Today’s post is inspired by reader Shawn, who reached out for help in trying to book a 7 night trip to Cancun for his family of five. He writes:

We have a trip planned to Cancun this Christmas. I have a great deal on a flight but am still looking for accommodations. They are pretty pricey that time of year! I was wondering if you have any advice. Is there a credit card or cards we could sign up for that would help pay for a hotel stay?

First of all, I know that we’re in a pandemic. So let me just state that I do believe that it is possible to travel responsibly, even during a pandemic. And I also understand that different people have different opinions on the subject, and I try to operate with no to little judging of other people without fully knowing their situations. Finally, December is still awhile away, so who knows what things may be like then.

Figuring out the basics of a plan

My first question to him was to look at which if any points hotels are down there that he might like to stay in. There is quite a variety of different chain hotels down there, and each of them has a different credit card. Another option would be to get a card like the Chase Sapphire Preferred or Capital One Venture card and use those points as “cash” points to offset the cost of any hotel. First, decide which hotels might be interesting, then we could look at which cards to get to help with the stay.

One option I suggested was staying at the Marriott Cancun Resort — that way you would get the fifth night free on award stays with Marriott. So 7 nights would be 222,000 Marriott points. I suggested that Shawn and his wife both get the Marriott Boundless card. That gives 100,000 points each and would probably cover the whole trip.

Deciding on a hotel

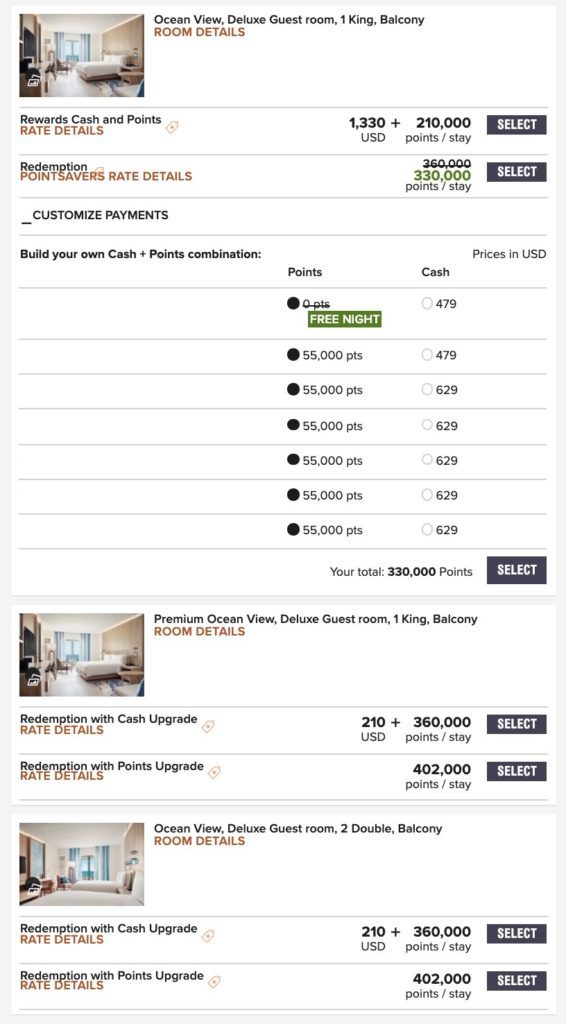

After looking through things, Shawn decided on the JW Marriott Cancun (pictured above, from Marriott.com). The base right at that hotel was 55,000 Marriott Bonvoy points per night, but Shawn wanted to get an “upgrade” to a room with 2 double beds.

I put “upgrade” in quotation marks because I find it ludicrous that the hotel will only book a standard points reservation into a room with 1 king and charges more points for a room with 2 double beds, but what can you do. One option would be to book the room as a room with 1 king and try to secure an upgrade, either beforehand or on arrival. I have fairly good luck with that strategy, but I can certainly understand why Shawn might want to pay extra to not have to worry about that.

Getting the points needed

Shawn and his wife both applied for the Marriott Bonvoy Boundless card. This card gives 100,000 Marriott Bonvoy points after spending $3,000 in the first three months of having the card. They’ll both also get 15 elite nights and Bonvoy Silver status, neither of which they value very much. They’ll both also get 1 free night up to 35,000 points each year on their card anniversary date, with a $95 annual fee.

