Amtrak holds a special place in my heart as it was my first major award redemption. As part of our honeymoon, my wife and I used the bonus from the Chase Amtrak Mastercard (discontinued) and the Chase Sapphire Preferred for over $3,000 of first-class train travel across the country. It was an amazing experience.

While everything about Amtrak Guest Rewards has changed since then, there is still some value in the program. And the primary way for the non-Amtrak-commuter to extract that value is through the co-branded BofA card. Here’s why you should consider it:

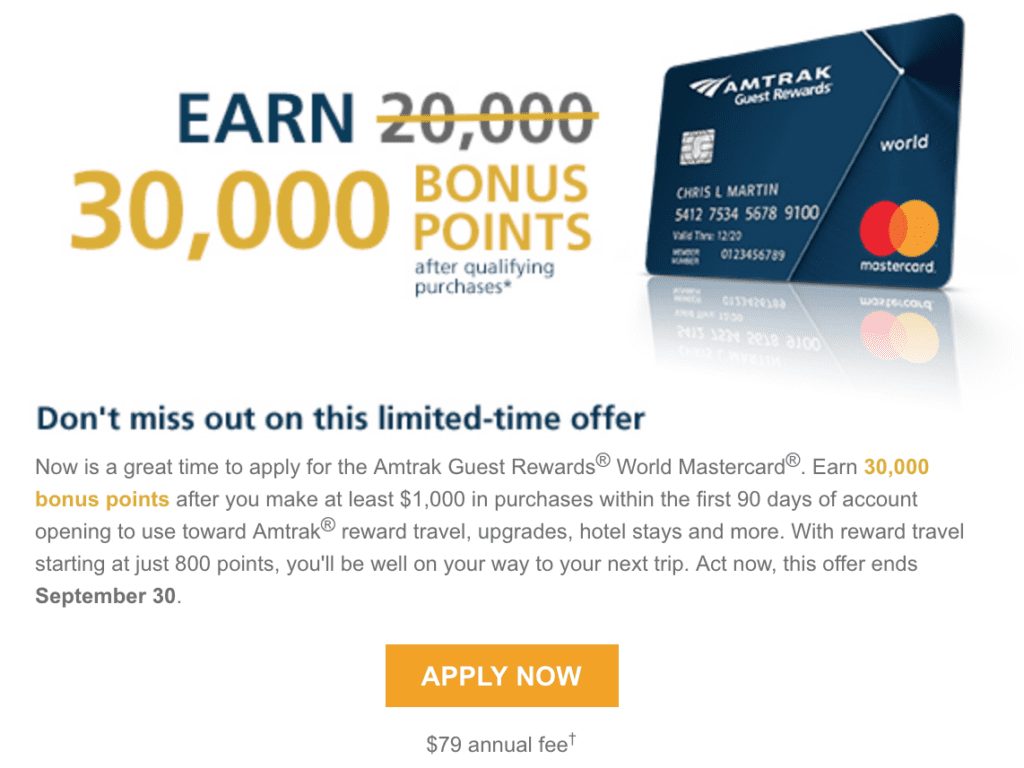

Current bonus is a 50% increase above normal

The Amtrak Guest Rewards Mastercard normally offers a bonus of 20,000 Amtrak Guest Rewards points after $1,000 in spending within the first 90 days. This isn’t a bad offer, considering the points are worth about 2.9 cents each. However, a 50% bonus over normal is significant. You can do a whole lot more with the 10,000 extra points.

Other benefits of the card include a 5% rebate on award redemption, 3 points per dollar on Amtrak purchases, extra Tier Qualifying points for every $5,000 points in card spending, and a single use companion coupon, a lounge pass, and a one-class upgrade certificate. If you ride Amtrak even occasionally, it is a solid card. The card does carry a $79 annual fee that is *not* waived.

What can you do with ~$900 in points?

So what can you do for 30,000 Amtrak points? There used to be a regional chart that could be exploited for insane value. Even when the sign-up bonus was previously a mere 15,000 points, this could still get you a Roomette between San Francisco and Denver, which might go for $800+ in summer months. So you could argue that the bonus “value” was $800 even back then.

