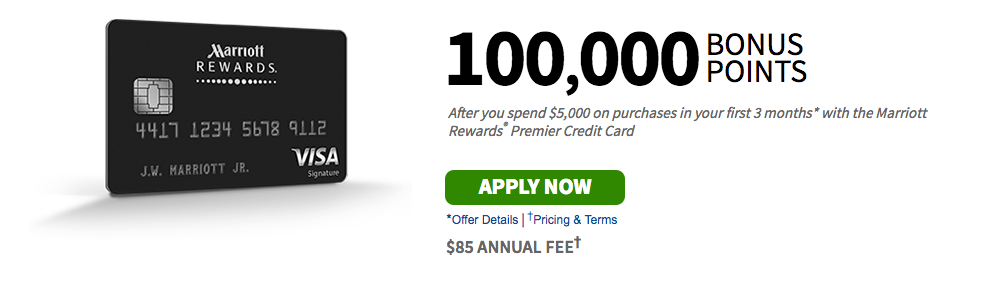

Yesterday, the news broke that Marriott and Chase had increased the sign-up bonus on the Marriott Rewards Premier Credit Card from the historic high of 80,000 points to an all-new high of 100,000 points! That is a great offer, with a potential snag, so let’s dive in and see if you should (or can) get this sign-up bonus.

Bonus Details

You can access the public link this offer here.

(UPDATE: This offer is expired – you can see other offers for this card on our top credit card offers page)

The terms of getting this bonus are:

- 100,000 bonus points after you spend $5,000 on purchases in your first 3 months from account opening

- 7,500 bonus points when you add the first authorized user and make a purchase in the first 3 months from account opening

Normally you’d get 87,500 points for $3,000 in spend, so 20,000 more points for $2,000 more isn’t so much of a stretch; however, don’t buy things you don’t need to reach a sign-up bonus! Bad!

Card Details

As usual, this card comes with an annual fee of $85, which is not waived in the first year. Additionally, you’ll receive 15 credits towards Elite membership when you’re approved for the card, as well as on your card anniversary. Remember, you’ll also earn one credit towards Elite status for every $3,000 you spend on the card. Finally, to sweeten the deal, you’ll also get a free night certificate (category 1-5) on your card anniversary.

In terms of earning points for credit card spend, you’ll earn at the following rate:

- 5x points per $1 spent at Marriott & Ritz Carlton locations

- 2x points per $1 spent on airline tickets purchased directly with the Airline, at car rental agencies and at restaurants

- 1x points per $1 spent on all other purchases

The snag, and hope?

Like most Chase products, the Marriott Rewards Premier Credit Card is subject to the dreaded 5/24 rule. If you’re unfamiliar with this sad piece of information, you should read some of Dan’s posts on the matter.

(READ MORE: Chase 5/24 is real and here’s the proof)

(READ MORE: The Chase 5/24 rule – cards you still CAN get)

If you’ve bumped up against 5/24 like I have, you may still be in luck–reddit reports are showing that applications for those with more than five card applications in the past 24 months are going to pending, rather than be denied right off the bat. If you’re not worried about a hard pull to your credit, you may want to gamble on this.

Final Notes

Remember, as Marriott and Starwood become one, you can transfer these points to your SPG account at a rate of 3:1, which would give you 33,333 SPG points. Also, Chase is generally very good about matching bonuses if you’ve applied for the same card within the past 90 days, so if you’re done that, send Chase a Secured Message asking to be matched to the new, higher bonus.

Will you be taking advantage of this offer? Let us know in the comments!

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Can you please let me know what the Marriott bonus points are for Canadians?