The Amex Platinum card is a card that I initially had shied away from, mostly due to reluctance to pay a $450 annual fee. I ended up taking advantage of an increased signup bonus (25,000 American Express Membership Rewards) on the Ameriprise version of the Amex Platinum, which does NOT have an annual fee for either the primary user or up to 3 authorized users for the first year.

I don’t think that I will end up paying the annual fee when it comes due, but we have definitely received a lot of benefits from having the Amex Platinum card over the past 8+ months. Here are a few of the posts I’ve written about some of the benefits of the Amex Platinum card

- How to use the American Express Priority Pass Platinum card benefit

- How to use (free) American Express roadside assistance

- A new way to get Hilton Gold status (the best mid-tier hotel status out there!)

Today I wanted to talk about the Amex Platinum $200 airline credit

Using the Amex Platinum $200 airline credit

The Amex Platinum $200 airline credit is an especially nice benefit, because you are able to use it every CALENDAR year. So for paying one annual fee ($450), you can get TWO American Express Platinum $200 airline credits. Now, I’m not one to say that this makes the annual fee only $50 ($450 – $200 – $200), but there is no denying that the Amex Platinum airline credit is a pretty good benefit.

The one tricky part about the American Express Platinum $200 airline credit is that you have to PICK your airline. This is in contrast to cards like the Citi Prestige, where you get a credit on any airlines without having to select the airline

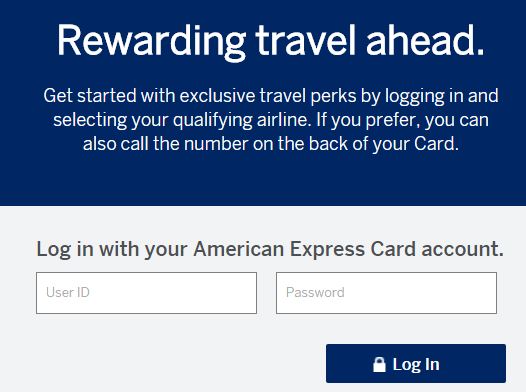

How to choose your airline for the Amex Platinum $200 airline credit

For the Amex Platinum $200 airline credit, before you make an airline purchase, you must first select one airline to get the $200 airline credit. You can change that each calendar year, but during a particular calendar year, you can only get an airline credit on one airline.

I actually found it a little hard to find the page where you change your airline (it didn’t seem to be easily found off of the “My Account” page. A little bit of searching found that the page to choose your airline for the Amex Platinum $200 airline credit is at http://rewards.americanexpress.com/olet/splash?campaignId=airline1&offerType=airlinechoice

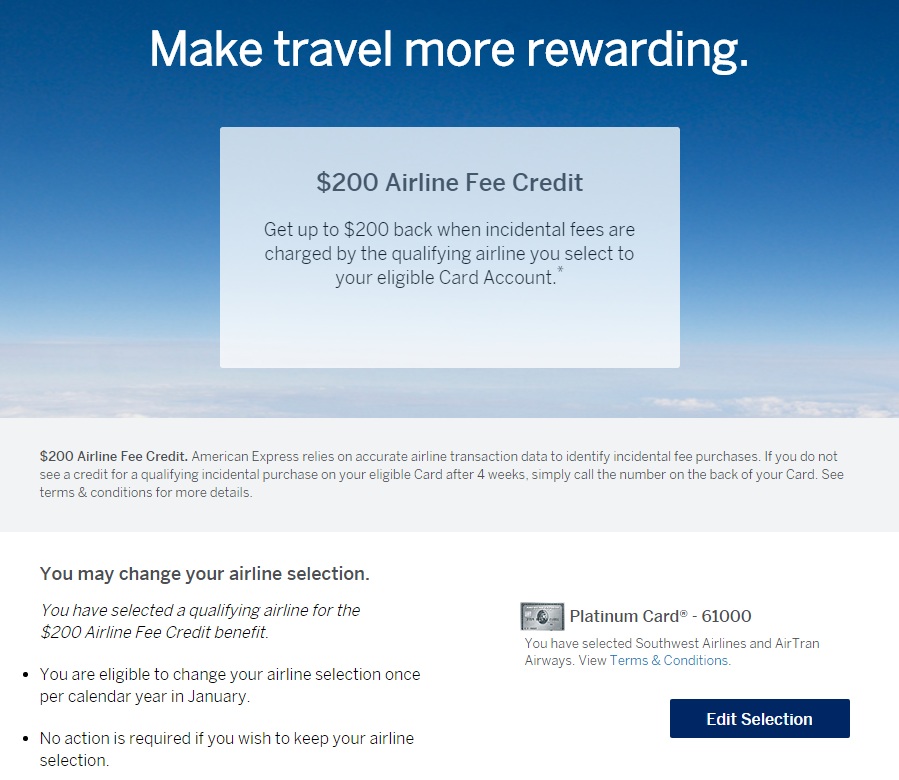

After you log in, you’re greeted with a screen that looks like this. Yours may look different – in my case I already picked my American Express Platinum $200 airline credit for 2015, so it’s letting me know that I can either keep the same airline (in my case, Southwest), or I can change the airline for my American Express Platinum $200 airline credit.

In my case, I changed it to American Airlines, because I know I have some upcoming charges on American for my Round the World trip.

What is the Amex Platinum $200 airline credit good for?

Another difference between the Amex Platinum $200 airline credit and the credits on other similar cards like the Citi prestige are that the Amex Platinum airline credits are a little more restrictive. The terms and conditions

The Amex $200 airline credit is typically only good for things like baggage fees, change fees, phone reservation fees (but you might not have to pay those!) and incidentals like food, beverage and wi-fi as long as it’s charged directly by the airline.

In practice, some people have reported getting the Amex Platinum airline credit reimbursement on gift cards or award ticket fees, as long as it’s for a smaller amount. I actually used an airline credit to buy gift cards last year, only to find out that American Airlines does not take gift cards for the taxes and fees on award tickets!

If you want to support Points With a Crew, you can sign up for the American Express Platinum card (and other cards) through these links.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

i have had the taxes from my award ticket covered before. not sure if thats still alive…

Will u explane to me , that is true .

“for paying one annual fee ($450), you can get TWO American Express Platinum $200 airline credits. Now, I’m not one to say that this makes the annual fee only $50 ($450 – $200 – $200), but there is no denying that the Amex Platinum airline credit is a pretty good benefit.”

Shila,

Shila – the annual fee is based on the date you apply for the card, while the Amex Platinum $200 airline credit is based on the calendar year. So say you apply for it now in October. You pay the $450 annual fee now (October 2016), but you’ll get the Amex Platinum $200 airline credit for 2016 and then again in 2017 and can then cancel your card before your annual fee is assessed again in October 2017. Hope that helps!