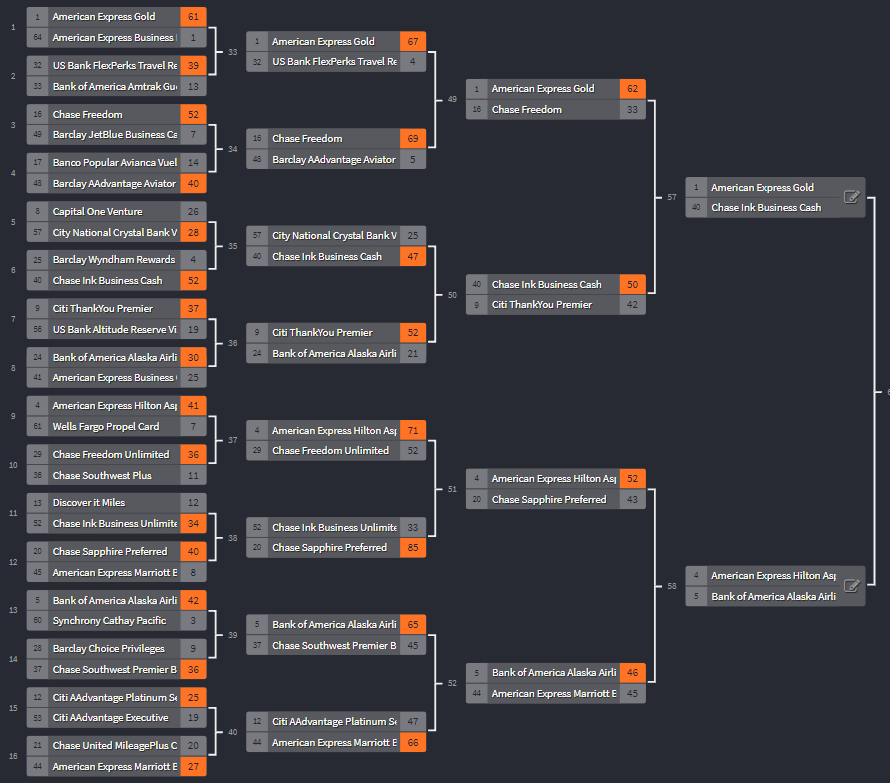

This time, Chase loses one of our favorite no fee cards, and the AmEx Gold continues its winning streak. Card Madness 2019 is halfway through, and we’re getting closer to the Financial Four!

Continue to vote on your favorite cards below, and see who won last night’s games!

Loving the Card Madness 2019 series? Follow along here:

- Pick the Best Credit Card of the Year with Card Madness 2019!

- Card Madness 2019 Bracket is up! Check the 64 Cards and Vote Now

- Card Madness 2019 – Vote for Your Favorite Round 1 Cards!

- Card Madness 2019 – AmEx and Chase Dominate the Competition!

- Card Madness 2019 – Two Games go into Overtime!

- Card Madness 2019 – Ultimate Rewards are Undefeated in Round 1!

- Card Madness 2019 – Flexible Points Lead the Pack, Goodbye Airline Cards!

- Card Madness 2019 – Hotel Cards for the Win, and Ultimate Rewards Finally Lose!

- Card Madness 2019 – PWaC Readers Must Like Paying Annual Fees!

- Card Madness 2019 – Barclays Narrowly Stays in the Tournament with its Last Card!

Game 49: American Express Gold (62 votes) vs. Chase Freedom (33 votes)

As expected, the AmEx Gold defeats the Chase Freedom in Game 49! Although the Freedom put up a good fight, there was a clear margin of victory for the Gold card. As we’ve seen throughout the tournament, benefits are the most important things to our readers when choosing a card, and this time it’s no different. The Gold card has a long list of benefits, including a new $10 monthly dining credit at select restaurants and the classic $100 airline credit. Goodbye Freedom, hello Golden handcuffs!

Game 50: Chase Ink Business Cash (50) vs. Citi ThankYou Premier (42)

Both of these cards had strong support in the first and second rounds of the tournament, so I’m not surprised this game was a close one. The Ink Cash will move onto Round 4, surpassing the Citi ThankYou Premier. The Chase Ink Business Cash earns 5x Ultimate Rewards on up to $25,000 spent annually on office supply stores, internet, phone, and cable, and another double UR on up to $25,000 spent annually at gas stations and restaurants. Citi is down to its last card: the Citi ThankYou Prestige, going up against the American Express Business Platinum in Game 54 below.

