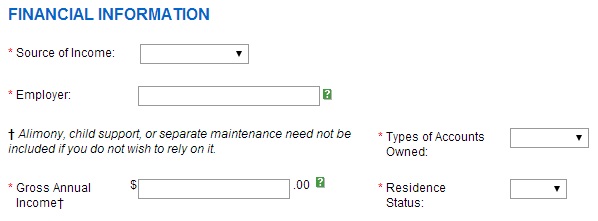

On every credit card application, there comes a section where you have to fill out your financial information

Makes sense, right? I mean this is a company that is going to just GIVE you money and HOPE that you’re going to pay it back. So I can understand why they would want a little bit of information about you, and your ability to pay it back.

For the most part, if you have a “simple” financial situation (a regular salaried job), this was no big deal – you just put your annual income in and that was that.

Starting in 2010 however, this got a bit tricky for stay at home moms and other people with more complicated situations. As part of the CARD act of 2009, banks were required to evaluate people based on their individual ability to re-pay (among many other reforms)

One unintended consequence of this was that all of a sudden, stay-at-home moms and others with more “complicated” situations found themselves frozen out of the credit card market. Applications all of a sudden specified INDIVIDUAL income, and so it was unclear whether stay-at-home moms had to put in $0.

There were some that went ahead and put in household income anyways, and if asked about it, just stated the truth. There were probably some people that may even been a bit “dodgy” with the situation, though I wouldn’t recommend that. I wasn’t particularly active in this back then, so I’m not sure what banks would do with SAHMs that listed $0 income, but thankfully this has all now been resolved.

Operating at the “speed of government” 😀 , an amendment to the CARD act was finally put into place in April of 2013. Specifically, the amendment “allows credit card issuers to consider income that a stay-at-home applicant, who is 21 or older, shares with a spouse or partner when evaluating the applicant for a new account or increased credit limit.”

So now there is no problem with putting down the total household income. In fact, Carolyn did a new churn today for a few new cards, which I will detail in an upcoming post.

What do you think? Did they finally get it right? Does it make sense to you to consider only individual income, or should household income be allowed?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

So if I’m a SAHM, I can put down my household income, but what doe I put for employer? My husband’s employer?

I would just put Homemaker or Stay at home Mom or Self.