(Update 1/1/2017 – It’s not 2016 anymore, so try here if you’re looking for the 2017 Citi Dividend Categories)

It’s the end of the year, and so it’s time to start talking about Citi Dividend categories 2016. The Citi Dividend card is currently not available for signup as far as I can tell, and even product changing into the Citi Dividend has been postponed, though I have read that Citi may be opening up product changes later this year (EDIT: A commenter has pointed out that apparently Citi is allowing product changes now)

Citi Dividend Categories 2016 – how they work

The Citi Dividend is a cash back card that works similar to more popular cards like the Chase Freedom. It’s a no annual fee card that earns 1% on all purchases, with a series of rotating quarterly categories that earn you 5% on purchases during that quarter.

With both cards, there is a limit of how much 5% cashback you can earn. With Chase Freedom, you get 5% on the first $1500 of spending each quarter, or $75 each quarter ($300 for the year). With Citi Dividend categories, there is also the $300 annual limit, but there has been no real quarterly limits.

Citi Dividend Categories 2016 5% calendar

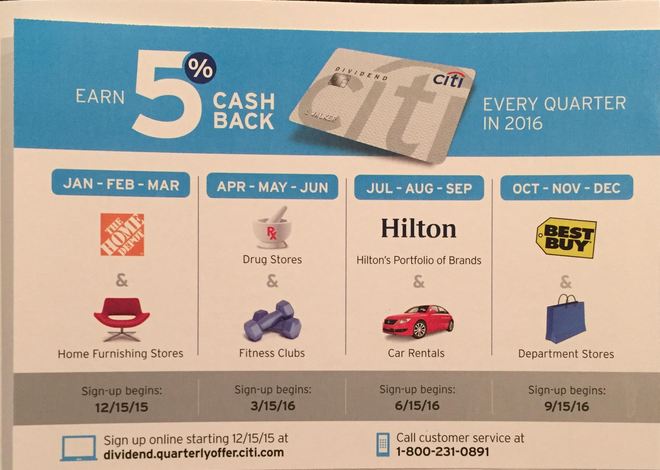

Here is the Citi Dividend Categories 2016 calendar:

This is fairly similar to the Citi Dividend categories 2015 calendar

For those of us with the typical cards, the drugstores are likely to be the biggest winners – if you have a drug store (CVS, Walgreens, Rite Aid) that will let you buy Visa gift cards, you can do the whole $6,000 in spending in that quarter, get your $300 bonus cashback, and then put the card back in the sock drawer!

Personally, I don’t have a card in order to take part in maximizing the Citi Dividend 2016 calendar, but if/when Citi opens product changes back up, I have a few Citi cards that I wouldn’t mind product changing into one!

(Thanks to Doctor of Credit and Reddit)

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

You might want to correct the post – $6000 spending for $300 bonus as against $15000 spend mentioned right now

Thanks – I’ll update it

People are reporting on Reddit that product changes are now available again. I have an AA Exec that I’m PCing to the dividend.

Can you use the points (TYP) instead of getting cash back if you have the Prestige?

I don’t believe the Citi Dividend is integrated with Thank You points, as far as I know.