Cathay Pacific, the de facto flag carrier in Hong Kong, suffers from no shortage of blog coverage here in the United States. They have a great business- and first-class product, which I hope to try in the future. Dan has flown Cathay business and experienced four of their five (!!!) lounges in HKG, so if you’re looking for a review, look no further.

(READ MORE: The best Cathay Pacific business class lounge in Hong Kong Airport?)

Today, we’re going to focus on their new credit card, aimed at US consumers, and whether or not it’s worth your time. You can get to the card’s landing page here.

Card Overview

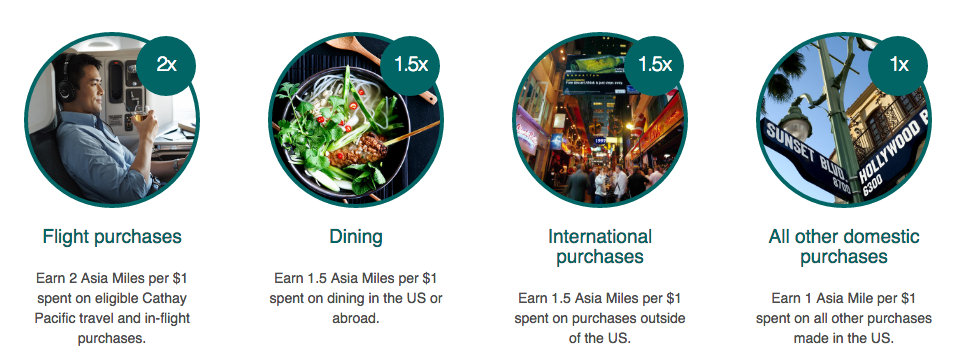

First off, this card is being offered through Synchrony Bank. This is not one of the bigger credit card issuers in the US, which is both a good thing (leaves room for other cards at more popular banks) and a bad thing (Synchrony who?). Beyond that, this card offers some interesting earning possibilities:

- 2 Asia Miles per dollar spent on Cathay Pacific travel/in-flight purchases

- 1.5 Asia Miles per dollar spent on dining in the US or aboard

- 1.5 Asia Miles per dollar spent on purchases outside of the US

- 1 Asia Miles per dollar on all other purchases

It also offers 25,000 points after you spend $2,500 within 90 days, no foreign transaction fees, and complementary enrollment in Cathay’s Marco Polo Club at the Green tier. This card comes with a $95 annual fee, and that fee is NOT waived in the first year.

What’s Marco Polo Club?

Marco Polo Club is one of Cathay’s two loyalty programs (the other being Asia Miles). Per the Cathay website:

Marco Polo Club is the loyalty [program] of Cathay Pacific and Cathay Dragon that is designed to reward our most valuable customers with benefits and services that enhance their travel experience. There are four tiers in the club – Green, Silver, Gold, and Diamond – and each offers its members a range of privileges and benefits that make every journey something to look forward to.

With the Cathay card, your enrollment in the Green tier gets you:

- The ability to redeem points for lounge access, extra legroom seats, and extra baggage;

- More free checked baggage;

- Designated check-in counters; and

- Priority boarding

Normally, this would set you back $100 (not worth it, in my opinion!), but for free, it’s a nice benefit.

25,000 mile bonus?

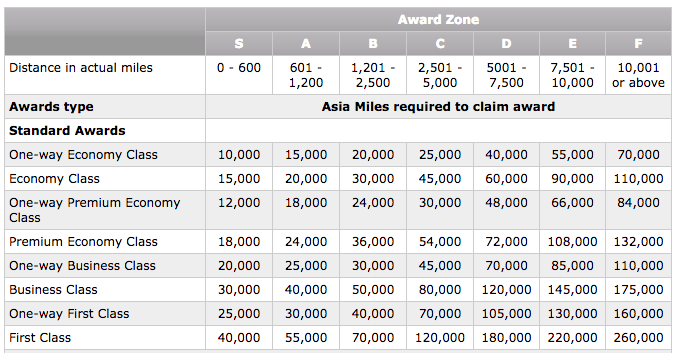

25,000 Asia Miles aren’t going to get you very far, sadly. Take a look at the award chart:

Even regional flights, like to Saigon or Shanghai are going to set you back 20,000 miles for a roundtrip economy redemption. And San Francisco? That bonus will only cover ~63% of the miles need to get there one-way in economy. In my opinion, you’re better off earning miles through American Express, Citi, or Starwood, and then transferring them to Cathay.

Conclusion

While it’s great to see Cathay add a US credit card, overall, this card isn’t worth a spot in your wallet, even if you travel with Cathay often. You’d be better served with a card that earns convertible points, like the American Express Platinum, which earns five points per dollar on airfare, rather than be locked into earning points with just the Cathay Pacific Asia Miles program.

Are you going to be grabbing this card? If so, what will you use the 25,000 points for?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Nice, balanced review (as opposed to some others on BA). I think I’ll take a pass on the card. I could see it being useful to supplement miles to be transferred from Amex, SPG or Citi…or for a specific use especially if one is shut out from additional cards from Chase, Citi, etc. for now. But otherwise…yaaaawn.