Game 51: American Express Hilton Aspire (52) vs. Chase Sapphire Preferred (43)

The Hilton Aspire defeats the Chase Sapphire Preferred!! Are you listening AmEx? PLEASE don’t gut the benefits on the Aspire (like we’ve seen happen to so many good cards). Hilton and American Express have crafted a fantastic card in the Aspire, with awesome benefits that make the annual fee well worth it. Although the Sapphire Preferred hasn’t been the buzzword it used to be, there are still plenty of fans of the card. With strong support in previous games for the Preferred, I’m surprised it didn’t get more votes.

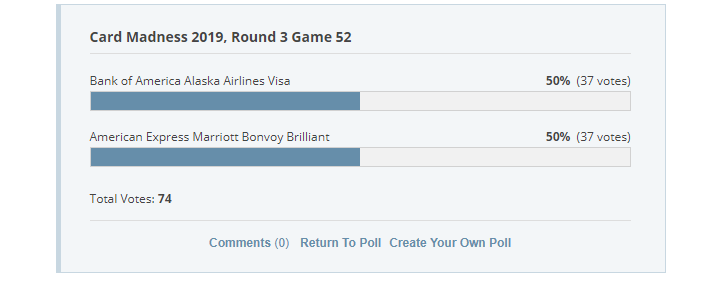

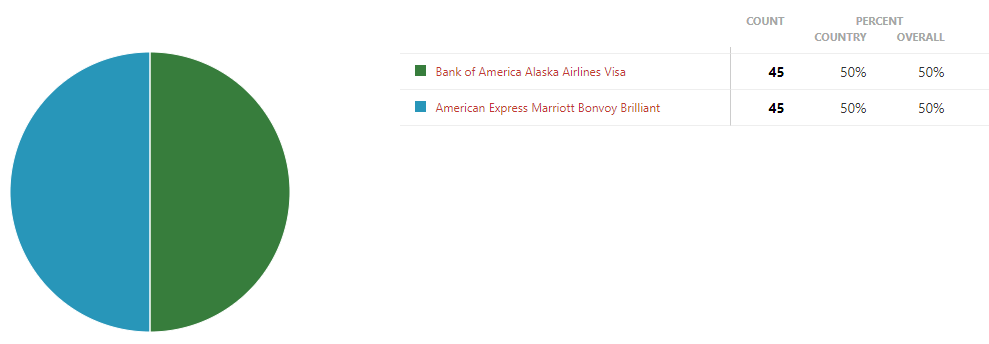

Game 52: Bank of America Alaska Airlines Visa (46) vs. American Express Marriott Bonvoy Brilliant (45)

Talk about an overtime game! When I originally went to write up this post early this morning, this is what I saw:

For every other tie game I’ve seen so far in this tournament, it’s been much smaller votes-wise, and one card always ends up taking the lead by the morning. Not this one! The Bonvoy Brilliant and the Bank of America Alaska card were locked in a struggle for the ages! So, I did what anyone would do, asked our readers to break the tie on our Facebook page.

And then it happened AGAIN.

So, I just kept refreshing the page. As soon as I saw an uneven number of total votes, I closed the poll! In the end, The Bank of America Alaska Airlines Visa card scraped out a win against the Bonvoy Brilliant, with a single extra vote: 46 to 45!

Follow the Challonge bracket here!

With these games under our belt, we’re one step closer to our tournament winner!

Round 3, Games 53-56

Game 53: Chase Sapphire Reserve vs. American Express Platinum Delta SkyMiles

I have to be honest here, I only see this game going one way…

The Sapphire Reserve earns triple Ultimate Rewards on travel and dining Weighing in at $450 annually, you’ll earn a $300 travel credit and have Priority Pass Select membership. Ultimate Rewards are a fantastic currency, with a long list of transfer partners. If you don’t want to transfer, the Chase Travel Portal can provide great value with the Reserve, making each Ultimate Rewards point worth 1.5 cents per point no matter what.

