I received an email from reader Kurt the other day, who asked:

I found your blog recently and it has been very inspiring to see how you travel for free with a big family. I’ve signed up for a couple of credit cards with bonuses in my name and now I’d like to see if my wife could sign up for the same cards. The reason I have doubts is because she’s a stay-at-home mom and does not have any income. I know the credit card applications ask for personal income and I’m wondering if we could list my income or if it would be questioned?

Great question and one that has come up for our family as well. Kurt (and I) are both talking about Stay-at-Home Moms (SAHM), but the same thing applies for Stay at Home Dads or any other kind of Stay at Home spouses, who typically rely on the income of a spouse / partner.

Stay at Home Mom income: What to put on credit card applications?

I gave Kurt the short answer, which is “Yes, you can put the income of the working spouse”, but told him I’d write a bit more about it as the “long answer”. I’ve actually written about this once before back in January 2014, in a piece called Credit cards for Stay-at-home moms. As Kurt (and myself, and others have seen), all credit card applications have a spot where you have to put in your income. Seems pretty straightforward, right?

But starting in 2010, this got a bit tricky for stay at home moms and other people with more complicated situations. As part of the CARD act of 2009, banks were now required to evaluate people based on their individual ability to re-pay (among many other reforms)

One unintended consequence of this was that all of a sudden, stay-at-home moms and others with more “complicated” financial situations found themselves frozen out of the credit card market. Applications all of a sudden specified INDIVIDUAL income, and so it was unclear whether stay-at-home mom income was $0 or not.

There were some that went ahead and put in their household income anyways, and if asked about it, just stated the truth. There were probably some people that may even been a bit “dodgy” with the situation, though I wouldn’t recommend that. I wasn’t particularly active in applying for credit cards back then, so I’m not sure what banks would do with a SAHM that listed $0 income, but thankfully this has all now been resolved.

It took 3 years but finally in April 2013 an amendment to the CARD act was finally passed which “allows credit card issuers to consider income that a stay-at-home applicant, who is 21 or older, shares with a spouse or partner when evaluating the applicant for a new account or increased credit limit.”

Signing up for cards in 2-player mode

There are some definite advantages to signing up for cards in “2-player mode”, and you can still take part even if one spouse is a stay at home mom (or dad). Stay at home mom income can be reported as the total household income (in most cases). If your situation is more complicated, you may want to double check.

[SEE ALSO: Why you should get 2 IHG cards at the same time]

Hopefully this helps all the stay at home moms and stay at home dads out there who still want to get lots of travel bonuses from credit cards!

What Credit Card To Get

So now that you know what to put for SAHM income on a credit card application, you might be wondering what card to get. While the best credit card to get will depend on your specific financial goals and situation, one credit card that I often recommend for people is the Chase Sapphire Preferred® Card. Right now you can earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening, though the card does come with an $95 annual fee.

(SEE ALSO: 4 Reasons to Get the Chase Sapphire Preferred® Card)

Note that the Sapphire Preferred card will likely require a solid financial history and good to excellent credit, so if you don’t think you would qualify for that card, you can also check out the full list of top travel and other credit cards.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

In joint property states you could always use spouses income.

I have reported family income since the 90’s on all applications and have never been asked about it. Same goes for my husband, for the years I was the primary earner.

Good point – in joint property states you would have always been able to use both spouses income, but now everyone can!

A year back when Millionmilessecret ran this article followed that.

For additional reading

http://millionmilesecrets.com/2014/01/09/stay-at-home-partners-can-get-credit-cards-again/

Just applied for Barclays Aviator – my wife did – but I didn’t list the joint income. Will see if the credit pull satisfies; she has a 835 credit score and is listed on the mortgage; has other cards, etc.

Why not take total household income and split it equally? If a person is a stay at home whatever they obviously aren’t making an income or they’d have to have all forms of taxes withheld. Sounds just like a lot of scams on this site.

Because that is not what the amended regulations say. Banks may consider “income or assets to which consumers have a reasonable expectation of access” when deciding to extend credit, per the CFPB. In this case, a spouse can report their household income (assuming they have full access to it) on a credit card application.

just applied to Capital one Venture (as a Stay at home mom) with my husbands income and our savings/checking information. Great credit. Low mortgage. Great income. got declined because “my income could not be verified”. (submitted husbands W2) can someone please explain? I have Barclay card now that I myself applied for. Doesn’t add up

I’d try calling in and talking to someone

The same happen to me with Capital One Venture. Obviously, they didn’t get the memo of the amendment to the Credit Card Act of 2009. Were you invited to apply for the card with a Reservation # or simply applied on your own from their site?

How can you get credit card agencies to HONOR new law? If they do not do we have consequences for them?

I don’t understand your question – what part of the law are you having trouble with?

Exactly. I’ve been refused from banks that I have accounts in even. One bank, I have $15k and my spouse has $15k, each of us in separate checking accounts (to earn awesome interest), but they deny me the credit card. And I HAVE a job–it’s just a small one that doesn’t pay much. Just because the amendment fixes that penalty to SAHM doesn’t mean they follow it. They’re allowed to have their own criteria which they say is more “protective of the risk” to their company. I followed up with the bank, and they said “because the mortgage is in both of your names, and if he is unable to pay it, you would have to, and your income cannot support that mortgage and a credit card from us.”

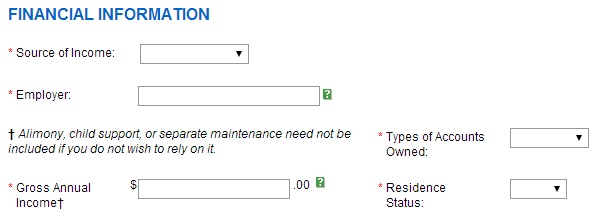

What do you put for employer and source of income?

I just choose stay at home mom and salary (or wherever the household income comes from)

is it ok as far as only marking other as far on the application cause I am a stay at home mom and I can use husbands income .Right now I am on his credit card and I have a score of 745

I don’t understand your question. Yes, generally if you expect to have access to your husband’s income to pay your bills then you can include it in your application

Is it better to list employer as homemaker or other? By better, I mean what has a better chance of being approved.

I don’t think it matters, but if I were you, and you are a homemaker / stay-at-home parent, I’d put that