I just recently completed my first Las Vegas trip as a full fledged adult (apparently visiting Circus Circus as a 12 year old doesn’t count). And while I had a lot of fun, as a travel hacker I was absolutely appalled by the things Las Vegas gets away with.

Take, for instance, hotel room rates. I booked a stay at the Excalibur for two nights at $39/night, thinking I was extremely clever and looking forward to earning some Hyatt points. Imagine my surprise, then, when my total doubled from $78 to $158 on the checkout page, a result of some undisclosed resort fees whose nightly total exceeded the room itself.

So, I did a little Googling, and here’s what I found.

Don’t Pay the Fees

Las Vegas is notorious for taking all your money, and resort fees are just the newest batch in the bunch. Sadly, there’s almost no way around them. That is, of course, unless you have elite status. While Mlife Gold (matched over from Hyatt) unfortunately won’t waive the fees for you, Caesar’s Diamond status will.

Luckily for us, Diamond status is pretty easy to get. Almost too easy, in fact. There are two main methods to getting status. First, you can sign yourself up for the Founderscard, a membership (not a credit card) that offers cardholders complimentary Caesar’s Diamond status (amongst other perks) for an annual fee of $595, though there are often promotions discounting the fee.

Or you can do what I did and leverage the existing status you have into a match with Caesar’s. This is a little complicated, so bear with me. There are a number of credit cards you can own that give you automatic status within a hotel program. Here are the ones you can use to match to Caesar’s Diamond:

The Cards

- Marriott Rewards:

- Marriott Bonvoy Brilliant American Express

- Annual fee: $450

- Gold status

- Marriott Bonvoy Brilliant American Express

- Hilton Honors:

- Hilton Honors Aspire American Express

- Annual fee: $450

- Diamond status

- Hilton Honors Ascend American Express

- Annual fee: $95

- Gold Status

- Hilton Honors Aspire American Express

- IHG Rewards Club:

- IHG Rewards Club Premier Credit Card

- Annual fee: $95

- Platinum status

- IHG Rewards Club Premier Credit Card

The Match

If it were a straightforward match to Caesar’s this post would practically write itself. Alas, this is the award travel community and nothing is ever easy. There are in fact four steps to completing your Diamond status match.

Step 1:

Own one of the credit cards listed above. I personally used my IHG credit card as the basis for my status.

Step 2:

Make your way to Wyndham’s (yes, Wyndham’s) status match page and complete the form. (You’ll need an account). Wyndham will immediately offer you a free 90 day match to its top-tier status, Diamond.

Step 3:

Head to Caesar’s status match page (you’ll need both your Caesar’s and Wyndham accounts activated), and complete the form, using your newly minted Wyndham Diamond Status.

Step 4:

Caesar’s will give you instant Diamond status, the equivalent of spending $15,000/ year at their hotels. You can now book your hotel resort fee free!

That’s Not All!

I originally did this because I was pissed off about having to pay resort fees, but Diamond status actually made a huge difference in my stay.

- I got to skip to the front of the valet line, which was:

- Free. Valet parking is totally free. (So is self-parking, but who’s gonna do that?)

- 15% discount on my room rate.

- Two free show tickets per month (from a list of about forty shows, including Penn and Teller).

- $100 in free dinner per year (valid at basically all of Caesar’s restaurants)

- Separate, priority lines for restaurants. This saved us queues of literally hundreds of people waiting to eat at some of the hottest restaurants in Las Vegas. I cannot emphasize enough how much time we saved here, as we walked up and were sat immediately.

There are also some benefits I haven’t used yet, but am planning on taking advantage of sometime this year:

- Free 3 night stay at The Atlantis, Paradise Island in the Bahamas. No, seriously, free.

