I am in the middle of planning a quick trip to Chicago later this week. I am looking at needing just one night at a hotel, so I was looking at different options. My first thought was to go back to the Palmer House Hilton that I stayed at last month, since it was only 29,000 Hilton points (a fairly low amount, all things considered)

But then I looked around and saw that there were many cash options that were super cheap! One that I was looking at was the Holiday Inn Express Magnificent Mile. Even though my AMAZING IHG Platinum status won’t get me breakfast at Holiday Inns, because this is a Holiday Inn Express, breakfast is included and that means cinnamon rolls!

Points rich and Cash poor

I would say that generally speaking I am “points rich” and “cash poor”. Meaning I have a lot of points but not a ton of cash. I guess a more accurate way of saying things is that I have a lot of points, so generally I would rather use them and save my cash for other things, travel or non-travel

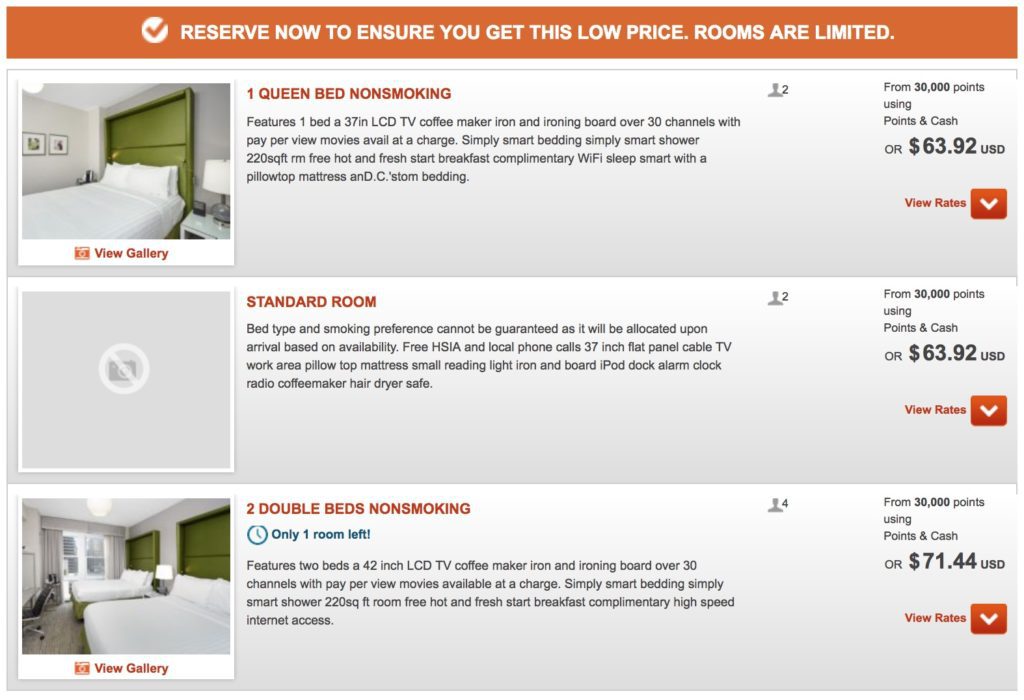

But man I could not pull the trigger on this! Look at these redemptions

I could spend $63.92 (it actually comes out to be about $75 after taxes) or 30,000 IHG points!?!? And actually that 30,000 points is not even really the ACTUAL cost / night in points. That’s just the minimum amount required to

The Cash and Points rates are even worse!

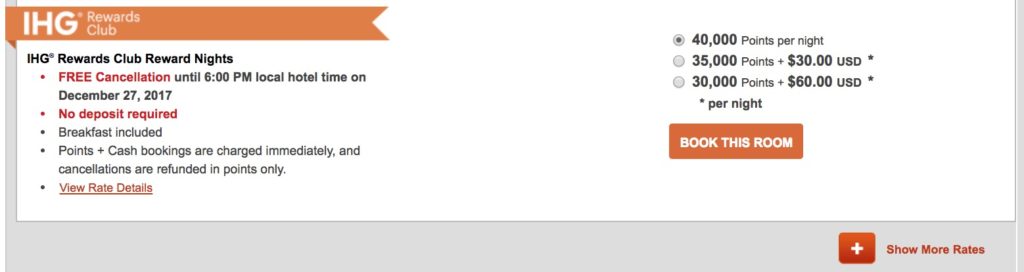

Hmm 30,000 points + $60 or $63.52…. that’s a tough call! 😀 That’s giving a valuation of 0.012 cents per point. That is…. incredibly bad!

