Everybody uses Venmo now, right? I’m not exactly on the cutting edge here, but I’m a fan of anything that makes payments faster and easier. Venmo is one of those technologies. The subject line of an email caught my eye the other day: “Apply for Venmo card, use it and you could earn $15 on eligible purchases”

Given me typical infatuation with free money, I had to open the email! Normally, $15 isn’t really a great sign up bonus. A double digit welcome offer? HA! Any good travel hacker should skip right over that, in favor of hundreds of dollars, or thousands of points (or both!). But here’s the thing, it’s not a credit card. As far as I can tell, the Venmo card is essentially a prepaid debit card, that links to your Venmo account. Seems pretty straightforward. This is a great fit for me, since I almost always have at least a small balance in my Venmo account. Whenever I go out to eat with friends for example, You’ll see me paying for the meal on a new card, and then my dinner mates will hand me some cash or Venmo me the next day.

The Case for the Venmo Card

As far as I can tell, the main benefit to the Venmo card is quick access to your Venmo balance. With free MoneyPass ATM access in the US, you can get cash out of your Venmo balance right away. You’ll have money in an account already (if you use Venmo), and you can get to it easily. Right now, the only way for me to get money out of Venmo is to transfer it to my bank. Transfers are usually complete in 2 business days, but that’s still not as fast as cash in my hand. The Venmo card also runs on the Mastercard network (issued by Bancorp), allowing you to use it just like a debit card the next time you’re at the store. There’s also no annual fee!

Applying for the Venmo Card

Applying for the Venmo Card

After looking quickly through the terms, I threw caution to the wind and applied for the card! Here are the requirements for this welcome offer:

- You must be a resident of one of the 50 United States of America

- You must be 18 years of age or older.

- Your Venmo account must be in good standing (not really sure what that means…)

- You must receive an “authorized” notification of this offer from Venmo, in the form of an app notification or an email.

- You must apply for and be approved for the Venmo card.

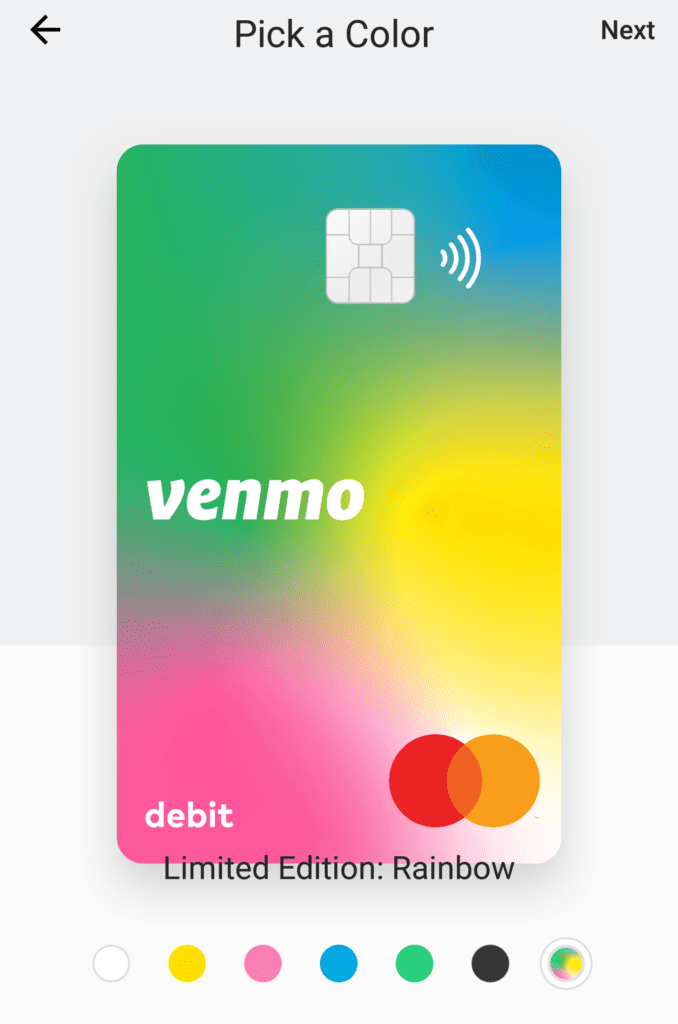

You’ll have to apply through the app if you want it. The application process is super easy. First, pick your color. White, Yellow, Pink, Blue, Green, Black, or limited edition Rainbow. Naturally, I selected Rainbow.

Venmo than confirms your name, social security number, and date of birth. Remember, the service already has all this information anyway, so it’s not like you’re getting yourself into any security concerns if you currently use Venmo. Next, you’ll input your mailing address (I believe this may be new information to Venmo). You can also choose how to fund “Reloads”. If you opt into Reloads, Venmo will pull money from your linked bank account in $10 increments if your Venmo card doesn’t have enough to cover the transaction. Think of it as debit card overdraft protection, but without the fees. I opted out of Reloads, so I assume Venmo will just decline any transaction that I don’t have enough funds to cover.

Hit submit, and you’re done! Venmo will verify your information and give you an estimated date of arrival for your new card. Here are the terms for my $15 bonus:

Apply for the card and make three eligible purchases with the Venmo card by 3/31/2019, and we’ll add $15 to your Venmo balance by 4/8/2019.

Review of the Venmo Card

I’ve got until the end of the month to make three eligible purchases and earn my $15 bonus! Once I do that, expect a full review of the Venmo card. At first glance, it doesn’t seem like this offer is particularly compelling after the first $15 bonus. It looks like there’s no strict explanation of what makes a purchase on the Venmo card “eligible”. One note in the fine print caught my eye though..

Eligible Purchase transactions are subject to review and verification. Venmo may provide an alternate reward of equal value if it is unable for any reason to fulfill the Reward for any reason.

Really Venmo? You’re worried you can’t cover the 15 bucks? Guess we’ll see how this goes!

Does anyone else have the Venmo card? Let me know what you think!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Thank you for the tips..