As part of the conversion between American and US Airways (or maybe it’s just Citibank or American changing card providers), some of the Citi AAdvantage cards are changing.

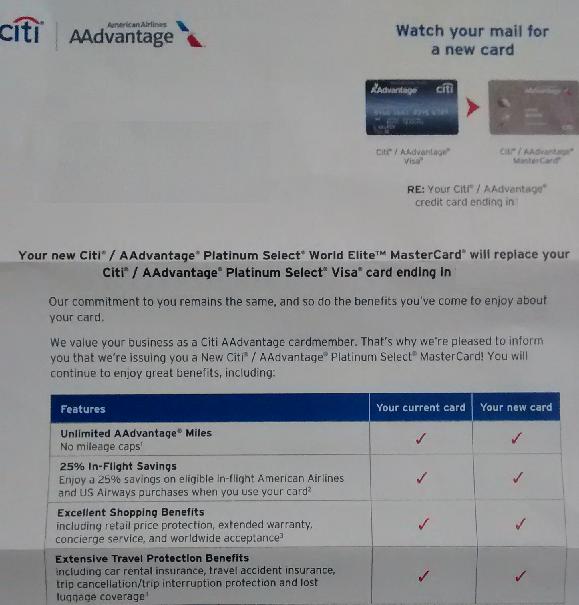

Kenny at Miles4More first alerted me to this fact, and to check the mail to watch out for this. Sure enough, the other day I got this fine notice in the mail:

Seems innocuous, right? What’s the big deal?

Here’s the big deal

Citibank’s rule for credit card churns have gone back and forth in some case, but right now are set up (for most cards) as limiting you to one bonus for having the card within 18 months.

Specifically, if I look at the terms and conditions for one of the Citi AAdvantage Mastercards, it says:

American Airlines AAdvantage® bonus miles not available if you have had a Citi® / AAdvantage® Platinum Select®MasterCard® opened or closed in the past 18 months.

So, if I were to let my card get converted to a Mastercard, that might limit my ability to get a bonus on a Citi AAdvantage Mastercard any time in the next 18 months. To me, it’s not clear whether an automatic conversion like this would count in the 18 month clock or not, but I figure better safe than sorry.

I called Citi to stop the conversion

I called up Citibank via the phone number on the back of my card. My intention was to product change into probably the Citi Double Cash card, but the lady that I spoke to said that she could just set something on their end to not convert the card from a Visa to a Mastercard (leaving it as a Visa), so that’s what I chose.

I’m a little nervous that whatever she did won’t actually work, but for now I am hopeful!

What about you? Did you get a note like this offering you a conversion?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Fortunately I canceled our AA Citi VISAs some time ago. In fact, I just applied for this new Citi AA MC with 50K sign up bonus.

Excellent! Churn away!

Wow that’s interesting- I just got a replacement Citi Platinum AA Visa with the EMV chip in the mail a few days ago. (Not by request, and my old card wasn’t due to expire til end of May.) I wonder what triggers the conversion for certain people and not for others.

It sounds to me like one will need to wait 36 months between card applications. Won’t you have to wait 18 months after you’ve closed your account?

I didn’t actually close my account. To answer your question, I don’t know if a conversion would count as the closure of an account. In my case, I have the same card so I’m pretty sure it doesn’t count as a closure.

Can be churned every 18 months. Apply for new card first after 18 months, get approved and then immediately close the old one. That way, your clock resets for another 18 months around the same timeframe (since you opened ‘and’ closed the AA card right around the same time and would have to wait 18 months anyways).

Makes sense?

Oh wow, thanks for the heads up. I haven’t received this yet. I was planning to close my AA Visa when the fee hits. Should probably push that forward I guess.