The American Express Platinum Delta SkyMiles card earns double SkyMiles on Delta purchases. You’ll also have the opportunity to earn Delta MQMs, if you’re trying to go for Status on Delta flights. An annual Delta Companion Certificate and in-flight savings can be useful for frequent Delta flyers too, but for a $195 annual fee, I’m hard pressed to think the Delta card will make it to the next round.

Game 54: Citi ThankYou Prestige vs. American Express Business Platinum

This game really boils down to Citi vs. American Express, ThankYou Points vs. Membership Rewards. While I think Membership Rewards have the edge over ThankYou Points, the ThankYou Prestige has enough benefits to make up for it. The Business Platinum has a few less benefits when compared to the personal edition of the card, but still earns MR, a great currency by any standard. The Business Platinum offers Priority Pass Select membership and a $200 annual airline credit. Once you select the airline you’d like, American Express will reimburse you for baggage fees, seat assignment fees, and the like. The Prestige earns 5x ThankYou Points on travel and restaurants, 3x on hotels and cruises, and 1x on everything else. You’ll also snag Priority Pass Select membership, access to Citi’s transfer partners, a $250 travel credit annually, and your 4th night free on two paid hotel stays per year.

Game 55: American Express Platinum vs. American Express Hilton Ascend Card

AmEx vs. AmEx. Remember, the Hilton Aspire took down the Chase Sapphire Preferred in Game 51 above, so maybe the Hilton Honors will surprise us! It’s an uphill battle against the AmEx Platinum though. The Platinum boasts a large suite of benefits, including monthly Uber credit, Priority Pass membership, access to Centurion Lounges, Hilton Gold status, and a $200 annual airline credit. Platinum cardholders earn Membership Rewards, 5x on airfare and AmEx Travel, and 1x on everything else. The Hilton Ascend card earns 12x Hilton points at Hilton hotels, 6x at grocery stores, gas stations, and restaurants, and 3x everywhere else. Cardholders have automatic Gold status and earn an annual free weekend night, and have the ability to spend up to Diamond status and a second free weekend night.

Game 56: Barclay AAdvantage Aviator Red vs. Chase World of Hyatt

The Aviator Red card is Barclay’s last representation in this tournament, after the issuer lost their JetBlue cards, the Arrival+, and a few others in Rounds 1 and 2. The Aviator narrowly defeated the Gold Delta SkyMiles in their last match to move onto the Chase World of Hyatt in this game. The Aviator Red offers double American Airlines AAdvantage miles on purchases, in-flight discounts, and priority boarding. Plus, earn a quick and easy 60,000 AAdvantage miles on sign up!

The Chase World of Hyatt includes one free night annually, with the chance to earn a second free night. These free nights can only be used at hotels in categories 1-4, but definitely still provide some value. At a $95 annual fee, you’ll also earn 4x Hyatt points on Hyatt stays, 2x points on gyms and fitness, travel, mass transit, ride-sharing, and restaurants. The World of Hyatt topped the AmEx EveryDay Preferred in Round 1, and the Chase Ink Business Preferred in Round 2. Which card will continue its winning streak??

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

This would be a cool exercise if you can run it on massive scale. You could share insights with card companies

Better trademark it before tpg steals the idea

Glad you’re enjoying it – we’re having a lot of fun with this series!

By chance, I happened to be on the Challonge page when you updated the brackets. It was kind of funny to watch the winners be added unexpectedly, because it turns out Challonge updates in real time, no need to refresh the page.

I am so glad you wrote an explanation of what happened with B of A Alaska vs. SPG Luxury. When I looked the two had been tied, and when I then saw B of A win on the Challonge page minutes later, I assumed you had used your power to break the tie yourself.

As for the current round, I hold both the Aviator Red and the WoH, and this will be a blow out. I cannot imagine anyone, even an AA flyer, finding more value in Aviator Red than in WoH. It shows in the previous rounds. WoH beat two traveler favs, Everyday Preferred and Ink Preferred, whereas Aviator Red got into the third round by beating two weak cards, Frontier and Delta Gold.

Looks like you’re right on the money for Game 56! I don’t have either card, and I thought it would be a closer game..

I was floored by the Alaska vs. Bonvoy Brilliant (former SPG Luxury) game – so cool to have one so close! I have a feeling some of the top 8 and Financial Four games will be very close too.