As I continue to enjoy racking up Hilton Honors Points through my portfolio of cards, this is another great way to boost your points bank! Hilton is doing a 100% bonus on the points you buy until December 18th.

Hilton Honors Points 100% Bonus

I currently value Hilton Honors Points at 6/10 of a cent per point (.006). You are able to purchase up to 80,000 points, which will earn you an extra80,000 on top, for $800 USD. This leaves you a value of 1/2 a cent per point (.005), which is a bit under my value. It is up to you to decide how much they are worth. But the real value is how you use them!

My family just stayed 5 nights at the Homewood Suites Orlando International Drive for only 140,000 Hilton points, and got a free upgrade to a 2 bedroom suite. Those rooms were going for nearly $250 / night, which means that we got nearly 1 cent per point value!

While I’m generally against buying points speculatively, if you need some points for your next redemption, it could be worth topping up your account or if you have a specific redemption in mind

(SEE ALSO: When is buying miles worth it? Only in these 3 instances)

However, I recommend applying for a Hilton Honors American Express Card to complement your points purchase (see below). With this, you will be well on your way to a beautiful award stay!

Getting more Hilton points

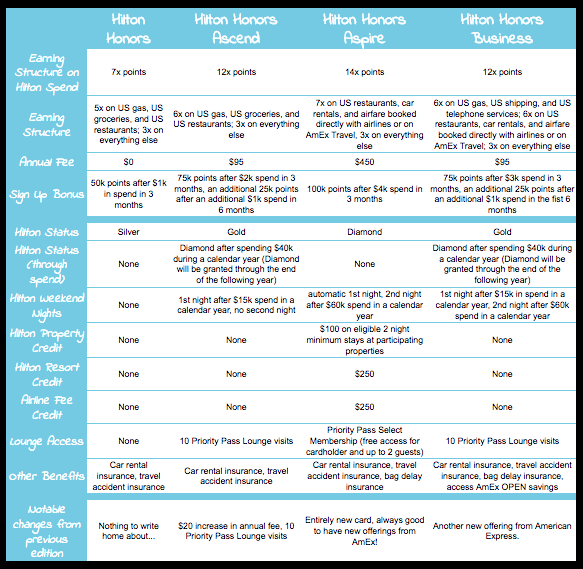

Generally I am more of a fan of using credit card welcome offers to get points instead of buying points. Right now several of the Hilton American Express cards have increased welcome offers.

(SEE ALSO: Taking a Closer Look at the New Hilton Cards from American Express)Hilton Surpass American Express 125k offer)

- Hilton Honors Card from American Express – 75,000 Hilton points after spending $1000 in the first 3 months. No annual fee. Learn more about this card by clicking here

- Hilton Honors Ascend Card from American Express – 125,000 Hilton points after spending $3000 in the first 3 months. $95 annual fee. A free weekend night after spending $15,000 on the card. 10 free Priority Pass lounge visits. Learn more about this card by clicking here

- The Hilton Honors American Express Business Card – This is the one (currently) with the big Hilton 125,000 point welcome offer. 125,000 Hilton points after spending $3000 in the first 3 months. You also get top tier Diamond status by spending $40,000 on the card in a year and the possibility of 2 free weekend nights with spend. This is a business card, though you may have a business even if you don’t really think you do. Learn more about this card by clicking here.

- Hilton Honors Aspire Card from American Express -150,000 Hilton points after spending $4000 in the first 3 months. $450 annual fee but plenty of benefits Learn more about this card by clicking here (not an affiliate link)

KEY LINK: Hilton 100% bonus on purchasing points you buy until February 26th.

Will you buy Hilton points with a 100% bonus?

Note: the affiliate links in this post support the blog and our bloggers. If you do use one of our links, thank you!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The Hilton card has nothing to do with the value of the points. There is no bonus for buying points with the card (or any other card).

It is very difficult to get more than 1/2 cent per point value at the top properties and the 160k points won’t even get you 2 nights at many of them. The main value in having points is the flexibility to cancel without penalty v prepaid rates.

I tend to disagree about only getting 1/2 cent. If you use the 5th night free and stay 5 nights, esp during a peak week like after Christmas, you can get a GREAT deal worth well more than 1/2 cent per point. I stayed at a Marriott in Aruba this past Dec into Jan and I got over 2.5 cents per point. It really depends on how and when you use the points. I have never bought points, although I have been tempted to, because I have enough for the next few vacations already. But it is worth it to do, my only fear is I have so many points already,that if i buy more, they might get devalued before I use them so I haven’t bought any. But again, the 5th night free is a big deal, so I tend to do 6 days, 5 nights vacations