Back in July, US Bank announced some big changes to its Flexperks Travel Rewards program. The biggest change was that beginning December 31, 2017, FlexPoints will be worth 1.5 cents per point for all airline ticket, car rental, and hotel redemptions, compared to currently 2 cents per point. The change was aimed to simplify the structure of redeeming FlexPoints to match the new US Bank Altitude Reserve card.

Cashing out FlexPoints at maximum value

My husband has been a FlexPerks member for many years. His card was converted from the old Northwest Airline visa card. We keep it open since it is his oldest credit card, and I do find it useful sometimes to have FlexPoints for flight redemption when award seats aren’t available. I got my own card during the 2016 Rio Olympics promotion. Between the two of us, we had a decent chunk accumulated. My plan was to redeem FlexPoints to the maximum value possible before December 31.

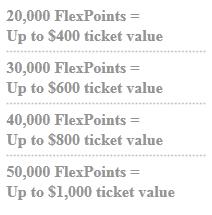

The current tiered redemption system for FlexPoints calls for:

- 20,000 points for fare priced up to $400

- 30,000 points for fare priced from $400.01 to $600

- 40,000 points for fare priced from $600.01 to $800

- 50,000 points for fare priced from $800.01 to $1000

- and so on

The strategy of redeeming FlexPoints is to find a fare at the top end of each tier. Back in September, when I was planning for our Christmas vacation in Orlando, I found a ticket for a friend between Dallas and Orlando for $398.60, the perfect redemption for just 20,000 FlexPoints! After December 31, the same flight would cost almost 26,600 points, 33% increase!

3 ways to redeem FlexPoints without a firm travel plan

No solid travel plans for 2018 but want to cash out your FlexPoints before the devaluation? Here are 3 tricks to consider:

- Use 20,000 FlexPerks to book a Southwest Airlines fare close to $400 (you have to book over the phone since US Bank can’t book Southwest online). After 24 hours, go to your reservation on the Southwest website and ask to cancel and exchange for a voucher that’s valid for one year.

- If you have Mosaic status with JetBlue, you can book a ticket with FlexPerks, then after 24 hours use your Mosaic status to refund the ticket funds to a TravelBank with one-year validity.

- Use FlexPerks to book a flight on Alaska Airline on US Bank website. Then after 24 hours, go to Alaska website and cancel the reservation. The funds will be returned to “My Wallet” in your Alaska account and will be good for one year. (All Alaska flyers can cancel a ticket more than 60 days in advance for free, while MVP Gold and MVP Gold 75K members can cancel up to departure day.)

How I cashed out 50,000 FlexPoints

After redeeming 20,000 points for the $398 American Airlines ticket, I still have 50,000 FlexPoints left. I wrote myself a reminder to redeem it before leaving for our Christmas vacation. Life became suddenly very hectic the past two months, and I could not come up with any trip idea for 2018. We love Alaska Airlines and I know at the very least I can always fly Alaska to Hawaii, I decided to cash out my remaining FlexPoints to Alaska.

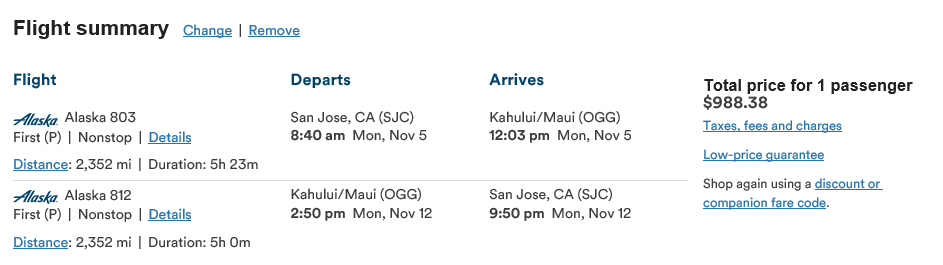

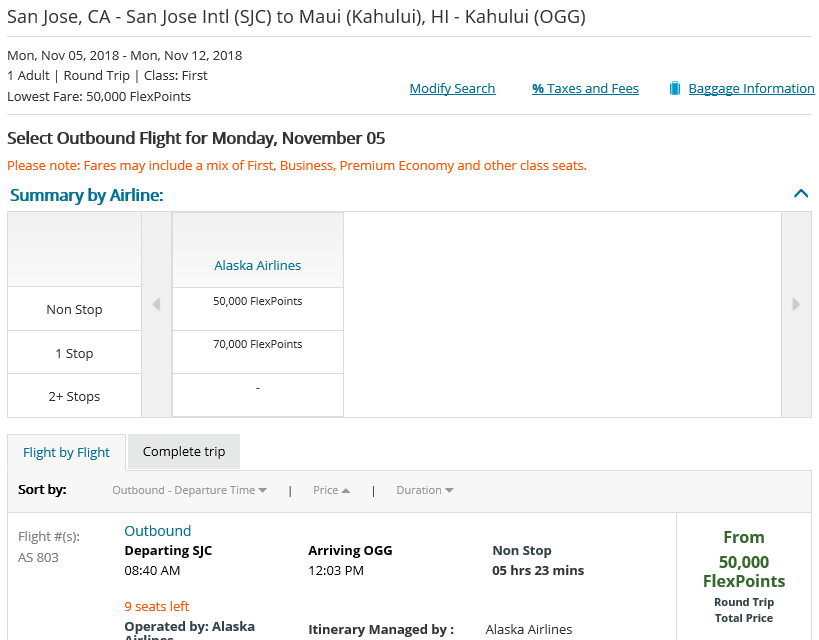

Using Google Flights I found a first class tickets to Maui on Alaska on random dates far on the schedule, for $988.38.

I knew the $988.38 ticket would cost just 50,000 FlexPoints, and sure enough I found it on US bank website.

I went through the booking process and the ticket was confirmed immediately. Within an hour I was able to add the reservation to my Alaska account online. I waited over 24 hours before cancelling the reservation, and I requested the ticket fare refunded to “My Wallet”. Now I have $988.38 sitting there waiting for me to spend before November 2018. Travel can be after Nov 2018 and as far as schedule opens in Nov 2018, which would be October 2019! To maximize the funds even further, I plan to purchase two tickets using the annual companion certificate that came with my Alaska Airlines Visa Card. By November 2018, I would be ready for a trip to Hawaii in summer 2019!

Are you planning to cash out your FlexPoints in the next three days?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

If I go the Alaska route, can I buy a ticket for a family member and have the funds returned to their “wallet”? I don’t fly Alaska but my sister always does.

Thanks for the tips!

Yes! You can redeem FlexPoints for anyone! When you redeem the points for your sister on Alaska, Just make sure you enter her Alaska MileagePlan#, the ticket will later show up in her account directly, and she can just cancel after 24 hours and have the funds deposit to her “wallet”. To be safe, I usually wait 48 hours instead of 24 hours.

Your best post of the year. Thanks for the ideas. Just booked a flight on Alaska for Nov 23,2018 at a total of $599.80 (search PDX-SJO then SJO-SNA in First and you should get same price) to drain my 30k Flex Perks.

I also used this trick to book an Alaska flight for July 2018. I wasn’t sure if I should wait longer to cancel, but I guess you’re saying the expiration is based on the flight date, not when you booked or canceled, right?

I believe the funds expire 1 year from the date you purchase the ticket.