I read an interesting article on the Efficient Asian Man site a few weeks ago, called “Frequent Flyer Miles aren’t for everyone“. His premise was that for the majority of people, focusing on frequent flyer miles does not make sense.

He said that you should only collect frequent flyer miles if:

1) You value premium cabin travel

2) You have a lot of flexibility, mostly in terms of time, but also in terms of where you’re willing to go

Other than that, you should put spend on a cash back card.

I disagree! Well, actually I DO agree with most of his point, but there is ONE reason that the miles and points earning cards still have a major part in most churner’s portfolios.

But first, some caveats

It’s always the fine print that gets you, right? 🙂

So when I say frequent flyer miles are for everyone, I don’t mean EVERYONE in the world. I am making some assumptions. First of all, you should have good credit, and you should be somewhat organized (to keep track of credit card signups and spending).

If you’re new to the game, I recommend first going through the Basics, or my Beginner’s Guide.

Why frequent flyer miles ARE for everyone

So why do I say that Frequent Flyer Miles ARE for everyone? Simple – it’s the signup bonuses. I agree with Edward’s point that for ongoing spend, in many cases, people would be better off putting their spending on a cashback card (or perhaps better, something like the Barclay Arrival card which will get 2.2% return on spending)

(SEE ALSO: Barclay Arrival, Citi Thank you, and CapitalOne Venture – points that count as cash)

But the mathematics of credit card signup bonuses are just SO attractive. Let’s take a recent offer that has been in the news – the Chase Ink 60K offer after $5000 in spending. That means each dollar of spending is worth 13 Chase Ultimate Rewards (12x for the bonus plus 1x for the actual spend)

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

That could even go up as high as 17x if you’re using bonus categories. In the Chase Ink’s case, it gets 5x at office supply stores, which is great for this week and next when Office Depot and Office Max are giving away free money!

Other cards might give 50,000 miles for only $1,000 in spend, meaning you’re talking upwards of 50 times return on your spend! That kind of return is really hard to beat!

The flexibility of frequent flier miles

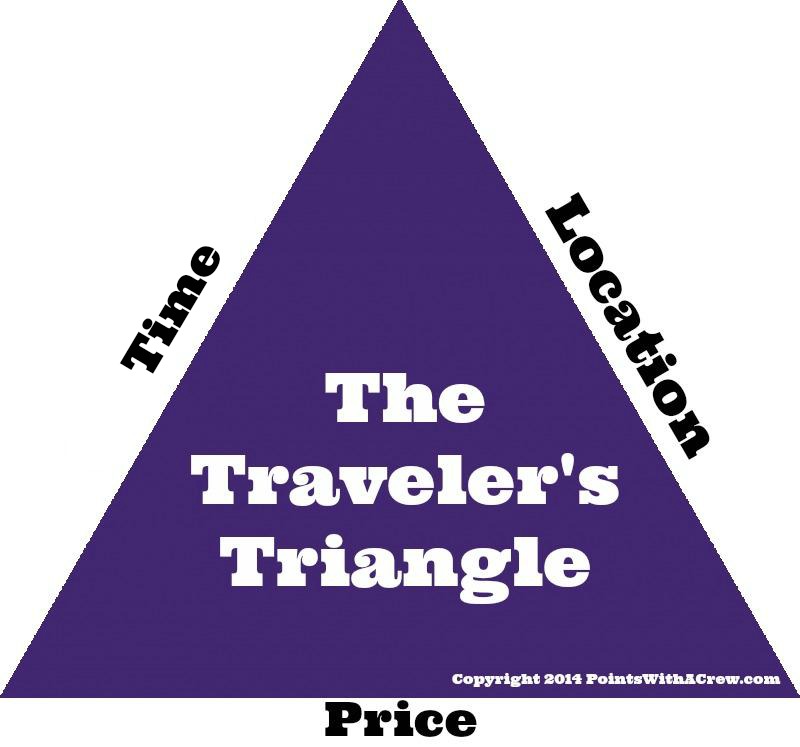

The original article is correct that frequent flier miles are MUCH harder to get specific flights. I’ve written about that before with the Truth of the Traveler’s Triangle: The relationship between time, price and location

The more flexible you are with your dates or your locations, the better price you can achieve, though that is true with either miles or dollars. As I’ve mentioned before, sometimes you just gotta suck it up and book the “standard” award.

The more flexible you are with your dates or your locations, the better price you can achieve, though that is true with either miles or dollars. As I’ve mentioned before, sometimes you just gotta suck it up and book the “standard” award.

Another thing to consider is that when redeeming frequent flier miles, you can take advantages of stopovers and/or open-jaws, to visit more places for the cost of only one ticket.

(SEE ALSO: Stopover, layover, open-jaw? What are they and what’s the difference?)

So, going back to the original question, I think the problem might be not deciding what to do with unbonused spend, but how to find more cards! 😀

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Excellent analysis.