Shopping portals are one of the easiest ways to earn extra airline miles and hotel points. If you’re not familiar with what a shopping portal is, basically you go to a website affiliated with a airline / hotel before you do your online shopping, and by doing so, you will get a percentage of your order as a rebate. It can be either miles, points, or cash back, depending on the portal and on what is most valuable to you.

Types of portals

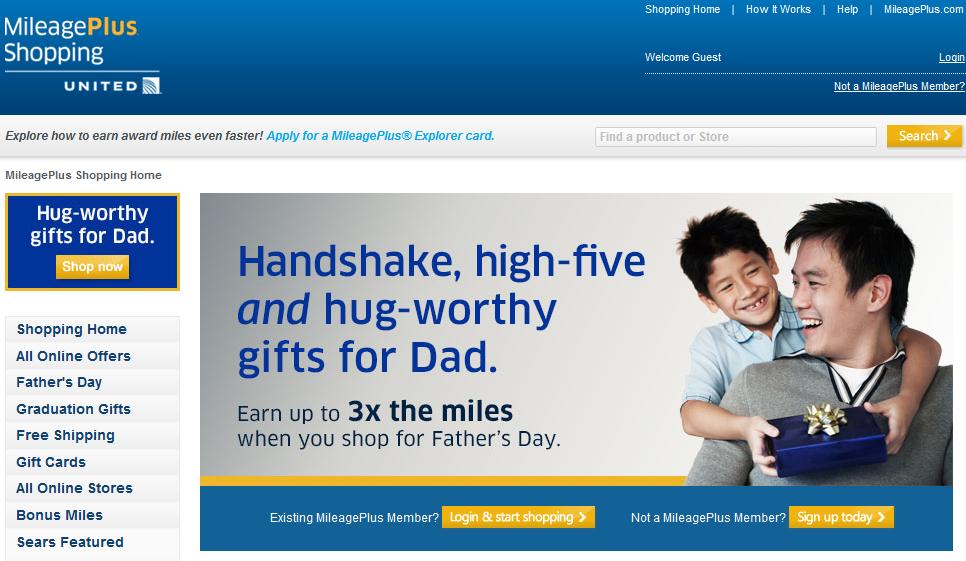

Just about every kind of mile or point earning currency has a shopping portal. United has Mileage Plus Shopping, American has AAdvantageShopping, Chase has the Ultimate Rewards mall (requires Chase login), etc. Different portals usually offer rates for shopping at different websites, so it pays to shop around. Interestingly enough, almost all of the shopping portals are all run by the same company, Cartera Commerce.

Finding the right portal

Frequent Miler is probably the blogger that has the most information on this topic (no surprise as his blog is mostly focused on the manufactured spending side of things. A recent blog post of his touched on this – The Best Portal Finder. The gist of that is that there are several different cashback site aggregators. A few of the top ones are:

These sites are great, because it would be a pain in the neck to have to log in to all the different shopping portals to find out which one had the best rate (and consequently, which one to use). But as Frequent Miler points out – the portal aggregators are only as good as how accurate they are. Personally I generally use Cash Back Monitor, and at least according to FM, that one appears to be the best (or at least close)

Example

Oftentimes seeing how it works in practice is a good way to help understand, so let’s walk through a real world example. The other day we needed to buy ink. After doing a bit of comparison shopping, we decided to use 4inkjets.com. (Needless to say, you should find the best price BEFORE you consider a shopping portal. While comparing shopping portals across different websites might make for a good masters course in this, spending $10 more to buy something at a more expensive site to get 50 more airline miles seems penny wise and pound foolish 😀 ).

So after we pick our website and price it out (let’s say the ink was $50 to make our calculations easier – have I mentioned I hate buying printer ink?), I go out to Cash Back Monitor and look for my vendor. Clicking on the 4inkjets.com site gives you the following screen

The payouts are grouped into different types. First you have the cash-back payouts, then the airline and hotel column, and finally the bank points. The site just provides the information – you have to decide for yourself which would be the most valuable to you. Your default should probably be the cash back. The 20% cash back is equivalent to $10, so if you choose miles or points, you’ll want to make sure that however many you get is worth more (to you) than that $10. One other thing to notice on the cash back side is the ones at the bottom such as Be Frugal where it says “Up to” 28%. With those you probably want to click through and investigate the fine print, but from my experience when it’s something like that where it’s “up to” – whatever YOU want to buy almost never qualifies and you’ll get a much lower rate. In this case, some inks qualify for the 28% off, but the regular ink only gets you 6% cash back.

