Now, I love Southwest, especially if you can earn 110,000 points in a year to get the companion pass. Because they have a different redemption tier than most of the other airlines, it serves as a counterweight to those programs. While American (and United and Delta) all offer zone redemptions, where, for example, any roundtrip ticket in the US costs 25,000 miles, Southwest’s redemptions are price based.

Now, I love Southwest, especially if you can earn 110,000 points in a year to get the companion pass. Because they have a different redemption tier than most of the other airlines, it serves as a counterweight to those programs. While American (and United and Delta) all offer zone redemptions, where, for example, any roundtrip ticket in the US costs 25,000 miles, Southwest’s redemptions are price based.

Currently, each point can get you 1.67 cents of value. So if there’s an $89 flight, then that costs 5329 points to redeem ($89 / .0167) – doesn’t matter where it is at all. There is an impending devaluation, so as of March 31, points will only get you 1.43 cents in value (making that $89 flight cost 6224 points), but still, it helps the deal seeking flyer know what they can get for what.

The downside to this is that you can’t use miles on “aspirational” rewards to get a ton of value out of your points. I wrote an article awhile back that compared a flight from Guam to Auckland, New Zealand where you could spend 42,500 United miles instead of paying the “regular” price of $8,947.50

That’s a value of over 21 cents per mile (sort of). I say sort of because nobody would ACTUALLY pay that much for that flight, but these kinds of super-charged values are impossible on Southwest. Your points are worth 1.67 (soon to be 1.43) cents no matter what. And again, that’s okay! You just need to know that, and know when is and is not a good time to use them. (Hint: It’s on the $89 flights, not the $8900 flights)

That’s a value of over 21 cents per mile (sort of). I say sort of because nobody would ACTUALLY pay that much for that flight, but these kinds of super-charged values are impossible on Southwest. Your points are worth 1.67 (soon to be 1.43) cents no matter what. And again, that’s okay! You just need to know that, and know when is and is not a good time to use them. (Hint: It’s on the $89 flights, not the $8900 flights)

Why you shouldn’t spend money on your Southwest card

So after all I say about why Southwest is a good airline, why should you not spend money on your Southwest credit card? It’s exactly because of those fixed values. You know that every dollar that you spend on the Southwest card will net you 1.67 cents of value.

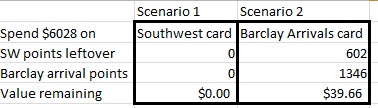

Compare that to something like the Barclay Arrivals card, which we picked up in my latest churn. Each dollar you spend on the Arrival card gives you 2.2 cents of value (including a 10% rebate if you redeem your points for travel). Let’s use an example.

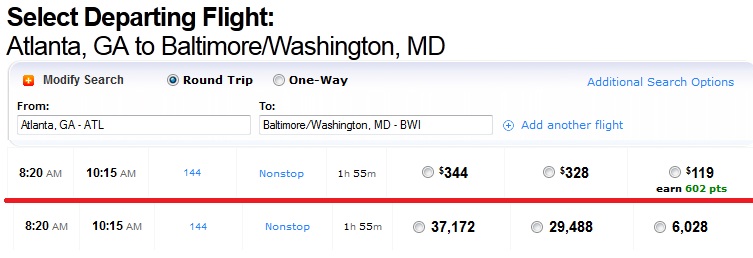

Flight from Atlanta to Baltimore later this month. It’s a $119 flight, or you can pay for it with 6,028 points. Actually that math doesn’t add up but I’m not sure why that is – but let’s just go for it for the sake of example.

Earning those 6028 points will take spending $6028 on your Southwest card (assuming no bonus categories). But if we spent that same $6028 on the Barclay Arrivals card, that would get us 12,056 Arrival points. We would use 11,900 Arrivals points to book the $119 flight

Then we would actually earn 602 points from traveling on Southwest (remember, to the airline, this is a fully paid fare). Plus we’d have 156 Barclay Arrival points leftover, AND earn a 10% rebate because we redeemed for travel.

Seems like a clear winner, right?

Seems like a clear winner, right?

Now I don’t mean to say that these cards are not worth HAVING – they certainly are, and I have one of both (personal and business). But after spending enough on the cards to get the signup bonuses (and a little more to get the companion pass), I’ll be putting my day-to-day spending elsewhere.

50,000 point bonuses expiring today

There have been several reports from the blogosphere that the current offer of 50,000 points for personal and business Southwest cards is expiring today (March 5th). Last time this happened (back in October), the affiliate links used by bloggers expired but you were still able to get it if you went to Southwest directly. We don’t know if that will happen again, but if you were on the fence as to whether or not to sign up for one of these cards, today is the day. Link is at https://creditcards.chase.com/a1/southwest/travel

Southwest expanding travel dates

Southwest is unique among airlines (again) in that they only release certain dates of their schedule. Last time they opened up the schedule through August 8th, and they just announced that they have opened it through October 31st. This will likely be your last chance to book travel before the devaluation at the end of March, so if you have travel to book with points, you should do it now. I still need to book our family’s tickets to Lake Tahoe this summer.

International availability

You can now use Southwest points to book to several different international destinations, which is a first on this (previously entirely) domestic airline

You can book to Aruba, Cancun, Montego Bay (Jamaica), Nassau (Bahamas) and San Jose Cabo (Mexico).

You can book to Aruba, Cancun, Montego Bay (Jamaica), Nassau (Bahamas) and San Jose Cabo (Mexico).

What about you? Where will you be heading (on Southwest or other)?

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

If you know you will be using the southwest points with a companion though (and have a lot of travel planned in the next 2 years), it’s essentially like getting 2 points per dollar if spend. This means you are getting 1.67×2=3.34 cents per dollar. Of course the same or similar could be said for any chase card that earns transferable points, but in the few instances that someone doesn’t have one of those it could be worthwhile to continue to spend on the southwest card.

How would I book SWA with arrival points?

Just book a Southwest flight with your Arrival card and then you can redeem your Arrival points for it on Barclay’s site. Email me if you still have questions at dan at pointswithacrew dot com