super easy! Also unlike Visa or Mastercard, Amex lists charges clearly for each cardholder, and provides the total amount spent by each cardholder on the monthly statement. I even set up a separate Amex login for my daughter. Not only she has her own Amex Offers, most importantly she gets the opportunity to learn about how to monitor and manage her expenses.

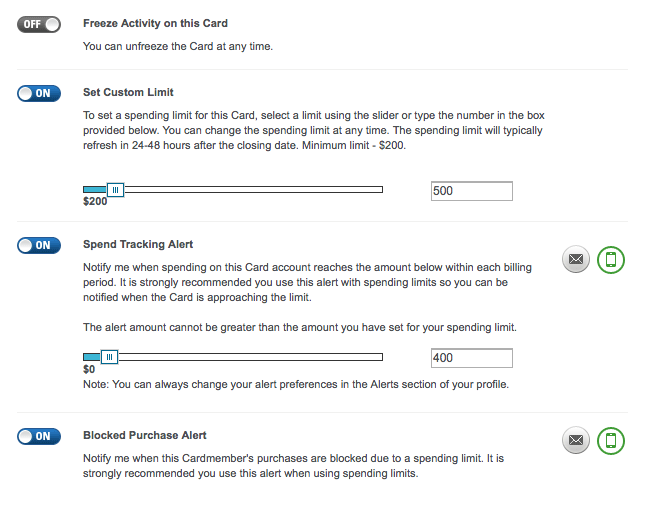

#2: You can assign a limit for the teenager

Worry about the teenager charge too much on the credit card? American Express allows you to set a custom limit and receive an Alert whenever the balance reaches the spending threshold that you determine. This custom limit can be modified or removed at any time. You can also freeze activity on the card at any time!

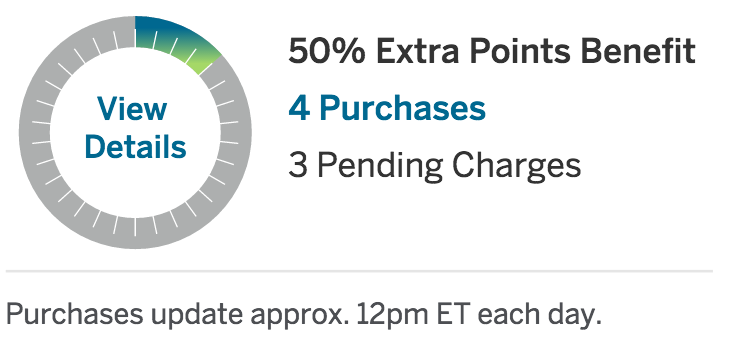

#3: Reach monthly transaction threshold easily

One of the unique features of the Everyday card is a monthly bonus not based on the amount spent, but on transaction volume. The Everyday card offers a 20% bonus on points earned after 20 transactions are made during the billing period, and the Preferred card has a 50% bonus after 30 transactions.

Teenagers makes lots of small purchases! A coffee here, and Jamba Juice there. Before you know it, you reach the monthly transaction threshold in no time. While my daughter makes small purchases, I put my big purchases on the card! And every purchase earns bonus points! Those bonus points do add up nicely over time! They certainly played a role in how I earned 1.6 million points in 2016.

[READ ALSO: What counts as a “month” for the Amex Everyday card ]

#4: Their purchases will earn category bonus just like yours!

The card comes with category bonus for purchases at supermarkets (up to $6,000 per year) and gas station.

- Everyday card – 2x supermarket and 1x gas station

- Everyday Preferred card – 3x supermarket and 2x gas station

When my daughter goes shopping at Sephora, Macy’s, Forever 21, or any stores, I told her to stop by our local Safeway to pick up a gift card first. Sometimes she does my grocery shopping too. Each year I max out the $6,000 annual limit at grocery stores and she certainly contributed. She also puts gas in her car every two weeks or so. All her charges on the card earns extra points regardless how small the amounts might be!

#5: Help the teenager build credit history

I had to provide my daughter’s social security number when I added her as authorized user under my name. While I am responsible for payment on the card, the card’s pristine payment history also shows up on her credit report. This will help her build her own credit without any downside risk.

Conclusion

Whether you choose the regular Amex Everyday® Card from American Express or the Amex Everyday® Preferred Card from American Express, either one is the best card for a teenager. If you would like to support PWaC and sign up for either of these cards, you can check out top American Express card offers on our top credit card offers page.

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Are you kidding? Credit cards for teenagers is ridiculous. I’m disappointed in you for encouraging this idea.

Obviously different people / parents can do things however they think is best, but I feel like giving teenagers a bit of responsibility / teaching them to be financially responsible while they’re still in your home and you have some measure of control over them is a bit better than having them try to figure it out when they’re officially “adults” and out of your house!

I am not trying to encourage others to do what I do. Obviously every parents have their own principles and guidelines. What Dan said was exactly the reason why I decided to give my daughter a credit card. I can also monitor how she spends the money which I otherwise won’t be able to do if I give her cash for everything! I set very strict rules and she knows that.

I’m with Dan and Sharon . . .

I agree with Dan and Sharon. My older kids (4 so far) each opened a checking account with a debit card at age 13 and received a credit card (authorized user on my account) at age 15. My oldest two are adults now and are very responsible with their money. They learned to manage their own finances at a young age. These are life skills that take time to learn and I am glad I gave them the opportunity to master them while they were young and the stakes were not as big.