With great products like the Chase Sapphire Reserve and the Citi Prestige on the market, there are many options for good all-around travel cards. If you’re locked into a single airline, you can also pick up their co-branded card. Hotels are in on the game, too, with their own credit card products. Beyond that, you can consider plain ol’ cashback cards that are often the best option anyway.

Yet, I find one thing missing from an otherwise wide field of travel credit card options…

Why aren’t there rental car co-branded credit cards??

This. This is something I’ve wondered for a long time. Every major hotel chain and airline has a co-branded credit card. These deals make them a lot of money. More airline miles are handed out for credit card spending than they are for flying these days.

So why haven’t rental car companies gotten in on the game? Well…there are a few possible reasons. First, it may simply be the hurdle of designing a product that will both satisfy consumers and make the company money. Given that the two points-based rental car rewards programs that I use require fairly low numbers of points for a free day (550 points for a weekend day with Hertz), you can’t simply slap on a “1 dollar earns one point” ratio and be happy.

While I would be content signing up for a product that would earn one point per $5 spent, my guess is that a lot of people wouldn’t. They’d want *gasp* five points for their $5, forgetting that the value of points and miles is all relative! When you can get 13 cents (or more) out of Hertz points, they are among the best in the hobby. I collect them every chance I get. This week I am getting both a good deal and earning valuable points, all while driving this sporty thing:

Second, some programs would have to be completely redesigned. National, for example, gives you free rental days after certain numbers of rentals completed. This doesn’t map well to a credit card rewards system. Others don’t even have a real rewards system. Changes like this are a major hurdle.

Third, people love to hate on rental car companies. There is a segment of the population that also goes out of its way to avoid ever having to rent a car. From long lines to getting dinged for scratches and dents you didn’t cause, dealing with rental car companies can be the worst.

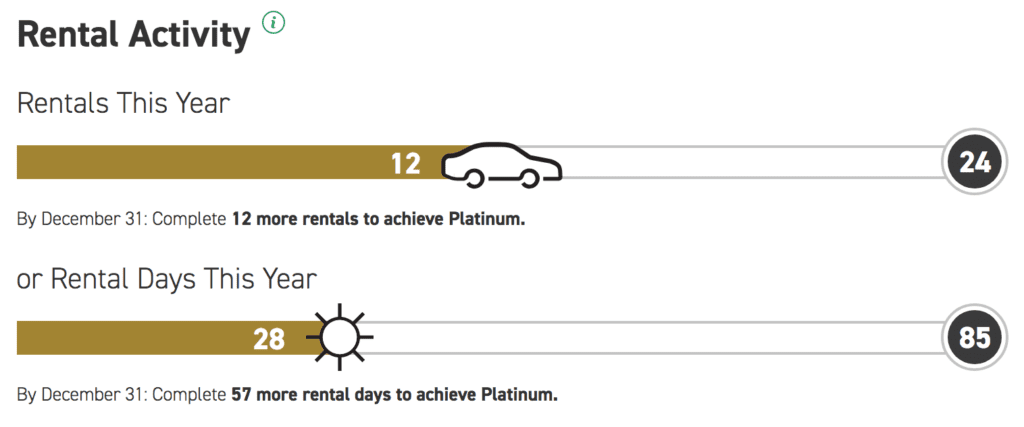

I’ve generally had very good experiences with Hertz and Enterprise, but this hasn’t garnered a significant level of loyalty that prevents me from choosing a $100 weekly rental deal from Alamo for a road trip across three states over the $160 Enterprise option. Still, I rent with Enterprise a lot. Enough to earn Gold status this year.

That being said, there could still be enough to entice people to sign up for a co-branded credit card, which may actually result in increased loyalty.

