KEY LINK – Marriott Bonvoy Business® American Express® Card – Earn 3 Free Night Awards, valued at up to 50K points each for eligible stays after spending $6,000 in 6 months. Free Night valued at 50,000 points. Certain hotels have resort fees. $125 annual fee (see rates and fees)

I’ve often said that one of the best ways to get lots of miles and points is through applying for new credit cards. It’s just too hard to get any appreciable amount of miles by just your regular everyday spending (unless you are spending a LOT). So for most people, regularly applying for new credit cards every couple of months is the best way to get enough miles and points to go somewhere fun. Of course, that also goes right into the other thing that I regularly say, and that is to not apply for a credit card just because some guy on the Internet said that you should.

Marriott Bonvoy Business Free Night Offer

The Marriott Bonvoy Business® American Express® Card just came out with a brand new offer and it’s pretty compelling. Normally, new welcome offers give a certain amount of miles or points, but this one currently is offering 3 free nights (up to 50,000 points) when you spend $6,000 in the first 3 months of having the card. While I sometimes find free hotel nights to be tricky to use, that’s mostly when you only have 1 or 2 of them. With 3 free nights, you can really turn that into a pretty amazing trip.

Keep in mind that with the Marriott Bonvoy Business card, you’ll also get:

- 6x Bonvoy points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy®

- 4X Bonvoy points for every $1 spent at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping

- 2X Bonvoy points on all other purchases.

- Complimentary Marriott Gold Elite status

- 15 elite nights towards status each year

The Bonvoy Business card does come with a $125 annual fee which is not waived the first year.

Where to use Marriott free nights

The 50,000 point cap will rule out some of the ultra-luxurious Marriott hotels out there, but that’s okay because I hate “fancy” hotels anyways, with one of the reasons being that they seem to charge you for every last little thing.

(SEE ALSO: How hotels categorize themselves (the difference between upscale and “upper upscale”))

