Last week, news finally broke of the rumoured Citi Prestige changes. We’ve compiled the info here, and I’ll be interested to hear what you think. If you have the card, will you keep it open? I think most of the changes are good, or at least reasonable, but we’ll sure miss the 4th night free.

Let’s take a look at the changes to the Prestige!

The good…

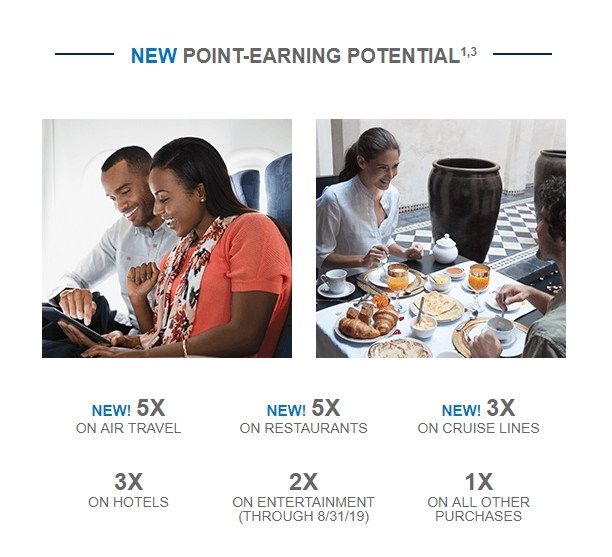

New Earning Structure

The revamped Citi ThankYou Prestige will earn Citi ThankYou points at the following rates, effective January 4th 2019:

- 5x on Air Travel

- 5x on Restaurants

- 3x on Cruise Lines

- 3x on Hotels

- 2x on Entertainment (through August 31st, 2019)

- 1x on Everything Else

Overall, I’d chaulk this up as a pretty good change. Citi is expanding your earning opportunities on travel transactions and giving you plenty of reasons to keep the Prestige in your wallet. For some of you, losing the double points on entertainment might hurt. At least they waited until the end of the summer concert season!

Expanded $250 Travel Credit

The new travel credit will cover any expense charged to the card. Remember, this credit is per calendar year, so you can “double dip” as the saying goes. Previously, the credit on the Prestige was only valid on air travel, though it was less restrictive than American Express’s airline credit, it didn’t even compare to the Chase Sapphire Reserve’s travel credit. We’ll see how flexible the new credit really is, but Citi specifically notes it will work for “taxis, hotels, car rentals, parking, tolls, and more.“

Cell Phone Insurance

Citi will offer cell phone insurance starting in May 2019. Details forthcoming, but I’m assuming you’ll have to pay for your monthly service on your Prestige card, and then you’ll have $400-$800 of cell phone insurance, depending on your circumstances. Usually this insurance has specific limits on types and frequencies of claims, but is common on many credit cards. In fact, I just switched my cell phone bill to my REI Mastercard since they now offer cell phone insurance!

Other Benefits

The Citi Prestige card will continue to offer TSA PreCheck/Global Entry credit. I know for a lot of you (like me) this is totally useless at this point. SO many cards offer the benefit, that I end up giving them away to family and friends. Don’t get me wrong, for the average person, that only has one or two credit cards, this is a great travel perk. But for those of us that are playing on the next level, Global Entry credit on all your credit cards has diminishing returns. I only have so many friends that travel regularly!

Speaking of which, Priority Pass Select membership will continue to be offered by the Citi Prestige card. Again, a great perk, if I didn’t already have two Priority Pass Select memberships…

(SEE ALSO: Our recent reviews of Stephanie’s at BOS, the Diamond Lounge at BRU, or the Aspire Lounge at AMS, all members of the Priority Pass system!)

The bad!

Annual Fee

Annual Fee will be increasing to $495, and $75 per authorized user, including cardmembers with a Citi Priority account. You will receive official notice of this change at a later date. This change will be effective at your account anniversary after September 1, 2019. If you maintain a Citigold or Citi Private Bank account, these annual fee and authorized user fee increases will not apply to your account.

