US Bank has (for now) a slightly different rewards system. Whereas most mileage currencies are either cash points or “points” points, US Bank FlexPerks are slightly different

(SEE ALSO: The difference between cash points and “points” points (and why that’s important) )

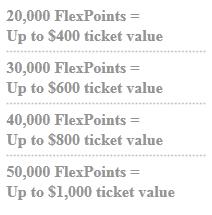

Currently, FlexPerks are slightly different in that you can use 20,000 FlexPerks for any ticket that costs up to $400, or 30,000 FlexPerks for a ticket that costs up to $600, etc

So if you redeemed your points at the high end of the range, you could get about 2 cents of value for each point. Apparently though US Bank also found this a bit confusing, as they’ve just recently announced that they will be changing later this year to have each point be worth 1.5 cents instead. While this does make things a bit more straightforward to use, it is a slight devaluation of the points.

I ended up using 60,000 FlexPerks to book 2 tickets to Sweden for later this summer

Get 500 free FlexPerks by enrolling in mobile rewards

So here’s a chance to get 500 FlexPerks. This isn’t worth a ton of money of course, but it should be worth somewhere between $7.50 and $10

You can watch US Bank’s video about mobile rewards here.

Personally that doesn’t seem like something that would be super interesting to me, but I’m happy to enroll for 500 points 🙂

To enroll,

- Log in to your usbank.com account, and hit “My Rewards”

- That will take you to flexperks.com and your rewards center. Choose “Offers”

- Enter in your account information.

- You can choose a minimum amount to use for your real time rewards and specific categories. I picked “Furniture” and $250 personally.

If you have multiple cards that earn FlexPerks (I have a personal and business), I believe you should be able to sign up for both accounts and get the 500 points for both accounts.

Good luck and happy travels!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Did your points post immediately? I un-enrolled and then re-enrolled. No points immediately, but wondering if I will get them. Thanks

They didn’t post immediately. I was planning on checking back in a few weeks