I’ve had a few requests to talk about manufactured spending, and how it works in today’s world. I’ve talked about manufactured spending as a a way to meet spending on credit cards, but the basic idea is that you want to spend money on your credit cards without actually spending money. The most famous idea was from a few years ago with the US Mint

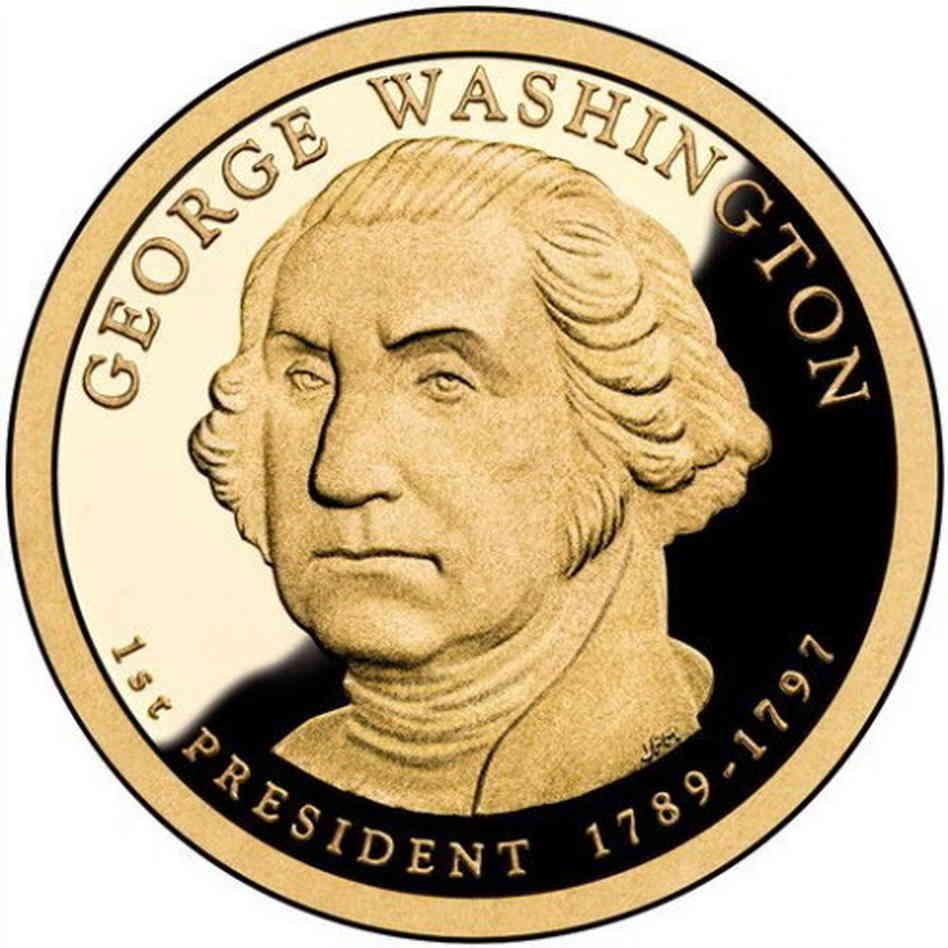

When the mint was trying to popularize the President dollar coins, you could buy them online with a credit card with free shipping. So, for example, you could buy $1000 in dollar coins with your credit card (earning miles, points or cash back), then take the coins to your bank and deposit them, using the $1000 to then pay off your credit card bill, for no cost to you (other than the weird looks you’d get from your local bank teller, of course). This deal is long since dead (you can’t buy dollar coins with a credit card anymore), but other ideas have come up.

When the mint was trying to popularize the President dollar coins, you could buy them online with a credit card with free shipping. So, for example, you could buy $1000 in dollar coins with your credit card (earning miles, points or cash back), then take the coins to your bank and deposit them, using the $1000 to then pay off your credit card bill, for no cost to you (other than the weird looks you’d get from your local bank teller, of course). This deal is long since dead (you can’t buy dollar coins with a credit card anymore), but other ideas have come up.

Vanilla Reloads

Most recently there was the idea of buying Vanilla Reload cards. These are intended to serve as prepaid debit cards for people that don’t have a checking account – in theory it’s a way to turn cash into something that you can use to pay bills.

Most recently there was the idea of buying Vanilla Reload cards. These are intended to serve as prepaid debit cards for people that don’t have a checking account – in theory it’s a way to turn cash into something that you can use to pay bills.

You could load up to $500 on your Vanilla account while paying a $3.95 fee. Typically people would buy these at CVS, since a) drugstores had good category bonuses and b) CVS would let you buy these cards with a credit card (a lot of other stores are cash / debit only).

So you go to CVS, spend $503.95 on your favorite rewards earning credit card, and then what?

