KEY LINK – Capital One Venture X Rewards Credit Card – Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening. $395 annual fee

There are 3 different ways that I like to think of to get value from a credit card:

- The welcome offer

- Category bonuses for spending (or a high rate for everyday spending)

- Other perks that you get from just having the card (free hotel nights, free checked bags, elite status)

It’s rare to have a card that hits all 3 of these things, but if you find one that offers even 2 of them, it’s definitely a card worth considering. I think the current offer from the Capital One Venture X card can realistically be said to hit all 3 of them. It does come with a $395 annual fee, but also an annual $300 travel credit and 10,000 Venture miles (worth $100) each year on your anniversary help to offset that.

Capital One Venture X Rewards Credit Card review – signup bonus

First up let’s talk about the signup bonus on the Capital One Venture X. The Venture X card currently is offering the ability to:

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening

This is worth hundreds of dollars if you redeem it for travel, and it’s pretty easy to get more value than that through transfer partners. I have found myself using my Venture miles to transfer to Wyndham Rewards (see below), where I’m easily getting 3 cents per point value. At those valuations, this welcome bonus would be worth thousands of dollars. I don’t know that I would speculatively value it that high, but it’s certainly a possibility.

Capital One Venture X Rewards Credit Card review – earning

The Capital One Venture X card has a very simple earning structure:

- 10X Venture miles on hotels & rental cars booked through Capital One Travel

- 5X Venture miles on flights booked through Capital One Travel

- 2X Venture miles on all other purchases

Personally I don’t book a lot of my travel through Capital One, so I find myself getting 2X Venture miles on most purchases. But because I value Venture miles pretty highly, it’s nice to get double miles no matter where I am.

Vacasa vacation rental booked through Wyndham Rewards (a Capital One transfer partner)

Capital One Venture X Rewards Credit Card review – redeeming miles

One thing I really like about the Venture X card is its flexibility in redeeming miles. You can transfer your miles to airline and hotel transfer partners, or you can redeem miles for travel purchases directly. With the relatively recent updates to Capital One’s transfer partners, both are reasonable options. One thing that I like about redeeming miles for travel directly with Capital One is you can use it after the fact for a purchase you already made. This is great for booking hotels because you can book directly to get elite benefits and then use your Venture miles to offset the cost. Of course, if you book through the Capital One travel portal you’ll get 10 miles per dollar, so that may be a good option as well in some cases.

There is a lot of flexibility in how you redeem Venture miles.

Some of the best uses of Capital One Venture miles

It’s nice to have a floor of value (1 cent per mile) set by the travel option, but I think the best uses are going to be transferring to Capital One’s hotel and airline travel partners. Most of the partners now transfer 1:1.

Here are 3 of my top uses of Capital One Venture miles

- Air Canada Aeroplan miles – I booked a (nearly) round the world Aeroplan award with 48 hours in business class for 230,000 Aeroplan miles

- Turkish Airlines Miles&Smiles – I used 7,500 Turkish Airlines miles to fly to Hawaii

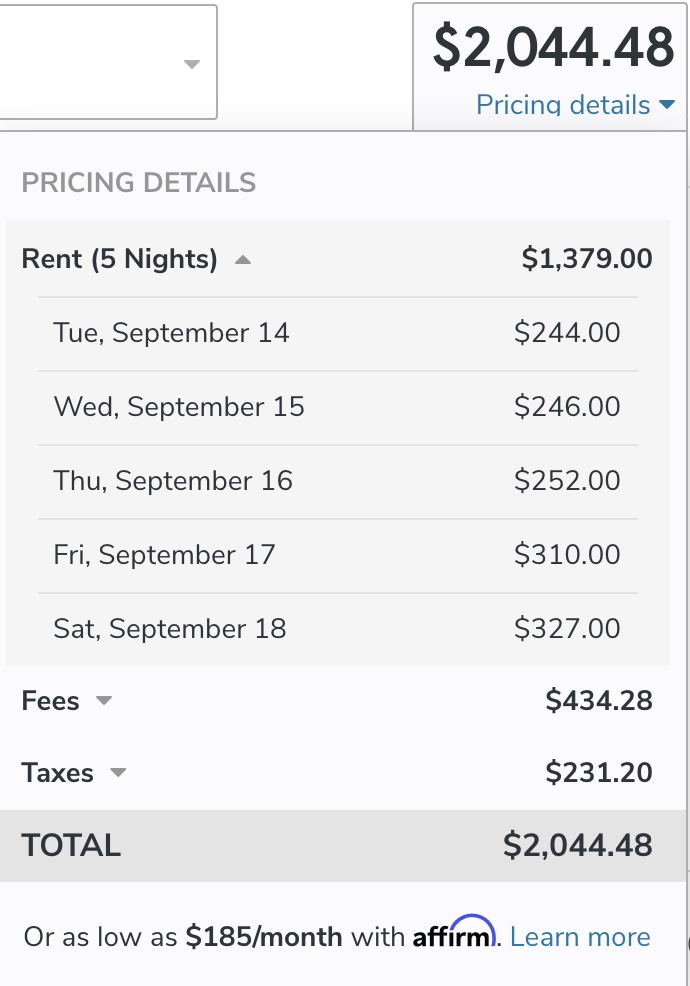

- Wyndham Rewards – as I mentioned earlier, I’m getting more than 3 cents per point value using Wyndham Rewards points to book Vacasa vacation rentals. You can see below a redemption of 67,500 Wyndham Rewards points for a Vacasa rental where they were charging $2,044 (3.03 cpp)

Capital One Venture X Rewards Credit Card lounge access

One nice perk of the Capital One Venture X card is that you get premium lounge access. This includes the Capital One lounges (currently just the one in DFW; pictured below)

You also get a Priority Pass Select membership, though it’s important to note that you do not get access to non-lounge experiences like restaurants. Adding up to 4 authorized users is free with the Venture X, and these authorized users DO get a Priority Pass membership, which is useful for a large family like mine.

