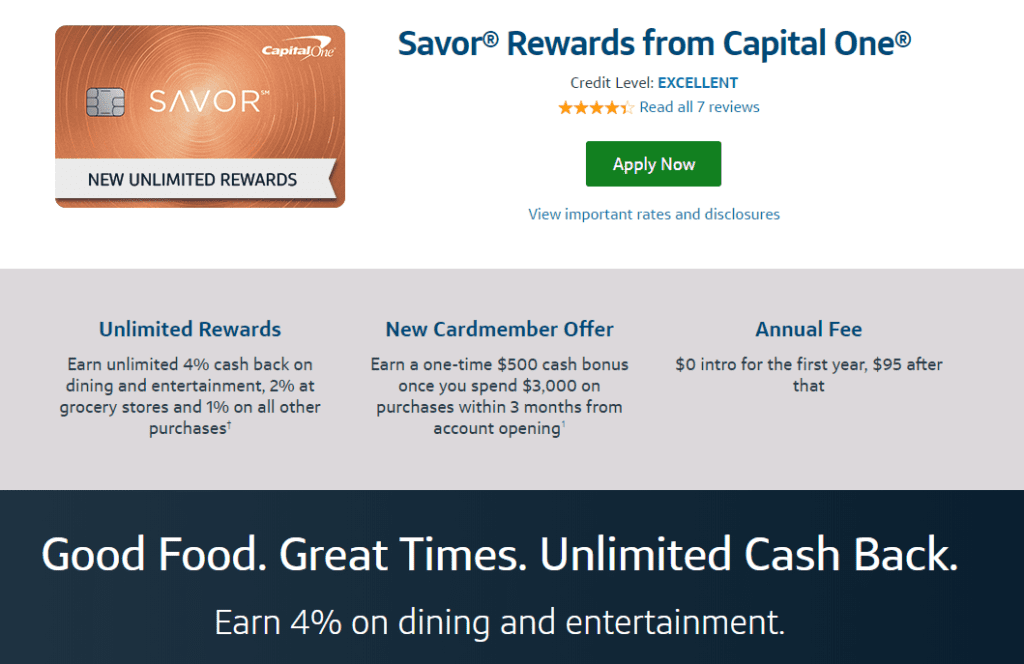

Capital One released a new card this week, the Savor Rewards card! With 4% back on restaurant spend, this has the potential to earn a spot in any self-respecting brunch-lover’s wallet. Keep reading to find out more about the New Savor Card from Capital One!

Here’s the Important Stuff:

- $95 annual fee, waived the first year

- Early spend bonus of $500 cashback after spending $3,000 in the first 90 days

- Earns 4% cashback on dining and entertainment (see below), 2% cashback on groceries, and 1% cashback on everything else

- No foreign transaction fees

- Extended warranty, price protection, travel concierge, and travel assistance

Entertainment is defined broadly, from the new Savor card’s landing page:

Buying tickets to a movie, play, concert, sporting event, tourist attraction, theme park, aquarium, zoo, dance club, pool hall or bowling alley. Also, making purchases at record store and video rental locations. This excludes non-industry entertainment merchant codes like cable, digital streaming, and subscription services.

That makes this card a great option for your foodies out there. The new Savor card will be competing directly with the Barclay Uber card (I’d give Barclay the edge here though, check out our write up!), which earns 4% cashback on dining, 3% on hotels and airfare, 2% on online purchases, and 1% on everything else. If cash is king, I’ll argue the broad 4% cashback category puts it almost on par with the ThankYou Preferred or Chase Sapphire Preferred. I know you won’t get he extra points on hotels and airfare, but worldwide 4% back on restaurants? Huge deal! I’m using points and miles to pay for my flights anyway, remember? Try paying your bartender with your AAdvantage account next time you go out…I didn’t think so!

