When I first started my blog, one of the first comments I got on Share was asking about how to meet the minimum spending requirements that most credit cards have in order to receive the signup bonus.

For example, one of the better credit cards out there is the Chase Sapphire Preferred, which you can find on our top credit card offers page. It often comes with a bonus of 50,000 Ultimate Reward points after you spend $4000 in the first 3 months of having the card.

That’s a very good offer – I mean, who wouldn’t want to get the “premium privileges you deserve”? Those 60,000 points can transfer to a number of places, like Hyatt hotels, or United Airlines, or British Airways (where they could be used for up to 5 roundtrip flights!)

- The Basics

- How does signing up for credit cards affect your credit score, Part 1

- How does signing up for credit cards affect your credit score, Part 2

- Meeting spending totals on credit cards

- Tracking signup bonuses (and making sure you GET them!)

- Earning miles through shopping portals

- The truth of the travelers's triangle: The relationship between time, price, and location

- Begin with the end in mind

But spending $5000 on a credit card in 3 months can be daunting, especially if you don’t already have a lot of credit card spending. The LAST thing that you want to do is put unnecessary spending on it, or spending more than you can afford to pay (remember, at 17.99% or worse, the finance charges will more than eat up any miles you get).

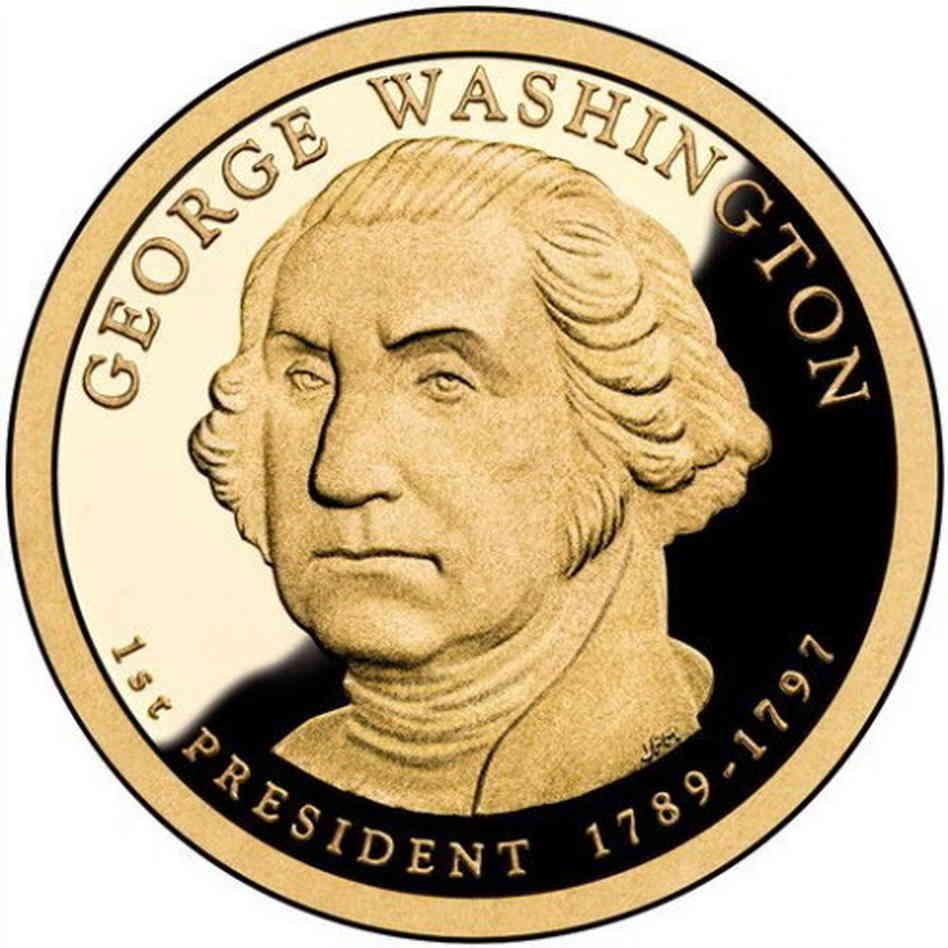

Still, there are a couple of ways that you can “spend” money on credit cards without actually spending money. The original idea for this was the US Mint.

Back a few years ago, when the mint was trying to popularize the President dollar coins, you could buy them online with a credit card with free shipping. So, for example, you could buy $1000 in dollar coins with your credit card (earning miles, points or cash back), then take the coins to your bank and deposit them, using the $1000 to then pay off your credit card bill, for no cost to you (other than the weird looks you’d get from your local bank teller, of course). This deal is long since dead (you can’t buy dollar coins with a credit card anymore), but other ideas have come up.

There is actually some reluctance in much of the travel / blogger community to share some of these deals, since as more people know about them, it runs the risk that they will get shut down. This post is meant as an introduction to some of these – but in deference to some of those folks, I won’t go step by step here – there is information out there if you’re willing to put in the work to figure it out, and if you have spent time trying to figure things out and have questions, most people (myself included) are willing to help out.