Capital One Venture X Rewards Credit Card travel benefits

Besides airport lounge access, the Venture X also has a variety of other useful travel benefits

- Up to $100 credit to Global Entry or TSA Pre every 4 years

- Complimentary Hertz President’s Circle status

- No Foreign Transaction Fees

- Travel protections, like primary auto rental insurance and travel accident protection. Having primary rental car insurance saved my mom nearly $900

- Trip cancellation and interruption insurance

- Lost luggage reimbursement

- Trip delay reimbursement

Capital One Venture X Rewards Credit Card benefits and perks

Besides the travel perks, the Venture X card also comes with a variety of other benefits and perks. First are the two big annual credits

- $300 each year when you book travel through the Capital One travel portal

- 10,000 Venture miles each year on your anniversary

There are also other perks that come with the Venture X card

- Cell Phone Protection up to $800 if your phone is stolen or damaged

- Purchase, extended warranty and return protection

Is the Capital One Venture X Rewards Credit Card the best premium card out there?

KEY LINK – Capital One Venture X Rewards Credit Card – Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening. $395 annual fee

So, given that the Capital One Venture X is a premium credit card, how does it stack up against the Chase Sapphire Reserve®, Citi Prestige and The Platinum Card® from American Express? Quite favorably, I think. Its annual fee is the lowest by far ($395 compared to $495 for the Prestige, $550 for the Sapphire Reserve and $695 for the Amex Platinum – see rates and fees). Plus, it feels like you can easily justify the $395 annual fee with only two of the benefits: the $300 annual credit for travel booked through the Capital One travel portal and the 10,000 miles you’ll get each year on your anniversary.

That annual $300 travel credit isn’t quite as lucrative as the $300 travel credit on the Chase Sapphire Reserve. The CSR travel credit counts for just about anything in the travel category, while with the Venture X you have to use it through the Capital One travel portal. Still, the annual fee on the Venture X is nearly $200 less than the fee for the Sapphire Reserve. In a climate where it seems the annual fees just keep going up and up, it’s nice to see Capital One buck the trend and go with a lower annual fee. The 10,000 miles each year are worth at least $100, and if you can get 3 cents per mile like I did on a recent redemption, maybe much more. And that’s it – already you’ve earned back the $395 annual fee. It’s much better than the Amex Platinum that has a gigantic annual fee and a “coupon book” of tons of annual credits of dubious value.

The authorized user policy on the Capital One Venture X credit card is again better than the other premium credit cards. The Amex Platinum charges $195 for each additional card (see rates and fees). The Sapphire Reserve charges $75 for each authorized user, as does the Citi Prestige. The Capital One Venture X card does not charge a fee for adding an authorized user, and authorized users get the lounge benefits and Hertz elite status. That is a big deal, especially for families with kids wanting to all visit an airport lounge together.

What do you think? Where does the Capital One Venture X card fall in the list of best premium credit cards cards out there? Leave your thoughts in the comments

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

You really should mention that early last year the offer was 100k points and included a $200 vacation rental credit. The current offer is pretty weak

This is the WORST premium card. Sent me a 1099 for referrals AND. Get this people. This is NOT AMEX. You will have ZERO protection from false charges unless you can prove fraud. Good luck. What’s in my wallet … NOTHING that says Capital one. Also good luck if you lose your card overseas. Not once have they reached out to help. Now.. no more priory pass restaurants and that $300 is good for toilet paper unless you enjoy that awful portal.

Can’t find one single benefit. Have fun with Capital One!!

Cap1 does have a nice lounge at DFW.

Something worth noting that I didn’t see mentioned in the article: cashback from other Capital One cards can be converted into miles at a 1 cent to 1 mile ratio (THIS DOES NOT WORK THE OTHER WAY AROUND). This is what made me ultimately (pun unintended) switch from Chase to Capital One as my main credit card stack: it means I can use the Venture X and SavorOne together. The SavorOne gets me unlimited 3% cashback at grocery stores (among other things) and the Venture X gets me 2 miles on everything else. Then I take the cashback from the SavorOne and convert them to miles on the Venture X.

Chase definitely has better transfer partners still and I’d argue more intuitive processes to redeem points, but the fact that none of the Chase Points cards (Reserve/Preferred, Freedom Unlimited, Freedom Flex) consistently get a bonus at grocery stores makes them less useful for me, as my largest card spending by far comes from grocery stores. (Worth nothing that the Flex occasionally has grocery stores as a rotating 5% category, but it’s not permanent like the 3% is on the SavorOne. And some chase cards give 3% back on online groceries, but not in-person.)

As such, while the Sapphire Preferred/Freedom Unlimited/Freedom Flex stack worked well for me, the Venture X/SavorOne stack is working even better. Your mileage may vary!

The ongoing delays in points transfers to airlines significantly reduces the value of the points. My last two transfers took five days. The airlines said capital one transfers can take up to two weeks. Dealbreaker.

well, you haven’t experienced the customer service….i agree, this is the worst premium card for sure. If you have any issues at all, this is the worst card by far

Does Cap One always downgrade you to the $95 version if you ask ? I got this card about 8 months ago for the sign up bonus – really dont want to pay the $395 for another year since we are not doing much traveling in the next year so the $300 credit may be harder to use. I dont really want to cancel it and wondering if they always will downgrade you if you request it. If not, I will have to decide where to move the points to, which I dont know at this point.