One of the more popular ways to manufacture spending involves buying American Express gift cards when they have a large portal bonus (typically this would be 2% or 2.25%)

One of the more popular ways to manufacture spending involves buying American Express gift cards when they have a large portal bonus (typically this would be 2% or 2.25%)

(SEE ALSO: Earning miles through shopping portals)

(SEE ALSO: How to manufacture spending)

A $2000 card was typically the limit of portal cashback, so you might buy a $2000 gift card with a 2.25% portal bonus, netting you $45, which would usually offset the costs of liquidating the $2000 American Express gift card.

I haven’t manufactured spend like this a ton, but I’ve done it a few times.

Major changes to Top Cashback terms

Frequent Miler is usually my go-to source for these deals, and this morning he posted that Top Cashback was offering a 2.25% portal bonus for American Express business cards. I was later alerted by Oren’s Money Saver that $200 was the highest denomination that was eligible for cashback.

Indeed, the terms state:

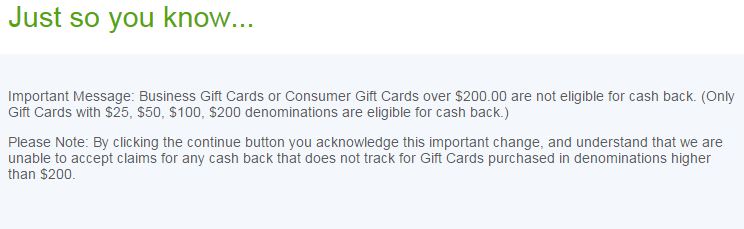

Please note: Business Gift Cards or Consumer Gift Cards over $200.00 are not eligible for cash back. (Only Gift Cards with $25, $50, $100, $200 denominations are eligible for cash back.)

And if you click through from Top Cashback, you are alerted that:

Doh!

This makes the deal quite unattractive, as there’s a processing / transaction fee with each transaction (it’s $3.95). So with shipping, you’re pretty much losing all your portal cash back. Frequent Miler already has some analysis on it, and I agree that this makes it a “NO”.

We’ll see if this is a one-time thing or not, and whether or not the other portals follow suit. My guesses are that NO, it’s not a one-time change, and YES, the other portals will soon follow suit, but we shall see.

If it is true, it just underscores the ideas that

- It’s always a good idea to diversify your manufactured spending

- If you don’t take the time to learn the basic concepts, when things change, you may no longer to meet your spending targets. Remember when Target Red card stopped allowing credit card loads? Or if you remember way back to buying coins through the mint?

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Getting to be pretty normal around this time of year for Amex to restrict/eliminate portal cash back. The last couple of years it’s lasted 6-8 weeks.