Because you can transfer Marriott points to another member for free, it will be no problem to combine Shawn’s points with those of his wife. He also mentioned that his dad has some Marriott points as well, so that could be another option. Marriott terms state that “You can Transfer up to a maximum of 100,000 Points, per calendar year, to other Accounts

A Member can receive up to a maximum of 500,000 Points, per calendar year, from other Member Accounts, as long as the Accounts are in good-standing and have each been open for at least thirty (30) days with Qualifying Activity, ninety (90) days without Qualifying Activity”.

Booking the hotel stay

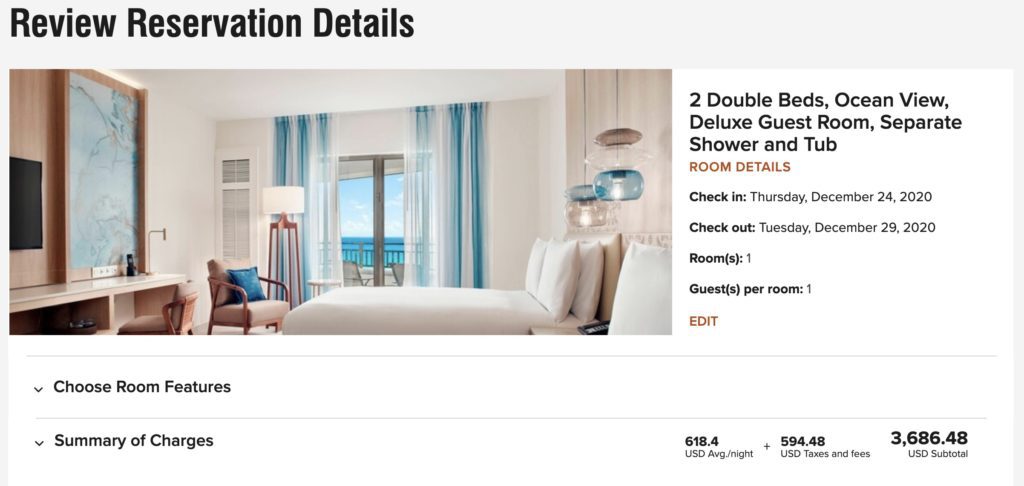

After talking it over, I recommended to Shawn that he book 2 separate stays. A 2 night cash stay and then a 5 night points stay. Making sure to have your award stay be at least 5 nights means that he can take advantage of the 5th night free policy that Marriott Bonvoy has with award stays. His 5 night award stay will end up costing 220,000 Bonvoy points, compared to a cash rate of $3,686.48

That’s a valuation of 1.67 cents per Marriott Bonvoy point, which is nearly twice as much as their reasonable redemption rate.

Thinking about refundability

The last thing to think about is the refundability of these redemptions. Since we’re living in the middle of a pandemic, I would be personally very leery about making any concrete, non-refundable travel plans. Regardless of how you personally feel about COVID-19 and traveling, there is certainly no guarantee that travel between the US and Mexico will even be possible in December. When this first started happening back in March, I was able to cancel all of my travel plans and get my money and points back, but not everyone was as lucky. Many people were stuck with vouchers of limited worth or are still fighting with airlines and online travel agencies.

I would want to make sure that any reservations that I booked were refundable. Looking at the JW Marriott Cancun, the points rates are cancellable up to 2 days before arrival. The cash rate I screenshotted above is cancellable up until 14 days before arrival. There are rates that are cheaper ($150-$200 cheaper per night), but those are not refundable. Personally, I would be very leery of that, given the uncertainty of travel in December. At the very least, I would want to book with a card that had travel protections in place in case I needed to or wanted to cancel.

Still, this is a great example of how miles and points can make a big difference in helping families travel, even to popular destinations at popular times!

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

JW Marriott Cancun is an outstanding choice. Stayed there many times. The restaurants in the hotel, and the other Marriott next door are all terrific.

Fantastic to see how the whole reservation transaction using the cards came out. I am also very cautious about booking anything non-refundable right now. But we are starting to venture out a little right now and do some trips where we feel we can safely travel and stay socially distanced. Thanks for the article!

I really loved Cancun when I went last year. We went to the Seadust resort. Amazing vlog. Keep up the good work