There is still huge potential here

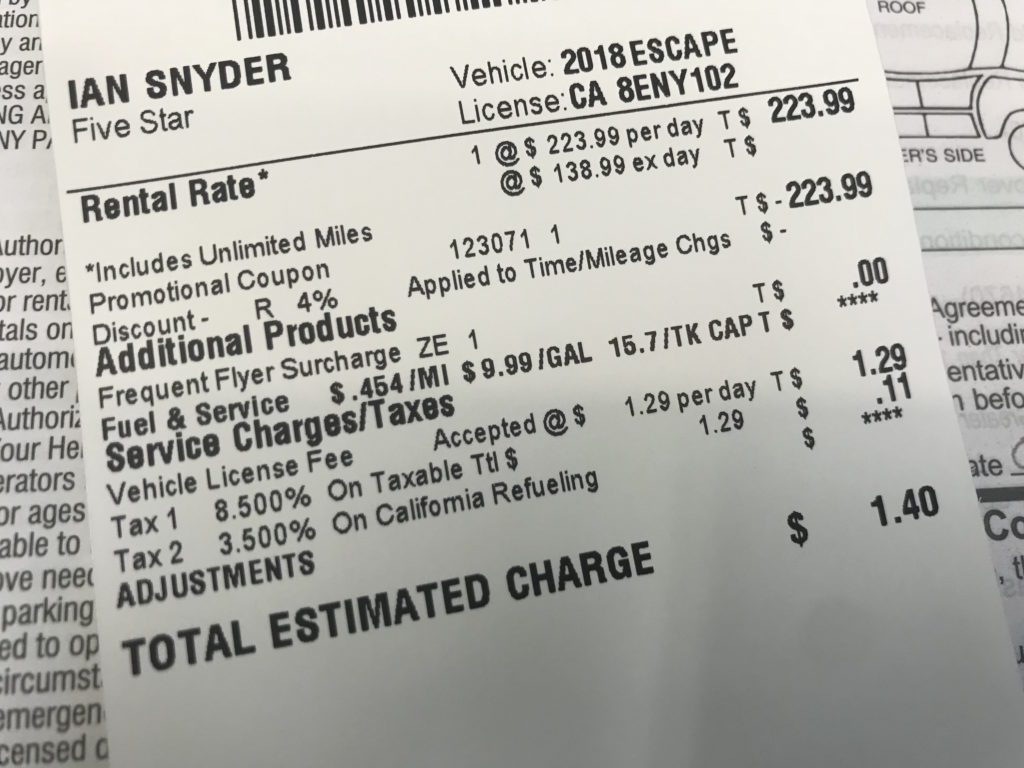

Even with the hurdles, I really hope a rental car company will see the potential here and capitalize on it. I also see the potential here as a frequent renter. Being able to amass a stash of rental car points, Hertz in particular, would be absolutely amazing. As a recent example, I burnt 1,100 points for a one-way rental to the Bay Area to catch a cheap flight I scored on a deal. Look how much we saved!!

Granted, had I not had points in my pocket already, we would have looked into a different solution to get us to the Bay. But nothing beats the convenience of a one-way rental where you can ditch the car and walk straight to the terminal. We’re also a one car family, so other than full family vacations, the family car gets left at the house.

What a product might look like

Here I’m going to offer what a potential product might look like for a co-branded rental car credit card. I’ve designed this on a whim, based on similar products that balance perks and rewards versus the companies bottom line. Just pretend with me for a moment.

Hertz Gold Rewards Mastercard

- 2,750 Hertz Gold point sign up bonus (good for one free weekly rental)

- Earns 1 points per $1 spent on Hertz rentals

- Earns 1 point per $5 spent on all other purchases

- 1 one-car-class upgrade certificate per anniversary year

- 550 points per year (good for one day weekend rental)

- Hertz Five Star elite status

- Rental car collision damage waiver (including coverage on award rentals)

- Points don’t expire

- $99 annual fee

I’d sign up for this product in a heartbeat. I don’t care that it earns one point for every $5 in spend. Given the value of Hertz points, this would be a great credit card to have in my wallet.

Enterprise could launch a similar version, with status perks, points every anniversary, and a reasonable sign-up bonus and earn rate calibrated to their program. They might need to be a bit richer than Hertz in terms of raw numbers, as their points aren’t nearly as valuable.

Conclusion

This is mostly me wishing for an awesome new product that I would find very valuable, but I honestly see this hole in the travel credit card space as something that needs to be filled. There is potential here, and one of the rental car companies will hopefully one day harness it.

A rental car credit card product obviously wouldn’t be for everyone. The value wouldn’t be there for people who live near an airport and never take road trips. But I would find great value in a rental car co-branded credit card, and I’m sure many others would as well.

I have to imagine that at least one of the companies has entertained the idea of signing a deal with a bank and launching a product. What am I missing? Why is there a hole here in travel credit cards?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I appreciate the time you put into this. It will only take one car company to do this and then they will all follow.

For me, I just put the rental on the Arrival Plus and then go earn the points to pay off the bill. While this is not as lucrative as it once was, it is still a good way to get about a 56% discount on what you have paid. You just need a friendly WM for doing all those visa debit cards.

I sure hope so! I’ve gone the Arrival+ route, too. But after finally earning enough Hertz and Enterprise points to cover some rentals and see the value of their points, I’m finding that I’d happily go that route every time. Especially Hertz.