The payouts are grouped into different types. First you have the cash-back payouts, then the airline and hotel column, and finally the bank points. The site just provides the information – you have to decide for yourself which would be the most valuable to you. Your default should probably be the cash back. The 20% cash back is equivalent to $10, so if you choose miles or points, you’ll want to make sure that however many you get is worth more (to you) than that $10. One other thing to notice on the cash back side is the ones at the bottom such as Be Frugal where it says “Up to” 28%. With those you probably want to click through and investigate the fine print, but from my experience when it’s something like that where it’s “up to” – whatever YOU want to buy almost never qualifies and you’ll get a much lower rate. In this case, some inks qualify for the 28% off, but the regular ink only gets you 6% cash back.

The other thing to consider is that most of  the cash back sites require reaching a certain minimum in order to “cash out”. So if you always hop around to whoever has the best deal, it might take you awhile to get enough accrued to cash out. I guess it’s not unlike airline miles in that regard, but at least for me, with Chase or American Airlines, I feel like I have more of a chance than with, say, “Coupon Cactus” 😀

the cash back sites require reaching a certain minimum in order to “cash out”. So if you always hop around to whoever has the best deal, it might take you awhile to get enough accrued to cash out. I guess it’s not unlike airline miles in that regard, but at least for me, with Chase or American Airlines, I feel like I have more of a chance than with, say, “Coupon Cactus” 😀

In this particular case, I might explore the 10x points at Southwest if I was angling to get enough points for the Companion Pass, but other than that, I would probably go through Chase for the 15x Ultimate Reward points.

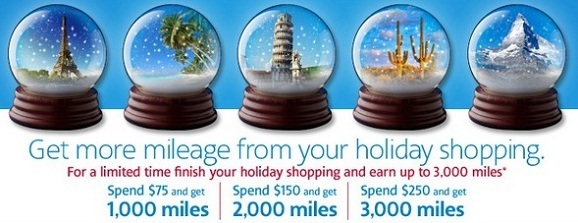

Promotions

Oftentimes, these sites will run promotions which give you extra miles or points above and beyond what you earn through just regular shoppping. For example, last December before Christmas, American ran the following promotion

So, going back to our ink example, if we say we needed $250 of printer ink (I mentioned I hated buying ink, right? 😀 ), then instead of getting only the $250 * 12 miles = 3000 AAdvantage miles, you would also qualify for this promotion, getting an additional 3000 miles, for 6000 total, or 24x your spend, which would move it ahead of the 15x Ultimate Rewards points for going through Chase.

So, going back to our ink example, if we say we needed $250 of printer ink (I mentioned I hated buying ink, right? 😀 ), then instead of getting only the $250 * 12 miles = 3000 AAdvantage miles, you would also qualify for this promotion, getting an additional 3000 miles, for 6000 total, or 24x your spend, which would move it ahead of the 15x Ultimate Rewards points for going through Chase.

These promotions come and go, so stay tuned to PWaC to hear about them

Double (or triple) dipping

Another great way to maximize your spending is by double (or triple!) dipping. An example of that is buying gift cards through a portal, then using those gift cards to purchase something (through the same portal). Different portals (and different vendors) have different rules about whether buying gift cards qualifies for cash back. Again, Frequent Miler is the best source for this kind of thing.

An example: Let’s say Sears is offering 5x cash back through the Chase portal, you go through the portal and buy $100 in gift cards (500 points). Then you take that $100 gift card, go through the portal again, and buy $100 in merchandise (paying for it with your gift card) (another 500 points). So instead of 5x, you get 10x. I have not experimented a ton with this but that’s the basic concept

Expiring Miles

Another thing that you can do with shopping portals is reset the expiration date on expiring miles. If you have any miles that are about to expire, you can buy something small through one of these portals, which will reset the expiration date on the miles.

Dangers

We mentioned earlier when talking about cash back sites that always hopping around might take you awhile to qualify for enough to cash out. The other danger is that some of these places don’t always have the easiest user interfaces or tracking. Not to mention that frankly I think some of them intentionally don’t track some of the purchases. It’s kind of like mail-in rebates in a sense, where you have to be organized and sometimes “fight” for your cash back. Buyer Beware for sure!

Conclusion

All in all, buying things through shopping portals can be a major way to increase your point totals. Before you buy anything online, check the portal payouts and buy it through a portal.

What do you say? Have you had good or bad experiences buying something through a shopping portal? Let us know in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

i like the double dipping concept. I’ve always wanted to travel but never had enough money to travel. But i think using the double dipping method i could buy stuff and sell it and begin to travel finally. Thank you for this great article.

What about shipping charges? Amazon ships things for free which makes it a probable choice for me. Do these portals offer free shipping too? Also I live in Alaska and not everyone will ship for free to Alaska.