So in the report for our latest churn, I talked a bit about business credit cards, but I think some of the hesitation that people feel about applying for these cards is that most people typically don’t have what they think of as a “business”.

Now, personally, I don’t have a problem for that, as I actually have a few things that could count as businesses, but if you’re like most people (especially if you’re a stay-at-home mom), you might have a regular salary or hourly job, with nothing that you consider a “business”, which might make you reticent to apply for a business card.

What is a Business?

What is a business, anyways? I don’t mean to get all dictionary on people, but basically a business is just an organization that provides either goods or a service, usually with the idea of turning a profit / making money

Are you in Business?

So based on that definition, you may already be in business!! Do you ever do anything like this?

- Watch other people’s kids

- Make crafts (beads / jewelry, art, etc.) to sell on eBay, Craigslist, or etsy

- Have yard or garage sales

- Buy things with the hopes of reselling them at a profit

If so, you’re already in business. You don’t have to be Walmart to have a business. You don’t have to be incorporated, or have a separate address or tax ID number to have a business. Most businesses are small.

Starting a Business

Or, maybe you don’t do any of those things, but have you ever THOUGHT of doing any of them (or any other potential money-making idea)? Maybe you’re one of the countless people that has dreamed of investing in real estate (cue Carleton Sheets music…)

Wanting to get started with a business is another good reason to give when applying for a business credit card. Most people that have a business, especially those starting out, want to keep their business and personal expenses separate, and having separate credit cards is a good way to do that.

Filling out Business Card applications

Now you’ve decided to get a business credit card, how do you fill out the application?

Well the first important thing to remember is DON’T LIE OR FUDGE THE NUMBERS ON THE APPLICATION. Just be honest. Believe me, not getting a credit card you’re interested in is going to be much better than what could happen if you end up lying on an application and someone catches you.

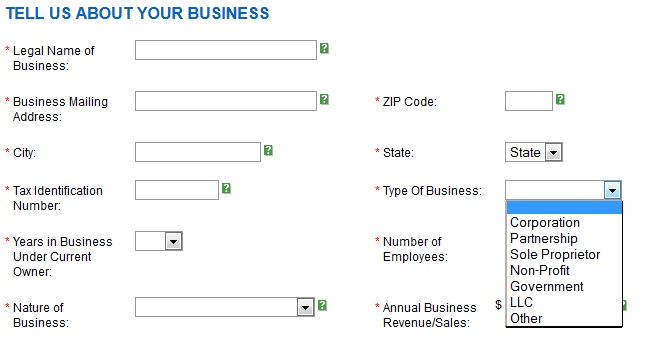

Typically, you’ll have to fill in all your personal information as well, and then on the application, there will be a section that looks something along the lines of this

Under Type of Business, you’ll probably put in Sole Proprietor. That just means that your business is just you, and that’s what 70% of the businesses out there are. Another option might be a Partnership, if you decide that the business is something that you and your spouse run. If your business is a corporation, then you probably already know that and can skip the rest of this section 🙂

Under Type of Business, you’ll probably put in Sole Proprietor. That just means that your business is just you, and that’s what 70% of the businesses out there are. Another option might be a Partnership, if you decide that the business is something that you and your spouse run. If your business is a corporation, then you probably already know that and can skip the rest of this section 🙂

For the Business Name, you can put your own name, or generally you can just make up a business name. IANAL, but in most states, you don’t have to register your “trade name” to use it. Now you can’t say your business name is “Home Depot” or some other trademark violation, but within reason, I have never seen an issue with it. For address, you can just use your own address.

For the business info, just put the truth. If you’ve been in business 0 or 1 years and have $0 or a very low amount of annual sales, just put that.

In my experience, if YOU (the person) have great credit (and if you don’t, you might want to check out our Beginner’s Guide before dipping your toe too deeply into signing up for credit cards), you can get approved for business cards, even if your business is pretty fledgling. It may not come with a huge credit limit, but for our purposes, that’s generally okay.

You may also not get approved automatically online, but usually after a phone call, you will.

If my mind can conceive it, and my heart can believe it – then I can achieve it

So what’s stopping you?

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

How do you handle timing of business credit apps? Do you basically handle them like you would a personal card? You wouldn’t, say, apply for the CSP, and a month later as your business seems to be going well, apply for the Ink? Same AOR rules apply? 90+ days? So you lump them in with your personal credit card AOR?

Also, have you heard (From FT or elsewhere) how successful folks have been in applying and citing blogs like yours as their business? I have a sense that Chase is seeing a lot of this since the Inks have gotten their incredible sign up bonuses and category bonuses. I’ve heard people pushing “If you baby sit/blog” for a while but I’m wondering how this has played out for applicants recently.

I just include them as part of my personal app-o-ramas, so every 90days or so.

I have not heard any firsthand experiences about people using blogs like this as a source of income. I’d imagine it could be fine. From my experience, the business folks haven’t been super picky.

On the flipside, as I mentioned, I was denied for the SW business card back in October, but I think that was more a factor of already having a Chase business card (Ink) for my real estate business. I’ve heard people be more successful with having a different business per business card (per bank).

I’m going to give that a try here in the next few days and will report back

When you have to call the reconsideration line, that is if your application is not approved instantly, it’s important to prepare answers for the representative. The representative is actually trying to assess whether you know what your business is, how it’s doing etc. They will ask what was your sales last year, this year, what is your expense this year, what is your cost of sales in %. If you say that you are just starting out, you can tell the representative your projected sales, your projected expense, and your expected profit. Having all those “figures” demonstrate you are serious in your business.

Great post! I have a few of these business cards because MMS said it was OK to apply, even without a business. Now, does this stuff ever get reported to the IRS? I mean, if I say I have a business, and tell them I make 5K a year, but I really don’t?

I would not recommend being untruthful on CC applications. If you don’t have what you would consider a business, count yourself as a startup and put down $0 as income. But to answer your question, I don’t think that what you put down on a CC application gets reported to the IRS.