Bluebird

What many people would then do is take those Reload cards and load them onto Bluebird, which is an American Express / Walmart product. Then using the Bluebird’s Pay Bill features, they’d use that to either pay legitimate bills like rent / mortgage / etc., or “pay” themselves to withdraw the money

One Vanilla

So a few months ago, this became untenable. I forget the exact reason – either CVS stopped allowing you to buy Vanilla Reloads with a credit card, or you couldn’t load them onto your Bluebird card at Walmart.

I believe Travel with Grant was the first to suggest using the One Vanilla cards, which had a $4.95 activation fee but still worked to manufacture spending. You also could automatically set them up with a PIN without having to go online or call – you just used whatever 4 digits you wanted.

At this point, I believe those also do not work for loading on to Bluebird. For awhile, you were able to do so by quickly hitting the “Change Payment” button on the Walmart credit card reader to change it to a debit payment, but recent Walmart POS changes make that impossible now.

Visa Gift cards

The other option that is out there is just regular Visa Gift cards. The fees are even higher on those (I think $6.95?). Of course, when there’s free money around (like there was last week), then those are no-brainers. Because of the recent credit card laws / regulations, pretty much all kinds of those gift cards are required to have a PIN available for debit card usage (I don’t pretend to understand all the finance law but I just tell it like I see it 🙂 )

Unloading to Bluebird via a kiosk

You still can’t load them onto Bluebird at the Walmart customer service or at a regular checkout lane, but if you can find a working MoneyCenter kiosk (better than the holy grail!), they can be loaded there. Of all the Walmarts in Cincinnati, I know of only one where the kiosk works, and I did verify that you can still load gift cards onto Bluebird there.

Money orders

Honestly, I do not get everyone’s fascination with Bluebird. From where I sit (unless I’m missing something and it’s certainly possible that I am), cashing out with money orders is way easier and carries a fairly insignificant cost. Walmart sells money orders for 70 cents, and Kroger sells them for 79 cents. Like Milenomics says, when manufacturing spending, you also need to account for your time, and when I read about people spending hours at Walmart trying to load cards onto Bluebird, I think the 79 cents is well worth it.

I’m a bit spoiled in that Cincinnati is Kroger headquarters so there are probably 10 Krogers within 5 miles of my house. I visited several of them last week to unload my Office Max Visa gift cards, and each time had no problem buying money orders with debit cards, and using multiple cards to pay.

Real life example scenario from last week:

- 4 $200 Visa gift cards (2 txns at Office Max) – cost $797.80

- Money order purchased at Kroger for $799.21 + .79 fee = $800 total

- Split tender with $200 paid 4 times (PIN by default on those cards is set to the last 4 of the card)

- Net profit of $1.41 (plus nearly 4000 Chase Ultimate Rewards)

- Time spent at the store – <5 minutes for sure

Was this guide helpful? Any other questions? Have you ever bought reloadable or other gift cards to manufacture spending?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

When purchasing money orders at walmart I understand the per money order limit is $995 or the max $$you can get from 4 gift card swipes. Is it the same at kroger, or are the $ and # or max number of swipes greater?

If $995, or max 4 gift card swipes, is the max per MO limit at Walmart, what are the same limits at kroger?

Hmm I’m not sure and haven’t asked. The max that I’ve done is 4 or maybe 5 swipes and max dollar value that I’ve personally done is I think is $800. If anybody else has any evidence, let me know

Re: why people might prefer the bird to MO: less remarkable things going on in their checking account, especially with a home loan in the next few years. Rather not have a critical underwriter on ones case about the amount of and frequency of MOs. BB/serve are perfect for this stuff.

Also, ever check Milford WM?

You can load BB or Serve at any register or at the Customer Service center, you just need to find someone that is helpful and nice (being friendly could make a Cashier’s day and your’s much easier). I have done 3 $800 loads with $200 VGC no problem and it only took maybe 5-7 min and didn’t cost me a dollar (I believe the swipe limit per transaction at WM is 4 per transaction from what I have heard and personal experience). OneVanilla GC can still be loaded to BB or Serve but only at Family Dollar for an amount max $500 per swipe and UNDER $1000 per visit (they have a low money velocity limit that can mess up your load especially if done with a GC and give you a headache), but $500 per time should be no issue. If you have any other questions let me know @mileswhip

I have never done any of this. I guess it sounds confusing. You buy gift cards at office max and then buy the money order at Kroger to pay what off? If you have a credit card you are wanting to reach the minimum spending limit or rack up more points on I get that. Are you buying the gift cards with the credit cards? I guess I’m not following

I have the Visa GC (metabank) from Staples and want to get a MO at WalMart via Kate. Is there anything I need to do beforehand (set a pin) or should I be good to go?

Some of the cards have a default PIN set up beforehand and others you have to call. If you’re not sure, it only takes a minute or two to call the number on the GC and set a PIN

Can you buy these money orders directly with a credit card? Or do I need to buy a gift card first and than use it towards the money order?