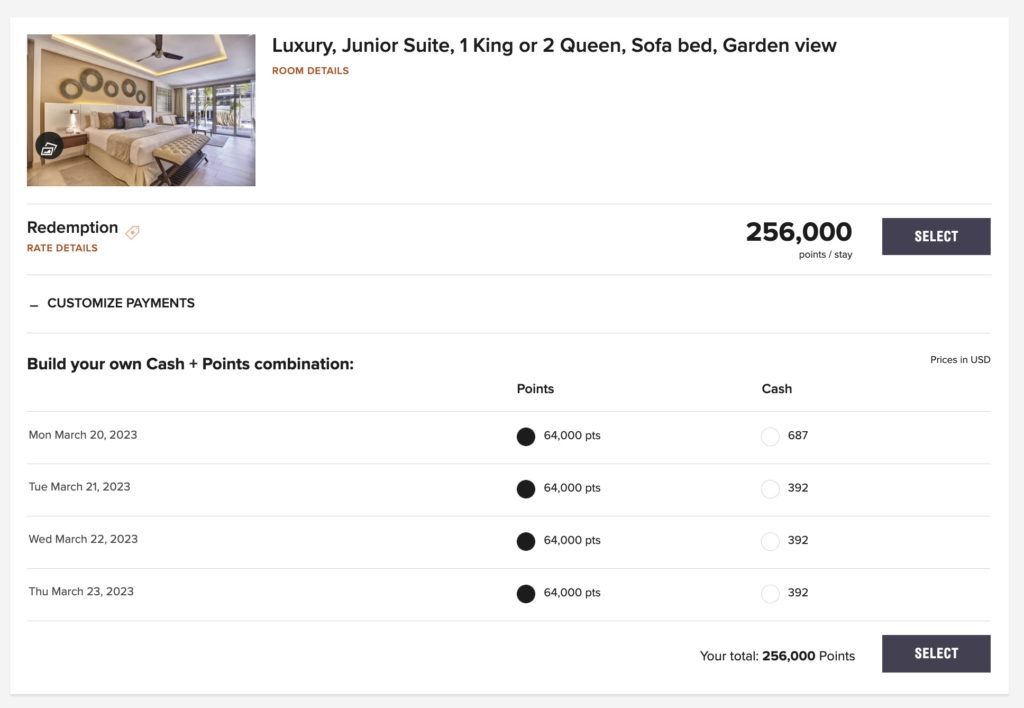

Remember that you can now top off your Marriott free night awards with up to 15,000 points per night, meaning that you can look for hotels and resorts at up to 65,000 points. You do also get the 5th night free with points bookings, but I’m not sure that using a free night would qualify for this. Here’s an example at the Royalton Riviera Cancun all-inclusive

Yes, you do have to pay 14,000 points / night on top of your free night certificates, but you’re also getting a room that is running for $687 / night (plus tax).

We also compiled a list of 6 Marriott hotels you can stay at for free that you can use to help get some travel inspiration

Who’s Eligible for this Marriott Bonvoy Business offer

The terms of the Marriott Bonvoy Business card state that you are not eligible for the welcome offer if you:

- have or have had this Card or the Starwood Preferred Guest® Business Credit Card from American Express or previous versions of these Cards.

- have or have had the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days

- have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, in the last 90 days

- have received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy Bountiful™ Credit Card from Chase, Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase.

Additionally, you do have to have a business to apply for this card, but you may have a business even if you don’t think that you do.

Other Marriott Credit Cards

If you’re not sure about paying the $125 annual fee on the Marriott Bonvoy Business, Marriott does also have a no-fee co-branded credit card with Chase, the Marriott Bonvoy Bold. Here are a few other Marriott cards that you could consider

- Marriott Bonvoy Bold® Credit Card – Earn 60,000 Bonus Points plus 1 Free Night Award after you spend $2,000 on purchases in the first 3 months from account opening. Free Night valued at 50,000 points. Certain hotels have resort fees. $0 annual fee.

- Marriott Bonvoy Boundless® Credit Card – Earn 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 in 3 months. Free Night valued at 50,000 points. Certain hotels have resort fees. $95 annual fee

- Marriott Bonvoy Bevy™ American Express® Card – Earn 85,000 Marriott Bonvoy bonus points after spending $5,000 in 6 months. $250 annual fee (see rates and fees)

- Marriott Bonvoy Brilliant® American Express® Card – Earn 95,000 Marriott Bonvoy bonus points after spending $5,000 in 6 months. $650 annual fee (see rates and fees)

Personally, I think that most people will get much more value out of the 3 free nights with the Marriott Bonvoy Business, at least during the first year. You can then downgrade to the Bonvoy Bold after the first year if you don’t want to pay the annual fee again.

The Bottom Line

KEY LINK – Marriott Bonvoy Business® American Express® Card – Earn 3 Free Night Awards, valued at up to 50K points each for eligible stays after spending $6,000 in 6 months. Free Night valued at 50,000 points. Certain hotels have resort fees. $125 annual fee (see rates and fees)

3 free nights (after spending $8,000 in 3 months) is a pretty amazing offer. With the value of Marriott points at around 0.7 cents per point, the 3 50,000 point nights would be worth over $1000. Yes, it comes with a $125 annual fee but you should be able to get significantly more value than that the first year, and each year you also get a free night certificate which should help you manage the annual fee.

As always, feel free to email me at dan at pointswithacrew dot com if you have any questions about your specific situation, or this or any other credit card offer.

What do you think of this Marriott Bonvoy Business credit card offer? Are you planning on signing up for it?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

We would like to apply for this Marriott card but we are in Maui for the summer. I don’t imagine chase would ship our card to us here. They probably will only ship it to our home address. Is that correct? The 3 month min spend time would pass with 0 spent.

I’m guessing that you are correct Larry. I would imagine that you are right that they would not ship it to another address. I have a few thoughts that might work

In any case, thanks in advance if you apply for the card through my link

Oh, will avail for sure.

But those 5 free nights expire! Just give me the points!