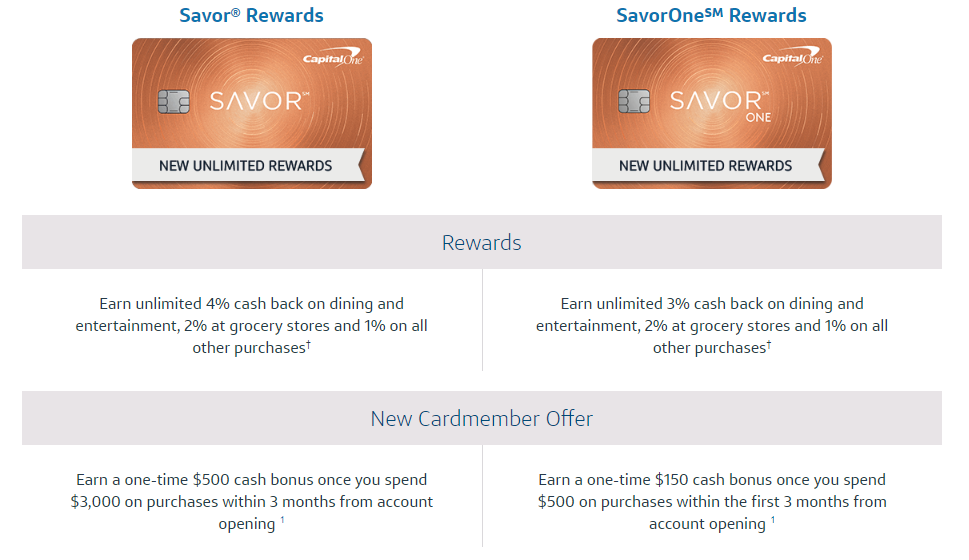

What about the old Savor card?

The old, no-fee version of the card is being rebranded as the SavorOne Rewards Card. The SavorOne will retain all the benefits of the original Savor card, namely no annual fee and 3% cashback on dining/entertainment.

Here’s the interesting part: current cardholders of the original Savor card will be product changed to the new version of the Savor card, but they get to keep the benefit of a $0 annual fee. It’s the best of both worlds! Wait, I know that sounds confusing…

- If you have the old Savor card, you’ll get a NEW Savor card, with 4% on dining and entertainment, and NO annual fee.

- If you don’t have one yet, you can apply for the new SavorOne (identical to the original Savor when it was first released) with only 3% back on dining/entertainment and no annual fee, or…

- Apply for the new Savor card, with $95 annual fee (waived the first year) and 4% back on dining/entertainment.

- Or as always, feel free to sit this one out. Keep reading to see why that might be a good idea…

If you’re not one of the lucky original Savor cardholders, you have a choice between a no annual fee card, or the additional 1% cashback. These are identical cards otherwise, discounting the welcome offer. It’s easy math to figure out, well you spend more than $9,500 on dining in a year? If so, the additional 1% cashback will outweigh the $95 annual fee. Of course, that’s discounting the 2% cashback on groceries, because I think there are better cards for grocery spend.

A Word of Caution

WAIT! Before you hit that apply button, there are some things you should know about Capital One credit cards.

- Capital One typically pulls all three bureaus! While that shouldn’t be an issue for the occasional credit card, it’s a big deal for anyone opening multiple, applying for a mortgage soon, etc.

- They’re also very stingy on approvals. Opened more than a few cards in the past year? No Savor card for you.

- Reconsideration is a pain. If you’re denied, you have to wait for the letter to come in the mail. Once you receive it, you can mail them a letter requesting reconsideration. (That’s right, snail mail.) Then, they’ll pull all 3 bureaus AGAIN.

- You can only open one Capital One credit card every 6 months (inclusive of their business and personal cards).

Check out Reddit and Doctor of Credit for plenty of datapoints (and tears) for Capital One.

Should you open the new Savor card from Capital One?

You know that saying about the tree? The best time to plant it and all that?

Well, the best time to open a Savor card was last year, when they launched it. The second best time is now. If you have a lot of restaurant spend this is a great card with an awesome welcome bonus. Although I’d be hard pressed to spend the $9,500 required to make the annual fee worth it, the welcome offer might sell me on the card. $9,500 in annual restaurant spend is about $800 each month in restaurant and entertainment spend. While I don’t spend nearly that much, some of you festival junkies and budding restaurant critics might be able to make use of it. I’d urge you to also consider the Barclay Uber card though, with the same 4% back on restaurants, but no annual fee.

You can learn more about the Savor Rewards card and also learn more about the SavorOne Rewards card at these links.

Now if you have the old Savor card, grandfathered into no annual fee, that’s great! Let us know if you have one in the comments!

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I FLIPPED when I received my email notification that I would receive the upgraded benefits without the annual fee. Talk about a win-win.

For everyone else’s benefit, though, I would tilt toward the Barclays Uber Visa because it offers that solid 4% on dining without an annual fee.

They’re definitely doing right by their existing customers on this one, t would have been really easy to just swap everyone to the SavorOne benefits, so kudos to Capital One! In most cases though, I agree the Uber card is going to win out.

That $500 welcome offer does sound enticing though…