As I’ve written about quite a bit before, the #1 way that I get so many miles and points is through credit card signup bonuses. I do try to earn points in a variety of manners, but there are few ways to earn 50,000 to 75,000 points or more with a small amount of effort!

(SEE ALSO: My first credit card signups)

(SEE ALSO: November 2014 credit card signups – what’s in my wallet?)

It’s why I don’t stress about figuring out category bonuses or which card to put every day spend on – I like to say that if you’re spending money where you’re not meeting a signup bonus, it’s time to apply for more cards!!!

Now, the one thing I DO recommend before signing up for a ton of credit cards is that you go slow, understand what you’re doing, and only go as fast as you are comfortable with. Don’t sign up for a credit card just because some guy on the Internet says you should!!!

(SEE ALSO: Beginner’s Guide (Start HERE!))

(SEE ALSO: How do Credit Card signups affect your credit? – Part 1)

Results from my last credit card signup

Let’s start off with a recap from my last credit card signup in May. We signed up for

- Citibank ThankYou Premier cards (his and hers): 50,000 ThankYou points each

- American Express Ameriprise Platinum card: 25,000 American Express Membership Rewards PLUS all the benefits of a Platinum card (lounge access, etc.) with no annual fee

- Bank of America Alaska Airlines cards (his and hers): 25,000 Alaska Mileage Plan miles and a $100 statement credit each.

For a total of 5 cards. We had some run ins with certain types of transactions not counting towards minimum spend, but in the end, we just recently completed all of our minimum spends, and received all of our correct bonuses.

So, like I said earlier, TIME TO SIGN UP FOR MORE CARDS! 😀

Now that the current rules for each bank for credit card signups have been tightened up, I am typically a little more cautious. Most cards will only give a bonus if you haven’t had the card recently and American Express personal cards only give a bonus ONCE per lifetime. So it doesn’t make sense to apply for a card like that unless its bonus is higher than normal.

The cards I’m looking at this time

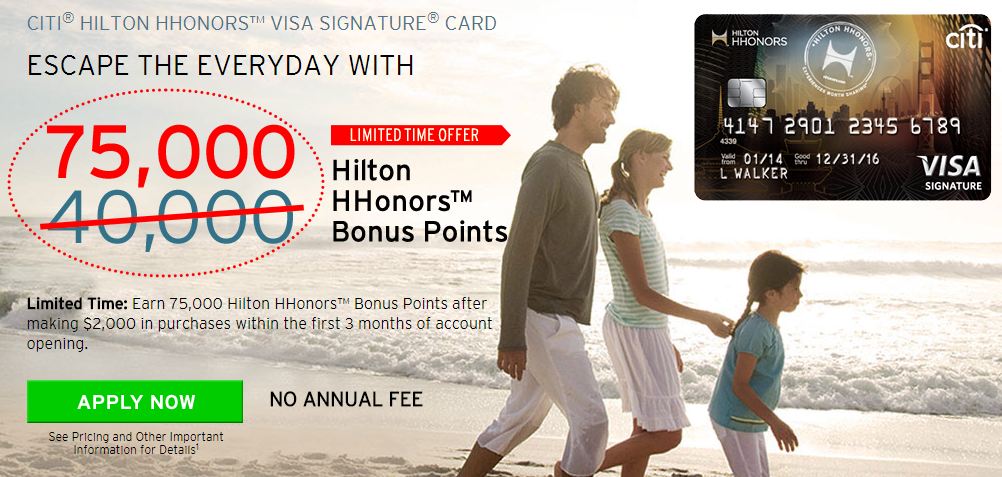

- Citibank Hilton HHonors 75,000 point card. Both Carolyn and I have this card (multiples), but we haven’t open or closed a card in the last 18 months, so we should be able to get the bonus again. Since this bonus is nearly twice as much as the normal amount, it definitely qualifies as a good one! I wrote about this card a few weeks ago – New limited-time 75,000 Hilton HHonors point credit card offer

- American Express Starwood Business card: 30,000 points (up from the normal 25,000 points). I got the SPG personal card with my first credit card signups, but with the business cards, you can get the bonus once every 12 months. We were originally targeting our SPG points for a stay at the Swan or Dolphin resort at Disney World, but now I’m not sure.

- After posting about the recent crackdown on people that signup for a lot of cards by Chase, I got an email comment suggesting that people might still be able to get Chase Ink (business) cards. So I may apply for one of those as well.

- Bank of America Alaska Airlines cards. I am not sure if I’ll try applying for multiples or not (I know some people have gotten 4 or 5 in a day, but I’ve heard they’re cracking down on that), but we both will probably get one personal card, and I may get a business card as well.

Any good ones I’ve missed? Discover It?

I don’t have individual affiliate links to these cards, but most of these cards are accessible through my links at creditcards.com. You don’t have to use my links if you’re signing up for credit cards (and you should always make sure that they represent the best deal), but if you do, I appreciate it!

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Are you still able to have more than one Alaska card at a time?

That is my understanding – I generally cancel the Alaska cards at some point, but I’ve definitely had more than one at a time. As for how many you can successfully APPLY for at once, that I am not sure of, but I’ll let you know once I apply how it goes!

Regarding the Hilton card. What if you upgraded from regular to Surpass in the last 18 months? Or downgraded?

Ignore my question. I remembered Surpass is Amex, not Citi, so I couldn’t get another Amex Hilton bonus again regardless.

I guess Amex will not give bonus for the upgrade to from regular to Surpass if you’ve had the Surpass before?

That might depend but I’d certainly want to check with them before upgrading.

@Carl P, in the past people would upgrade their regular Amex Hilton to Surpass to get the upgrade bonus then downgrade a month later after the bonus posted, the repeat upgrade a year later for another bonus. I would look at the T&C of the upgrade and search for the “once in lifetime” wording. Maybe worth trying anyway since I don’t remember getting a hard pull for upgrading

Chase is being very harsh on sign ups lately. If you have signed up for several other cards, how long would you say to wait on more cards before trying Chase again?

From what I’ve seen / read / heard, you won’t be approved if you have 5 or more new accounts (with any bank) in the past 24 months

Can you share any more info about the email you received regarding Ink cards? Is there evidence of people being approved for Ink while having opened 5 or more cards within the prior 24 months?

I don’t have any inside knowledge on the Ink unfortunately. The only thing that I had heard was a comment on my post about the current credit card signup rules from a commenter who suggested that you might still be able to get an Ink even if you had 5 new accounts in the past 24 months.