I’m a big fan of that one college basketball tournament going on right now whose name I can’t say for fear of violating their trademarks. Last year, we did a “Top Travel Tool March Mayhem” tournament where we ranked the top miles and points tool, with Award Wallet beating out AutoSlash in the finals.

CardMadness

This year I thought I’d try a similar tournament to pick the “best” miles and points credit card. While the definition of a “best” credit card is fairly impossible to judge, since there are so many factors that go into that decision, most importantly figuring out where you want to go before you just sign up for cards, but hey, let’s give it a try!

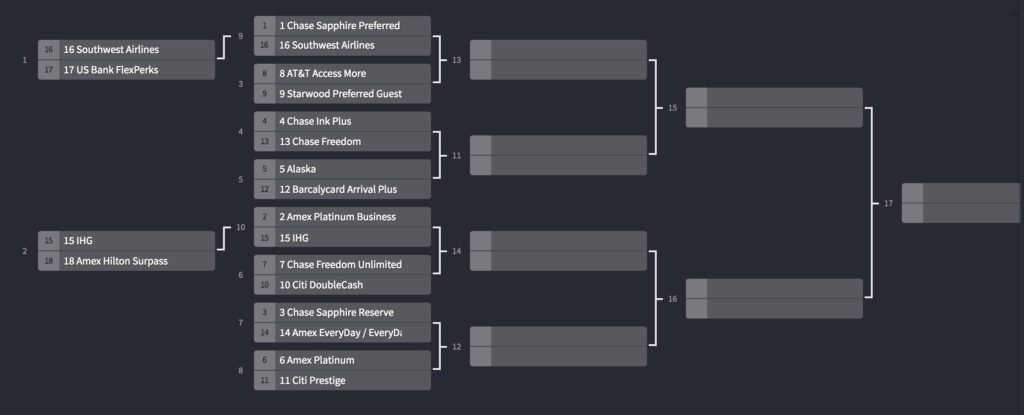

CardMadness bracket

Here is our CardMadness bracket for 2017.

You could certainly argue with some of the seeds I’m sure, but I think it’s a fairly reasonable list.

Card Madness Opening Round

The other opening rounds are still going on and will close next week – you can still vote if you haven’t already

- #4 Chase Ink vs. #13 Freedom and #5 Alaska Airlines vs. #12 Barclaycard Arrival

- #6 Amex Platinum vs Prestige and #3 CSR vs. #14 Amex EveryDay

#1 Chase Sapphire Preferred vs. #16 Chase Southwest Airlines Card

#1 Chase Sapphire Preferred – The CSP spent many years at the top of the miles and points travel rankings. In fact, I’ve written before about how it seems like the Chase Sapphire Preferred was the #1 card I would recommend to people just starting out. In 2016, the introduction of the Chase Sapphire Reserve temporarily supplanted the CSP at the top of most people’s rankings. But with the bonus on the CSR back down to 50,000 points, the lower annual fee moved the CSP back up to the #1 seed. Here’s a comparison of the Chase Sapphire Preferred vs. Chase Sapphire Reserve.

#1 Chase Sapphire Preferred – The CSP spent many years at the top of the miles and points travel rankings. In fact, I’ve written before about how it seems like the Chase Sapphire Preferred was the #1 card I would recommend to people just starting out. In 2016, the introduction of the Chase Sapphire Reserve temporarily supplanted the CSP at the top of most people’s rankings. But with the bonus on the CSR back down to 50,000 points, the lower annual fee moved the CSP back up to the #1 seed. Here’s a comparison of the Chase Sapphire Preferred vs. Chase Sapphire Reserve.

[How do you destroy a metal credit card like the Chase Sapphire Preferred?]

The CSP comes with 50,000 Ultimate Rewards as a signup bonus, and is considered a premium Chase card, allowing you to transfer your Ultimate Rewards to travel partners. It also comes with premium car rental insurance and travel protection.

#16 Chase Southwest Airlines Rapid Rewards® – The big benefit of the Southwest personal and business cards are the ability to get the Southwest Companion Pass, which you can get by earning 110,000 Southwest points in a calendar year. [3 ways to get the Southwest Companion Pass in 2017 without flying]. Bonuses on the various Southwest cards usually go as high as 50,000 or 60,000 points, with a $69 – $99 annual fee. These cards are not great for any additional spend after meeting your minimum spend and getting the companion pass. If you have a Chase Sapphire Reserve card (#3 seed), even spend on Southwest flights would be better put on a Chase card. [Does the Chase Sapphire Reserve make Rapid Rewards obsolete?]

#16 Chase Southwest Airlines Rapid Rewards® – The big benefit of the Southwest personal and business cards are the ability to get the Southwest Companion Pass, which you can get by earning 110,000 Southwest points in a calendar year. [3 ways to get the Southwest Companion Pass in 2017 without flying]. Bonuses on the various Southwest cards usually go as high as 50,000 or 60,000 points, with a $69 – $99 annual fee. These cards are not great for any additional spend after meeting your minimum spend and getting the companion pass. If you have a Chase Sapphire Reserve card (#3 seed), even spend on Southwest flights would be better put on a Chase card. [Does the Chase Sapphire Reserve make Rapid Rewards obsolete?]

#8 AT&T Access More card vs. #9 Starwood Preferred Guest® Credit Card from American Express

#8 Citi AT&T Access More card – The AT&T Access More card is another grandfathered card that is powerful due to the fact that it gives 3x ThankYou points on most online purchases. I know many product resellers use it for purchases online, and I have used it to get 3x points paying my mortgage through Plastiq. [Currently double signup bonus on Plastiq]. It does have a $95 annual fee, but you also get 10,000 ThankYou points if you spend $10,000 in a year. The AT&T Access More card is currently closed to new cardmembers, but there are still ways to get the card if you want.

#8 Citi AT&T Access More card – The AT&T Access More card is another grandfathered card that is powerful due to the fact that it gives 3x ThankYou points on most online purchases. I know many product resellers use it for purchases online, and I have used it to get 3x points paying my mortgage through Plastiq. [Currently double signup bonus on Plastiq]. It does have a $95 annual fee, but you also get 10,000 ThankYou points if you spend $10,000 in a year. The AT&T Access More card is currently closed to new cardmembers, but there are still ways to get the card if you want.

#9 Starwood Preferred Guest® Credit Card from American Express

#9 Starwood Preferred Guest® Credit Card from American Express – The signup bonuses on the Starwood Preferred Guest® Credit Card from American Express cards have gone as high as 35,000 points, but currently they are at 25,000 points. These cards give benefits at Starwood hotels (including complimentary lounge access!), but a big benefit is that there are ~20 SPG airline transfer partners that you can transfer your points to [SEE: The 3 SPG transfer partners you do NOT want to use]. You also get a 20% bonus transferring to airlines, meaning 20,000 SPG points becomes 25,000 airline miles in most airlines. Also, remember that due to the Marriott / Starwood merger, any Starpoints you have will transfer to Marriott 1:3.

A note on shenanigans – this contest is meant to be in fun and there are no prizes for winning. While I don’t mind if you encourage friends, family members and others to vote for a particular tool, please don’t try to rig the system by voting multiple times. I do reserve the right to disqualify entries and/or just arbitrarily pick a winner if I feel like it.

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments