As my kids get older and turn 18, it’s time for her to start signing up for credit cards. She’s got to start pulling her weight getting those miles and points for family trips, after all! I mean we’ve been lugging her around for free for 18 years!!!! 🙂

The CARD Act of 2009 says that she has to have independent income or a cosigner to get a card before she turns 21, so in a way we still control her credit for a few years. Because she is currently still living at home, we still have a modicum of control over her credit cards and credit history, and are attempting to help teach her good financial habits as well as set her up with a good credit score / history as she starts out in life.

My daughter’s first credit card

Well, before she ever applied for her first credit card on her own, my wife and I have been adding her (and her siblings) to some of our cards as authorized users. The goal with that was to help her build up her own credit history and score. By making on-time payments, even as an authorized user, the idea was to make it easier for her to apply for her own credit cards once she turned 18.

I was actually a bit behind on things and didn’t have a plan in place to have her apply for her first card directly on her 18th birthday (like I would if I were a GOOD travel blogger dad 😀 ), but recently she applied for the Bank of America® Cash Rewards Credit Card for Students (not an affiliate link). The card gives

- 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 2% cash back at grocery stores and wholesale clubs

- and a $200 welcome bonus after spending $500 on the card

She was approved and received her bonus.

Plans for her next credit card

Fast forward a few months and it was time for her to apply for a new card. I wanted to get another basic card that had decent benefits. I knew with her limited credit history and income that she wouldn’t be likely approved for a card like the Chase Sapphire Preferred, so I wanted to keep things basic.

(SEE ALSO: 5 reasons I keep recommending the Chase Sapphire Preferred for people starting out)

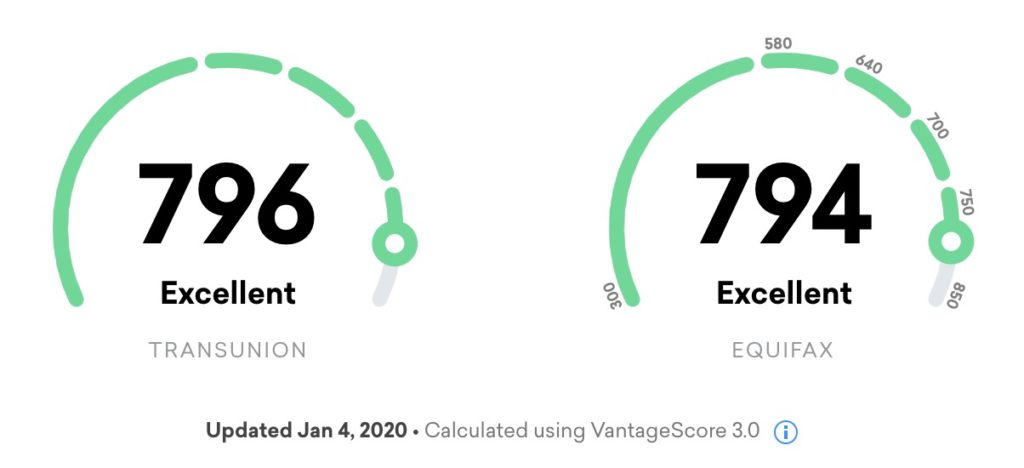

I also wanted to get a card with no annual fee, with the idea that this could be one that she could have and keep for a long time, providing her with an ever-increasing average age of accounts, which is one of the big factors in determining your credit score. I wasn’t sure how her history had impacted her credit score, so I checked it out before applying

Dang – she’s got a higher credit score than me! After considering a few other cards, I ended up deciding to have her apply for the Chase Freedom Unlimited card (refer a friend affiliate link).

The dreaded decline message

After filling out the Freedom Unlimited, I unfortunately got the immediate 7-10 day decline message :-(. I will wait for the official letter in the mail with the decline reason, but after looking around, I’m guessing her income was not high enough and/or she didn’t have enough of a credit history of credit on her own. I probably should have researched that a bit better before applying…. Depending on what they say, I may consider co-signing the card for her. I am generally against parents cosigning for their kids, but some of the unique situations in her particular situation may make that a reasonable option.

What next?

We will regroup and apply for something else, probably another “student” card in order to help continue to build up her credit score and history of on-time payments.

What are some of your favorite cards for 18-21 year olds? Leave them in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Great post Dan. It must’ve been frustrating for your daughter to get declined by Chase.

My son is also 18 and recently got approved for the same B of A credit card. For his next card, I suggested the Citi Rewards+ Student Card. One of its nice features is it rounds up to the nearest 10 points.

I remember my own days. I didn’t think of being an authorized user. Instead, I got an Exxon gas card (not Visa or MasterCard). I then got an American Express green card for about a while. I eventually got a bank’s Visa.

Yeah – truly you can set your kids up to at least START their life in a solid financial place by adding them as AUs etc. When I saw her credit score that high my jaw dropped!! 🙂

There must be quite a few “student” credit cards out there for y’all to choose from! Can establish credit card history with those first too, I imagine.

Yes there are. But most of those student cards stink ;-). Or at least don’t have as good benefits as some of the other cards. But you’re right – we’ll probably look to pick one of those up

My 18 year old got instant approval on Amex DL gold. Waited a year and got instant approval on the Freedom Unlimited via referral from me. Most people say you’ve got to have first cc a year before applying for any Chase card. Seemed to work in our case.

I don’t remember getting my first credit card till I was around 25 so seeing approval strategies for 18 year olds now is really making me feel old.

Is the Freedom Unlimited just hard to get approved for or is it Chase just being stringent? I got approved for a CSR, but denied for the Unlimited with that decline letter as well.

Have her call the recon line. If she gets any scholarships for school have them include that income. That’s what the person on the recon line told my girlfriend when she applied and was initially denied, and then she was approved after adding it.

How much income is required for a student card while in college? My son is currently an authorized user on two of my cards but I’d love for him to get his own now that he’s 18.

I”m guessing not much. They’re marketed towards students so I have to imagine that the card issuers don’t expect much income

Discover has a couple of cc for students. Discover was my first cc and still have it.

Can they not fall under the family income, if still living at home? I would go into a Chase branch and talk to them and see if they can help. Those Chase points are too valuable to let slip without another try at it.

That’s a good idea. I’ll probably wait until the letter comes in and maybe give that a try

Thanks for sharing this information. Awesome to help teach your children about this.