The Totals

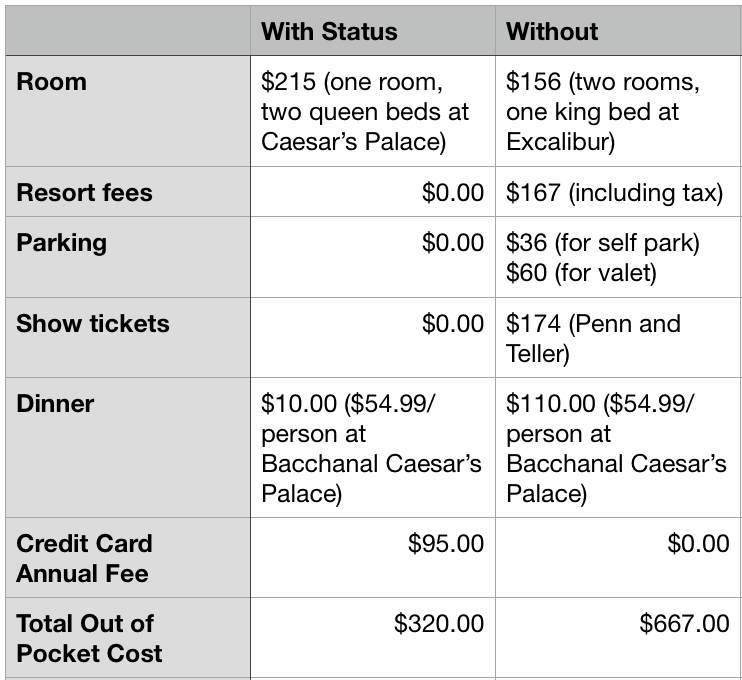

Ignoring the value of those free stays as mentioned above, as well as all the time I didn’t spend in line waiting for things, we can break down the difference in my stay with status vs. without:

Conclusion

So you can see there are some really good financial incentives to matching over. This chart doesn’t account for intangibles, like how much nicer Caesar’s Palace is than Excalibur, or the time we saved overall throughout the trip, but the numbers don’t lie. Even accounting for the credit card’s annual fee (which you don’t have to keep by the way), you still come out way ahead.

Hope you guys enjoyed this breakdown- now get matching!

Have any of you done this before? How was your experience?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The ” ‘ ” in Caesars is driving me cray cray. 🙂 BTW, Dubai is NOT a benefit for those who status match to Caesars Diamond.

RE: Caesars: https://travelzork.com/caesars-not-caesars-palace-las-vegas/

There are daily resort fees, gratuities, and taxes that you will pay at Atlantis Bahamas as a Diamond member (unless you earn 40K tier credits and travel off-peak or earn 80K tier credits).

You’re right- it’s not totally free (and I’ve heard that the food there can be expensive too) but it’s definitely still nice to have the free rooms.

There have been “grumblings” that even though it’s a “free” offer that Atlantis Bahamas has some expectation of casino play (and perhaps some new “fine print”). I do not necessarily agree with this, but just something to be aware of. Obviously, those who obtain Diamond (15k tier) are gamblers (somewhat) — so perhaps they are trying to deal with “status match” folks. Perhaps.

How long is the status match good for? Thanks!

My status match to Caesar’s is good through 1/13/2020, thought my Wyndham is only good for 90 days.

Great story but what exactly got the cost of dinner down to ten dollars. I don’t see this covered. Thanks.

Hi!

The $100 annual ‘Celebration Dinner’ credit is afforded to all Diamond members, which I used on the buffet.

You will NOT get free nights in Dubai if your status is MATCHED rather than earned. I suspect the same applies to Atlantis

Thanks for catching this! As far as I can tell, the free nights in the Bahamas still apply.

Thank you for showing me a more cost effective way to get my Diamond status back!

Glad to help! I loved feeling like an ‘elite’ in Vegas.

Status is only valid until 1/31/20

Oooh an esa!

Hi, this is a service dog.

It’s important to understand the distinction, as “A service animal is any dog that is individually trained to do work or perform tasks for the benefit of an individual with a disability, including a physical, sensory, psychiatric, intellectual, or other mental disability.”

vs. “An emotional support animal (ESA), assistance animal, or support animal, is a companion animal that a medical professional says provides some benefit for a person disabled by a mental health condition or emotional disorder.

I know it can sometimes be hard to distinguish between the two. Thanks for your understanding.

It’s simple. Never stay at any place that has resort/destination fees.

Like where, in Vegas ?

The status match I wrote about is valid at all Caesars properties, such as Caesars Palace, Ballys, Paris, Flamingo, etc.

Any news on if Founders Card and Caesars Rewards are continuing their relationship past January 31, 2020?