We all want to earn lots of miles and points so that we can fly around the world in first class, or stay at Airbnbs with amazing vistas or travel however we want to travel. One of the best ways to get a bunch of miles and points is through credit card signups. Many credit cards offer welcome bonus of 50,000, 75,000 or even 100,000 points or more just for signing up for the card and making a minimum amount of spending. If you want to get serious about earning miles and points, you’ll want to focus on applying for multiple cards. Personally, my wife and I apply for new cards every couple of months or so and that’s how we have accrued several million miles and points, with very minimal flying or manufactured spending.

The difference between personal and “business” credit cards

Some credit cards are referred to as “business” or “small business” credit cards. Non-business credit cards are referred to as personal credit cards. Many credit cards have both a personal and a business version, and they are considered different cards. For example, there is an American Express Delta Gold personal card as well as an American Express Delta Gold business card. You can apply for both and even hold both at the same time.

The reason I say that you could be earning twice as many miles and points as you are today is if you are ignoring small business cards. Business credit cards often have some of the best signup bonuses, rewards for ongoing spending and credit card offers. If you see the word “business” and immediately look the other way, you are missing out on half the miles and points that you could be getting.

Another thing to keep in mind is that many business credit cards do not report to your personal credit report (unless there is a delinquency). This means that you can apply for small business credit cards without affecting your Chase 5/24 number. So if you’ve applied for a lot of credit cards lately and are trying to limit your inquiries to be able to apply for a Chase credit card, applying for business credit cards can be a good strategy.

(SEE ALSO: Overturning Chase 5/24 – here’s how I did it)

How a Business Credit card application is different

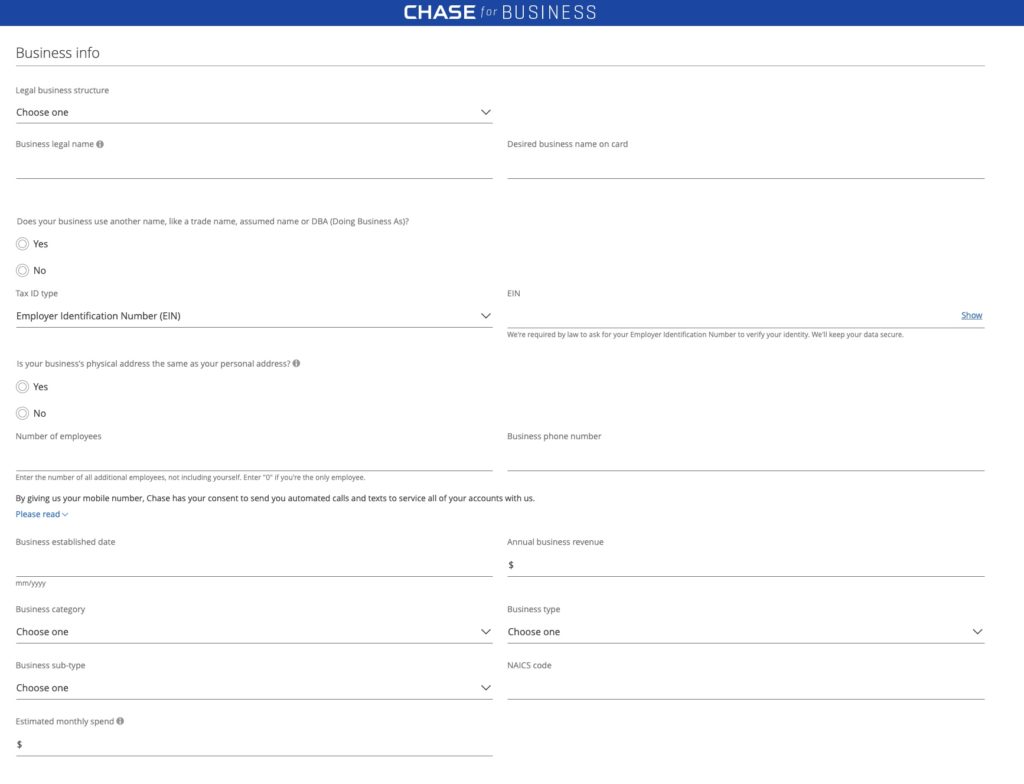

The biggest difference between a personal credit card application and a business credit card application is that you will be asked for information about your business. This might include:

- Business Name

- Business Type (Corporation, LLC, Partnership, Nonprofit, Sole Proprietorship)

- Annual Business income

- Number of employees

- Date your business was established

- Type / category of your business

Here’s a screenshot of the relevant section for the Chase Ink Unlimited card.

As with any credit card application, it’s best to be honest and truthful about the information that you put on your application. In many cases, especially if your business is new, you may be asked to provide documentation to support your application information.

In my experience, there is no actual requirement to only use a business credit card for business expenses and a personal credit card for personal expenses. Some business credit card terms may include language to this effect but again, in my 7+ years of experience this has never been an issue. I use whatever credit card I feel like for whatever expense I happen to have. The only thing you’ll need to do is make sure that you keep good bookkeeping or accounting records for tax season.

Starting a business

I am fortunate in that I have several legitimate expenses with many years of history and actual annual revenue. So I’ve never needed to get, shall we say, “creative” with my business on a business credit card application. But it is definitely true that you may have a business even if you don’t think that you do. I have heard many reports of people with new businesses, sole proprietorships or businesses with $0 or very low annual income be approved for a business credit card, especially if you have outstanding personal credit.

But if you aren’t comfortable doing that, consider starting a small business. It doesn’t have to be something big – just write it down and make a plan for what your business is or wants to be. Some free or low-cost steps you could do to help document your business:

- Create Articles of Organization or an Operating Agreement (you can find free templates online)

- Register your business with your state’s Secretary of State

- Get an Employee Identification Number (EIN) from the IRS (free)

Taking some of those steps might give you the documentation (and confidence) you need to sign up for your first business credit card.

Best Business Credit Cards

Here are a few of the top business credit card offers out there right now

- Chase Ink Unlimited card – welcome offer of 75,000 Ultimate Rewards after spending $7,500 in the first 3 months. No annual fee

- Chase Ink Cash card – welcome offer of 75,000 Ultimate Rewards after spending $7,500 in the first 3 months. No annual fee

- Chase Ink Preferred card – welcome offer of 100,000 Ultimate Rewards after spending $15,000 in the first 3 months. $95 annual fee

- IHG Premier Business Card – 140,000 hotel points after spending $3,000 in the first 3 months, plus a free night each year on your anniversary and the 4th night free when redeeming on an award stay.

As you can see, there are some very solid offers out there that you may not want to miss out on

The Bottom Line

If you’re ignoring small business credit cards, you may want to take another look at them. You may have a business even if you don’t think that you do. If you’re not ready to apply for business cards right now because you’re not sure that you could provide documentation of a business, take some steps now to get that documentation and establish your business. If you don’t, you’ll eventually reach a limit to the number of non-business credit cards you can get (and thus limit the total amount of miles and points that you can get and use)

What do you think is the best business credit card? Leave your thoughts in the comments

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

You left out by far the best business credit card! The Amex Blue Business Plus card which gives you 2X points on $50,000 spending each year – no category restrictions (except don’t use it abroad or you will pay foreign transaction fees) And you get the flexible Amex points.

I do like that one (and have it), but the lack of the signup bonus makes me downgrade it a bit. Compare it to the Ink Business Unlimited with 75,000 Ultimate Rewards as a signup bonus. It takes quite a lot of spending at 2x (vs 1.5x) to make up for that