This one’s a little complicated, but effectively, your annual fee (and authorized user fees) will be going up sometime after September 1st, 2019, depending on your cardmember anniversary. The increased fees will be waived if you hold a Citigold or Citi Private Bank Account.

…and the ugly:

No More Bonus Value When Redeeming Points for Air Travel

Previously, the Prestige offered a 25% bonus on points redeemed for flights, similar to Chase and American Express redemption rules. Losing the redemption bonus weakens the ThankYou currency, and means all those 5x categories are just a bit less impressive. This doesn’t go into effect until September 1st, 2019, so you’ve got plenty of time to use up your existing ThankYou Points.

(Keep in mind though, the ThankYou program has some unique transfer partners!)

Gutting the Complimentary 4th Night Benefit

The Citi Prestige’s 4th night free benefit was what really made the card stand out. For some travelers, the 4th night free was a game-changer, and immediately made the Prestige an indispensable card. Particularly useful for those with work/expendable travel, users could cash in on the 4th night free constantly throughout the year, saving a ton of money. We all knew this wasn’t going to last, and bloggers, Reddit, and FlyerTalk all waited for the day Citi would take this benefit away. To be honest, I’m surprised it took them this long.

Now, you’ll only be able to use the benefit twice in a single calendar year. The good news is, there’s still no dollar value limit. You’ll get your 4th night free whether you stay at the Ritz or at the Motel 6. Additionally, this change doesn’t take affect until September 1st, 2019, so you’ll have plenty of opportunity to use the benefit before then.

I think these changes really fall into two categories. The first set of changes position the Prestige to compete directly with other premium level cards. The second set of changes are reductions of benefits that were previously too generous. Here’s my verdict:

- 5x points on dining to beat Barclay’s Uber card and Capital One’s new Savor card (4% cashback), the new AmEx Gold (4x Membership Rewards), and the Chase Sapphire Reserve (3x Ultimate Rewards)

- 5x on airfare to compete with the AmEx Platinum (5x Membership Rewards) and the Chase Sapphire Reserve (3x Ultimate Rewards)

- 3x on hotels to compete with the Chase Sapphire Reserve (3x Ultimate Rewards)

- Expanded $250 travel credit to compete with the Chase Sapphire Reserve ($300 credit) and beat the AmEx Platinum ($200 credit on your selected airline, somewhat restrictive).

- Cell phone insurance is offered by a number of credit cards, and is a great fringe benefit added to the Prestige.

- 25% increase in points value when redeeming for airfare is very similar to Chase’s Ultimate Rewards program and the Business Platinum benefit from American Express.

- Annual Fee increased to offset some of the new benefits. Citi’s new authorized user fee structure is similar to American Express’s fee structure on the Platinum card.

- The unlimited complimentary 4th night free was bound to be let go eventually, totally unsustainable for Citi in my opinion.

You can read more about the changes at Citi’s dedicated page for the information, here. What do you think? Is the higher annual fee worth the change? Is the 4th night free benefit still valuable?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I’m really going to miss that 4th night free. We’ve used it between 5-10 times in one year! I honestly don’t care much about the earning categories because I don’t get much value out of Thank You points, but maybe I should look more closely going forward. The 4th night thing plus increased AF are heavy blows.

I hear ya Debra, that was a HUGE benefit for the card!

A lot of people with the $350 AF who no longer meet the citigold requirements seem resigned to the fact the fee will be going up.

But do we really know if Citi will do an effective ‘sweep’ of the prestige account holders not meeting the current citigold criteria? Assuming we value holding the card at a net $100 AF, shouldn’t we wait until post Sept-2019 datapoints before cancelling?

With competition between the card companies, how do they think taking away a major perk is going to get them more card clients?

That’s always the question!