It’s actually too bad that this stay isn’t in early 2018, as my IHG Accelerate Q1 2018 offer is pretty good and can be completed in just one stay

(SEE ALSO: Looking to maximize my killer IHG Accelerate offer in early 2018

I looked at using Chase Ultimate Rewards at just 1.25 cents point. Even though that’s not a “good” deal, again, like I always say, the best deal is the one that gets you where you want

Now it’s your turn – have you ever found a more worthless valuation of points? Share in the comments

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Must be the individual franchise holder doesn’t want the business.

I’ve got some nice rooms booked for a few days in Paris in April at 40k points per night.

I’ve seen even worse. I’m looking at the Days Inn Rio de Janeiro, Lapa for mid June. You can either pay 200 Brazilian Real cash, or with cash and points you can pay 3,000 Wyndham Rewards points plus 203 Brazilian Real cash. So you pay 3 BRL extra for the privilege of redeeming your points…

Ridiculous!

This is atypical. That’s a higher rate than some Intercontinentals. Likely the franchise owner…

All of the hotels in Chicago (city limits) are ridiculous points-wise. There are some okay values in the suburbs. The real value comes into play during special events. I was in Vegas during CES and rates were asinine, but I was able to redeem my IHG credit card free night and 60,000 points for 2 nights at the Palazzo. At the time, the cash rates for the room were about $800/nt.

“Man IHG points really ARE worthless”.

Come on Dan… your title is nonsense. Like all points and miles there are horrible redemption values and great ones. I mean, I assume you know this. The example you gave was clearly a horrible example. I come across these too and only use my IHG points when it makes sense to do so. I normally redeem them for about 1 cent per IHG point. The key is between all of their bonus opportunities, Quarterly Accelerate offers, and the 20% Spire redemption rebates it is easy to get a lot of IHG points quickly.

Points rewards stay the same in high and low season.

The theory is nonsense because this is ultra-ultra low season in Chicago. Cash prices are just above free many places.

Try this friday at the Key West La Concha Crowne Plaza- $395+tax cash ($435) or 50K points. ($250 worth of points with no tax).

Better yet, 12/31 at the Times Square Crowne Plaza- $1235+tax cash or 50K points (I’m using my free night cert there then).

IHG is good for availability at peak times.

IHG also has some not-good rewards and some fantastic rewards. Search for the bargains.

IHG points are valuable enough that everyone’s accounts have been hacked lately because of the ridiculously easy 4-digit password they use.

It’s all avout timing. Most people aren’t traveling to that area for business because its right in the holiday weeks. Most leasure travelers aren’t going to downtown Chicago because it’s after Christmas. Most normal travelers aren’t going because it’s super cold there right now. I feel the same way. I have tons of hotel and airline points but can hardly pass up such cheap rates at times. Even being cash poor.

For your ridiculous claim that IHG points are worthless I will point to the fact that I am booked next fall at the Intercontinental Amstel in Amsterdam for 50,000 points per night, which cost me $250, versus a paid price of over $650 per night. Oh, and I’m getting 10 percent of my points back by virtue of having an IHG Visa, for a net cost of $225. Knowing the difference between a terrific and a terrible redemption value is probably rule number one in the loyalty program game.

Intercontinental Tokyo The Strings, 50K IHG points/night or 316 USD/night (not refundable), or, in reality 392.39 USD/night (refundable rate), since I can cancel the points booking before 6 pm the day of. Not the greatest value for IHG points, but works for me.

Wow, that’s SO bad that you almost have to wonder if it was a mistake … although certainly not like the “error fares” we like to see! 😀

I’ve had the same experience as you. Worse, when I do book, I find I can often get a better rate online from the various hotel booking sites–and they allow cancellation for the same or lower price whereas IHG’s low price is a non-cancel reservation!

I stayed at a Super 8 in Homestead FL when we went to the Everglades. They have a deal where you can pay 3000 points and get a better deal (usually). I have used that deal to cut the price to about half and save $60-70 a night in Monterey and San Diego. Anyway, at Homestead it was actually $5 more to use the points than it was to just get the AARP deal and it was about the same price if you didn’t use AARP so you’d be just giving away 3000 points a night. So some nights those 3000 points were worth about $60 but in Homestead they were not worth a thing or even actually make my bill higher.

Wow, I can’t believe how cheap that room was in the middle of a highly desirable, big city! I get that there’s an ultra low season for travel, but as a financial hub, Chicago will always have business travel. Smart to save the points though!