So here are a few basic ideas

Amazon Payments

(EDIT: As of September 2014 , this no longer works)

Amazon has a Paypal-like service called Amazon Payments that lets you send $1000 a month to anyone for free (you can send more than this, but not for free). You can fund your account with a credit card

(which is why we’re mentioning it here!!!). So let’s say that you have someone you trust (like a spouse or good friend). Each month, you fund your account with $1000 on a credit card that you’re trying to meet spend on, and then send them the $1000. Then they can withdraw it to a bank account and get it back to you so you can use it to pay off the $1000 credit card bill.

Important Note: Some people have apparently signed up for multiple accounts. If $1000 a month is good, surely $10,000 a month must be 10x better, right? 😀 Most reports that I have seen have indicated that a few accounts has worked okay, but people with more than say 2-3 have reported getting their accounts closed down by Amazon. Apparently using the same credit card on multiple accounts has sometimes been a red flag

Kiva

Who wouldn’t want to meet credit card spend AND do good at the same time? Kiva is a non-profit microfinance site where you can give loans to (mostly) third-world entrepreneurs. There is a risk that you don’t get paid, but you can mitigate that by being smart about the loans that you pick – from what I’ve seen, the default rates are typically pretty low. I’ve made a few loans with Kiva and have not been defaulted on yet, though that’s a pretty small sample size. If you sign up through my link, you will get a free $25 to loan (and I’ll get $25 to loan also).

meet credit card spend AND do good at the same time? Kiva is a non-profit microfinance site where you can give loans to (mostly) third-world entrepreneurs. There is a risk that you don’t get paid, but you can mitigate that by being smart about the loans that you pick – from what I’ve seen, the default rates are typically pretty low. I’ve made a few loans with Kiva and have not been defaulted on yet, though that’s a pretty small sample size. If you sign up through my link, you will get a free $25 to loan (and I’ll get $25 to loan also).

Obviously if you’re doing this to meet credit card spend, you’ll want to pick loans with shorter time periods, and you’ll need to be able to float the extra cash until you get repaid. Since the interest rates you’re getting on savings accounts are microscopic, maybe you can use some of that money as capital to meet credit card spend, with the expectation that you will get it back over the course of the next few months.

Taxes

With the new year upon us, many of us have either income tax or property tax bills to pay. Now, typically the places that let you pay those bills with a credit card charge a percentage fee. So this is not something that I would recommend doing just to get the points on your credit card since a 3% fee on a $1000 tax bill ($30) is going to be more than the value of the 1000 points you’ll get, but if you’re trying to meet a minimum spend, it can make sense, since if it’s the difference between getting 50,000 points or 0, then of course it’s going to be worth it.

Vanilla Reloads / Bluebird

Vanilla Reloads are somewhat of an analogue to the US Mint analogy mentioned above. Bluebird is a subsidiary of American Express and is an online site where you can pay bills, write checks to people, and other things of that nature. Vanilla Reloads are similar to prepaid Visa cards – you buy them at a store (where they’re available varies by location but the typical ones are CVS and some gas stations). There is a $3.95 activation fee, but you can take that Vanilla Reload and use it to fund your Bluebird account.

So the typical idea is that you buy a Vanilla Reload for $500 (the maximum allowed on one card). This costs $503.95 and then you load the $500 to your Bluebird account, which you can use to then write yourself a check or transfer to your bank account, and pay off your credit card. Important: Similar to the Amazon payments above, if you go crazy on this, you run the risk of getting your account shut down (and/or having all your miles forfeited). I do not know of anyone who has had their account shut down for operating in a normal manner, but there have been reports of people that have gone crazy with this and gotten in trouble. The holy grail of this was doing it at Office Depot with a Chase Ink card (5x at office supply stores), which would give you 2500 Chase Ultimate Rewards for the $3.95 activation fee. Like i said above, when a deal gets too popular, it tends to get shut down, which is what happened here – now you can only buy Vanilla Reloads at Office Depot with cash.

Mommy Points wrote a good article on this recently which covered a little more about how this works.

Conclusion

So, if you’re worried about meeting the minimum spend on some of these credit card offers, you might want to consider some of these strategies to help.

This post is part of our Beginner’s Guide, which takes an introductory look at how to get started earning miles and points to travel for free. Make sure and check out the rest of the series!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I went to the Amazon payments site and it looks like they’re no longer doing this as of October 2014. Am I missing something?

“What has happened to Amazon WebPay?

As of October 13, 2014, Amazon WebPay is no longer be available to send, receive, or request money from other Amazon Payments users.”

Just wondering if I’m missing another way to use this to generate spending or if this deal is dead.

Thanks!

Hey Katie – yep Amazon Payments no longer works (for most cases). See also No more person to person Amazon Payments

For you and your large family or anyone else buying grocery stores gift card is a good solution. Meet your required spending and eat later!

If you buy and return after your rewards points post that may work, but credit card companies are pretty savvy so no promises here. This may not be worth the risk.

Hi,

Just got introduced to your site.However I am Canadian,& I’m not sure I can make your ideas work in this country,ie:limted number of banks,credit cards,airlines.I would appreciate your thoughts.Thanks,

Rick