We’ve talked before about how Barclay Arrival points can be some of the best points out there, especially for newcomers or people that aren’t super interested in getting 20 credit cards. The reason for this is that these points can be used for just about everything.

We’ve talked before about how Barclay Arrival points can be some of the best points out there, especially for newcomers or people that aren’t super interested in getting 20 credit cards. The reason for this is that these points can be used for just about everything.

The Arrival points are, in my opinion, the best of the bunch – not only do you get 2 points for each $1 you spend on the card, but as long as you redeem them for travel, you also get a 10% rebate on your points, making each dollar of spending worth about 2.2 cents.

Priority of Spending

In case you missed it, my priority of spending is

- Spending to meet signup bonuses. This is probably the cheapest points you’ll ever get. In some cases, $1000 in spending can get you 50,000 points, meaning each $1 earns you 50 points. Needless to say, 50x is the best deal you’ll ever see out there 🙂

- Spending in category bonuses. Whether it’s 3x on supermarket spending on the new Amex Everyday Preferred card, or the 5x on spending at office supply stores from the Chase Ink card, this would be my next priority.of spending.

- After that, we put our spending on our Arrival card as 2.2% is the next best spending

Redeeming your Arrival points

So Carolyn and I both got Arrival cards back last fall and have been sitting on about 40,000 points each without a good redemption in mind yet, since typically we like to use our points rather than cash for traveling.. But recently one showed up that made sense.

This summer my brother and sister are getting married (not to each other!) My brother’s wedding is at the Mountain Lake Lodge in southwestern Virginia

So to me this is a perfect place for redeeming Barclay Arrival points. I have no flexibility – as the date and place are fixed (assuming that I actually WANT to go to the wedding, it’s only happening in a specific place and time! 😀 )

Redeeming Arrival points Tutorial

So how do you redeem Arrival points? The first thing that is somewhat counter-intuitive is that you actually pay for it first, rather than redeeming it for the actual purchase. In the case of most flight redemptions, you redeem your points INSTEAD of paying for the flight, but that’s not how this works. So in this case, I called up Mountain Lake and paid for my stay with my Arrival card.

I had actually not redeemed my points yet so I wasn’t completely sure where to go, but it was pretty easy to figure out.

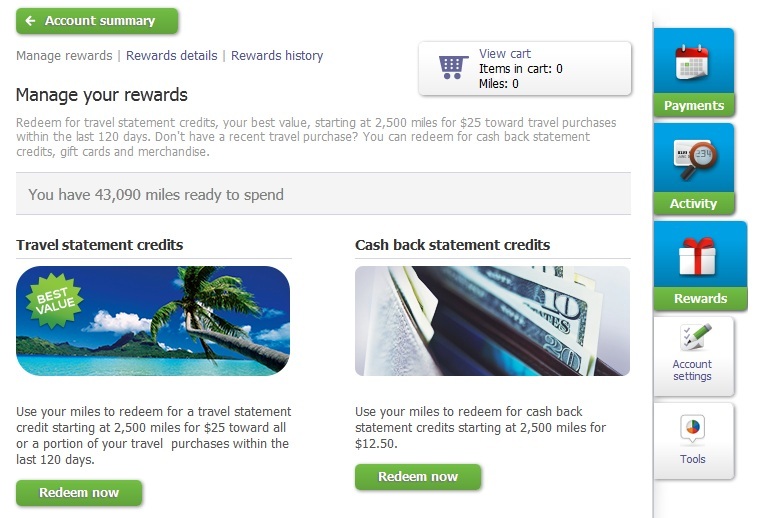

Step 1: Go to your Account Summary, and click on Rewards.

Once you’re on the Rewards screen, you have the choice of cash back statement credits or travel statement credits. You want the travel statement credits (the cash back ones pay out only half as much)

Once you’re on the Rewards screen, you have the choice of cash back statement credits or travel statement credits. You want the travel statement credits (the cash back ones pay out only half as much)

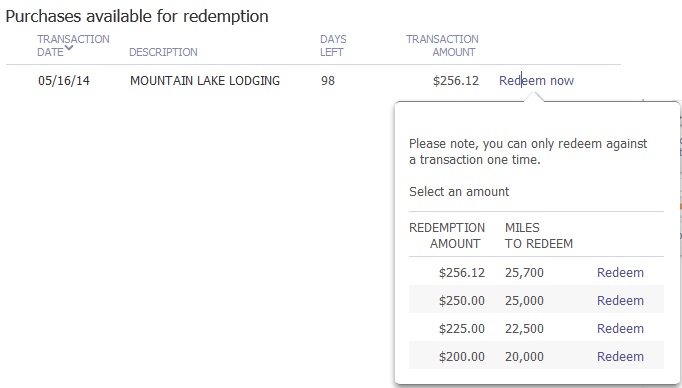

Step 2 – Choose your redemption

You have I believe 120 days after you make the initial purchase to redeem your reward. In my case, this is the only eligible redemption, so I clicked on Redeem. Once I did, that brought up the popup at the below where I could choose how many points I wanted to redeem. I chose the top version, but yes, in case you were wondering, it DID pain me to leave those 88 cents on the table…. what can I say, I’m frugal!

You have I believe 120 days after you make the initial purchase to redeem your reward. In my case, this is the only eligible redemption, so I clicked on Redeem. Once I did, that brought up the popup at the below where I could choose how many points I wanted to redeem. I chose the top version, but yes, in case you were wondering, it DID pain me to leave those 88 cents on the table…. what can I say, I’m frugal!

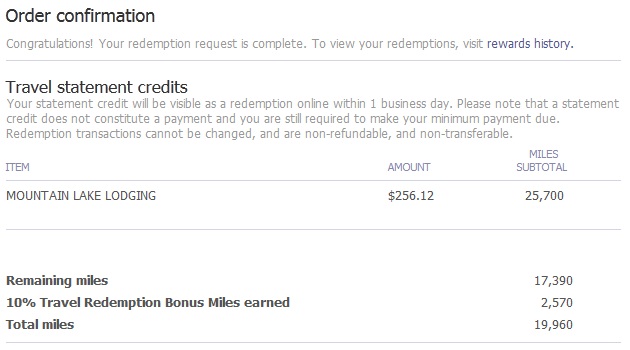

Step 3 – Receive a 10% bonus

You’re then taken to a screen where your redemption is displayed. As you can see, my balance was debited by the 25,700 miles that I spent on the lodge, but then credited with a 2,570 bonus for redeeming points for travel, leaving me with a balance just shy of $200.

You’re then taken to a screen where your redemption is displayed. As you can see, my balance was debited by the 25,700 miles that I spent on the lodge, but then credited with a 2,570 bonus for redeeming points for travel, leaving me with a balance just shy of $200.

One nice thing about the Arrival, as opposed to US Bank FlexPerks or Citi ThankYou points, is that you are allowed to redeem for partial amounts. For example if I wanted to spend $200, I would be able to redeem my 19,960 miles, leaving me with a 40 cent balance. With FlexPerks, a $400 flight costs 20,000 points, while a $401 flight costs 30,000 points. Major bummer!

I hope this was helpful – do you have any Barclay Arrival redemptions upcoming?

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments