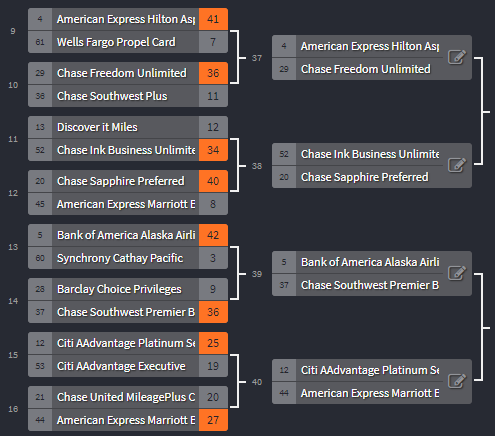

Ready for the results from Day 2’s Games 9-16? I bet nobody is surprised that Chase and American Express continue to win their games. And when the rubber hits the road (or when it hits the court?) Chase edges out American Express in Game 12.

Check out the original Card Madness 2019 post here, and keep reading for the most recent results!

Game 9: American Express Hilton Aspire Card (41 votes) vs. Wells Fargo Propel Card (7 votes)

The Hilton Aspire knocks the Wells Fargo Propel card out of the tournament in a 41 to 7 victory. The Aspire offers tremendous value, albeit at a high fee, and our readers recognized that. In the northeast, I don’t see a lot of Wells Fargo cards, but it seems to have some fans out in the western half of the country. To be honest, I’m surprised a large bank like Wells Fargo doesn’t offer more credit card options! In the end, American Express must have gotten something right with their 2018 revamp of the Hilton cards.

Game 10: Chase Freedom Unlimited (36) vs. Chase Southwest Plus (11)

Another victory written on the wall, the Freedom Unlimited beat the Southwest Plus. To be honest, the Southwest Plus did pretty well, considering the Unlimited’s strong, steady value proposition for many cardholders. I can almost hear those 11 people laughing as they get hundreds of dollars out of their Companion Pass this year!

Game 11: Discover it Miles (12) vs. Chase Ink Business Unlimited (34)

In Game 6, we saw the Chase Ink Business Cash beat the Barclays Wyndham Rewards Visa, despite a lower original seed. This happened again in last night’s game, with the Ink Unlimited (52 seed) beating out the Discover it Miles (13 seed). People either really love Ultimate Rewards, or just see Chase in the name and go crazy! Besides, Discover’s removal of the $30 annual WiFi credit probably left some people disappointed in the it Miles recently.

Game 12: Chase Sapphire Preferred (40) vs. American Express Marriott Bonvoy Business (8)

Chase continues to come out ahead, despite the updated benefits on the AmEx Marriott Bonvoy cards. Let’s be real though, this was a tough match for the Marriott Bonvoy Business. I know I personally voted for the Chase Sapphire Preferred too, it was my first travel rewards card, has a great earning rate, and just came out with a new welcome offer!

Game 13: Bank of America Alaska Airlines Visa (42) vs. Synchrony Cathay Pacific (3)

I find the Cathay Pacific card intriguing, if not entirely useful. With 1.5 Asia Miles on everything, you can definitely earn and burn, but it locks you into a complicated mileage system, with expirations and multiple levels. The BoA Alaska cards offer great value and some fantastic sweet spots on their partner awards. With a lack of Alaska transfer partners, you better have an Alaska card if you want MileagePlan Miles. Seems like the public agrees, with Alaska beating Cathay 42 to 3!

Game 14: Barclay Choice Privileges (9) vs. Chase Southwest Premier Business (36)

This time, Southwest prevails! The business version of the card wins 9 to 36 against the Choice Privileges card from Barclays. In addition to double Rapid Rewards on Southwest purchases, cardholders have a better chance of earning the Companion Pass.

Game 15: Citi AAdvantage Platinum Select (25) vs. Citi AAdvantage Executive (19)

This was a really close game! The Platinum ended up beating the AAdvantage Executive by only a few votes. In the end, the annual fee just wasn’t worth the Executive’s long list of benefits for most people. I currently have a Citi AAdvantage Platinum Select myself, but will be cancelling after April 30th!

Game 16: Chase United MileagePlus Club (15) vs. American Express Marriott Bonvoy Brilliant (24)

(SEE ALSO – Bye Bye Bonvoy My Marriott Titanium Status is Headed for the Bon-Void)

The Bonvoy Brilliant beat the MileagePlus Club card by a wide margin, despite mixed initial feelings by folks on its release. Both of these cards have large annual fees, but they also offer quite a few benefits. I have to agree with our readers here though, unless you’re a huge United flyer, the Bonvoy Brilliant will provide a better value for its $450 annual fee.

Follow the Challonge bracket here!

In Games 9-16, a major trend continues: transferrable points cards win. The flexibility of these cards resulted in victories for the Freedom Unlimited, Ink Business Unlimited, and Sapphire Preserve, all big wins for Chase. Game 15 was a great one too! So close, but the AAdvantage Platinum Select with its lower annual fees beat the AAdvantage Executive with its long list of benefits. Next Round we’ll see the Ink Unlimited against the Sapphire Preferred – sure to be a good match!

Check out tonight’s games below, and vote here! Some of the games seem like no brainers (we may have to invoke the mercy rule for Game 17), but some will be good matchups. I’m particularly interested in Games 21 and 24, two 2% back cards will challenge travel cards with great benefits.

As Game 15 illustrates, with only a 6 point swing, your vote counts!

Atlantic Division, Round 1, Games 17-24

Game 17: Chase Sapphire Reserve vs. Synchrony Sam’s Club

Sorry Sam’s Club, I just don’t see you winning this one…don’t get me wrong, you’re a great cashback card for the right person! With no annual fee, 5% cashback on gas (up to $6,000/year), 3% on travel and dining, and 1% on everything else, you’ve got some fans. Against the Reserve though? The Chase Sapphire Reserve is a favorite, just look around the next time you go out to dinner. I guarantee you’ll see a few people whip out the CSR. It’s easy to see why people love the card, with triple points on dining and travel, and a 50% bonus on redemptions through the Chase Travel Portal. Add to that the $300 flexible travel credit and Priority Pass membership, and a lot people keep the card despite a $450 annual fee. Well, we’ll see who wins tomorrow!

Game 18: Chase United MileagePlus Explorer vs. Bank of America Virgin Atlantic World Elite Mastercard

The Explorer is the standard level United card, offered by Chase. You’ll earn double MileagePlus miles on United Airlines purchases, restaurants, and hotels. With a $95 annual fee, you’ll also get 2 United Club Passes, priority boarding, and Chase has recently added a Global Entry credit. The Bank of America Virgin Atlantic card really shines with it’s welcome offers. Check out this Flyertalk thread – you can regularly earn up to 90,000 Flying Club miles!

Game 19: American Express Platinum Delta SkyMiles vs. Barclay Miles & More World Elite Mastercard

The Platinum Delta SkyMiles card is American Express’s mid-tier Delta offering, and also has a business version. American Express will give you double SkyMiles on Delta purchases, free checked bags, priority boarding, and an annual companion certificate for the $195 annual fee. The Miles & More card from Barclays earns Lufthansa miles. Lufthansa is based out of Germany, and is 1 of 3 European airline cobranded cards in the tournament! Cardholders earn double miles on purchases with Lufthansa’s extensive list of airlines, and two Lufthansa Business Lounge Vouchers annually.

Game 20: Barclay JetBlue Plus Card vs. Bank of America Travel Rewards

I love the JetBlue cards from Barclays! (Guess which one I’m going to vote for in this match…) With 6x TrueBlue miles on JetBlue purchases, double miles on restaurants and groceries, and free checked bags, it’s an awesome card for anyone near an airport served by JetBlue. The Bank of America Travel Rewards card earns 1.5 rewards points per dollar spent on everything. Think Freedom Unlimited, but issued by Bank of America. It’s even the same color!

Game 21: Barclay Arrival+ vs. Chase Ink Plus

I think this is going to be a great match! Both of these cards have a huge fanbase and offer tremendous value in certain situations. As always, any Ultimate Rewards card is sure to be popular. UR is a great currency, and the Ink Plus earns 5x points on office supplies and internet and double UR on gas and hotel purchases, with both categories capped at $50,000 in spend annually. The Arrival+ on the other hand, earns double miles on every single purchase, and Barclay “miles” are worth 1 cent per piece. This is basically a 2% cashback card, but provides a few minor bonuses. People love the flexibility of the Arrival+.

Game 22: Capital One Spark Miles vs. Citi ThankYou Prestige

The Capital One Spark Miles recently had a great welcome offer, and earns double Spark miles on every purchase. Although it’s notoriously hard to get approved for Capital One cards, this ranked 26 out of 64 in the initial voting, so it’s looking up. Citi recently devalued the Prestige, but the card can still offer a decent proposition to the right traveler. You’ll earn 5x ThankYou points on airfare and restaurants, 3x on hotels and cruise lines, and a $250 airline credit each year.

Games 23: Bank of America Premium Rewards vs. US Bank Aeromexico Visa Signature Credit Card

The Travel Rewards’ big brother, the Premium Rewards card boasts a slightly better value proposition for big spenders: double points on travel and restaurants, in addition to 15 points everywhere else. The $95 annual fee is almost immediately negated by the Global Entry fee credit and $100 annual airline fee credit. Lesser known is the US Bank Aeromexico Visa Signature Card. Aeromexico’s award program can offer good sweet spots on SkyTeam members, and US Bank awards cardholders double miles on all gas, groceries, and AeroMexico purchases.

Game 24: Citi DoubleCash vs. American Express Business Platinum

This is another game I’m really looking forward to! The DoubleCash was voted into the tournament by Facebook poll, and is something of a ruler we use to compare every other card to. No annual fee, 2% on everything, it doesn’t get simpler than that! The AmEx Platinum on the other hand, is a totally different ballgame. Cardholders get tons of benefits, including Priority Pass, Global Entry, hotel status, concierge access, an a $200 annual airline credit. Will simplicity beat benefits? Vote below!

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Chase Sapphire Reserve also provides full travel cancellation/interruption on all travel flights and tours (including points trips). This is a big deal for overseas travel where the full travel coverage can get pricey.

Very good point! I think the CSR is a no brainer over the Sam’s Club card, but we’ll see if it makes it to first place!