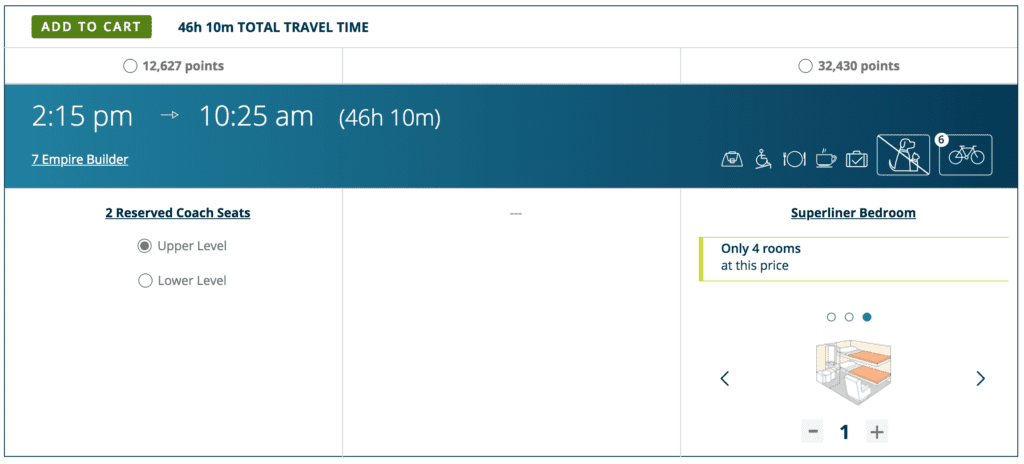

But Amtrak has gone and moved to a revenue-based redemption system. Even though this was a bit hit to the value of their long-distance sleeper car redemptions, the current elevated bonus is enough to give you some decent options. Consider this trip from Chicago to Seattle, for example:

With just a little card spending, you can make the two night trip on the Empire Builder for free with the 30,000-point bonus! The cash cost for this ticket for the date I checked was $940. This is definitely a fairly low price for this route. Prices can fluctuate quite a bit depending on the season and occupancy of the train.

Train travel is a blast!

If you haven’t experienced a long-distance train trip, I highly suggest you try it at least once. Just make sure you book a sleeper car, especially a bedroom. The bulk of the travel my wife and I did was in a bedroom car. You have a little more space, a much more comfortable lower bed (although you’ll probably still end up sleeping separately), and a private bathroom including a shower.

Any of the four long-distance routes between the midwest and the west will treat you to some incredible scenery. My favorite sections were both on the California Zephyr, first through the Sierra Nevada and then through the Rockies. Getting to sit back, relax, and enjoy the scenery as you travel along is unbeatable. It is so much better than car travel.

One of the benefits of booking a sleeper car is that all your meals are included. There are no other fees. The only thing you’ll pay each day is a tip to your waiter in the dining car.

Conclusion

The elevated Amtrak 30,000-point offer is good through September 30. If you’re interested in Amtrak experiences, consider Dan’s trips with his family (SEE: Reviewing the Amtrak Empire Builder route from Chicago to Seattle, AND: 4 reasons my Amtrak trip was a blast).

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Would that example be per person or per room?

That example is per room, for two people. The price does change slightly based on the number of people traveling in the cabin. A second (or third or fourth, in the case of a family bedroom) tends to increase the price, but not all that significantly.

I cashed in my points when you could still get a Roomette Denver/Sacramento/Portland for 15,000 points! All meals were included. That trip was 2 years ago, before devaluation. I still spend a little time on the Amtrak site ‘exploring’ new opportunities. Relaxing is an understatement.

Not seeing the 50% bonus when I looked at the card on BofA web site. Did you have a special link? Looks like you say its good til Sept 30.

Link added in the second paragraph.

Hi,

Your “link” to the offer doesn’t work.

Tom

Link added in second paragraph.