I recently received an email AND letter in the mail with an offer from IHG to upgrade to the IHG Rewards Club Premier Card to earn 10,000 bonus points after making one purchase. I’m a big fan of getting easy points where I can, but does this offer make sense?

The Card I’d be Giving Up

Chase is trying to lure me into closing the IHG Rewards Club Select Credit Card which I have held since 2015. With only a $49 annual fee and an anniversary free night at an IHG property, it has been one of the cards that I believe makes sense to hold long term. We have typically been able to get a free night that would cost $250 or more at the cash prices.

Last year, my wife and I were able to stay at the Intercontinental in Paris for a weekend using each of our free nights. Sadly, that amazing value came to an end when IHG capped the free night at hotels that cost 40,000 points or less. Even with this change, I think the benefits including the anniversary night and 10% rebate on points redemptions helps to justify the $49 annual fee.

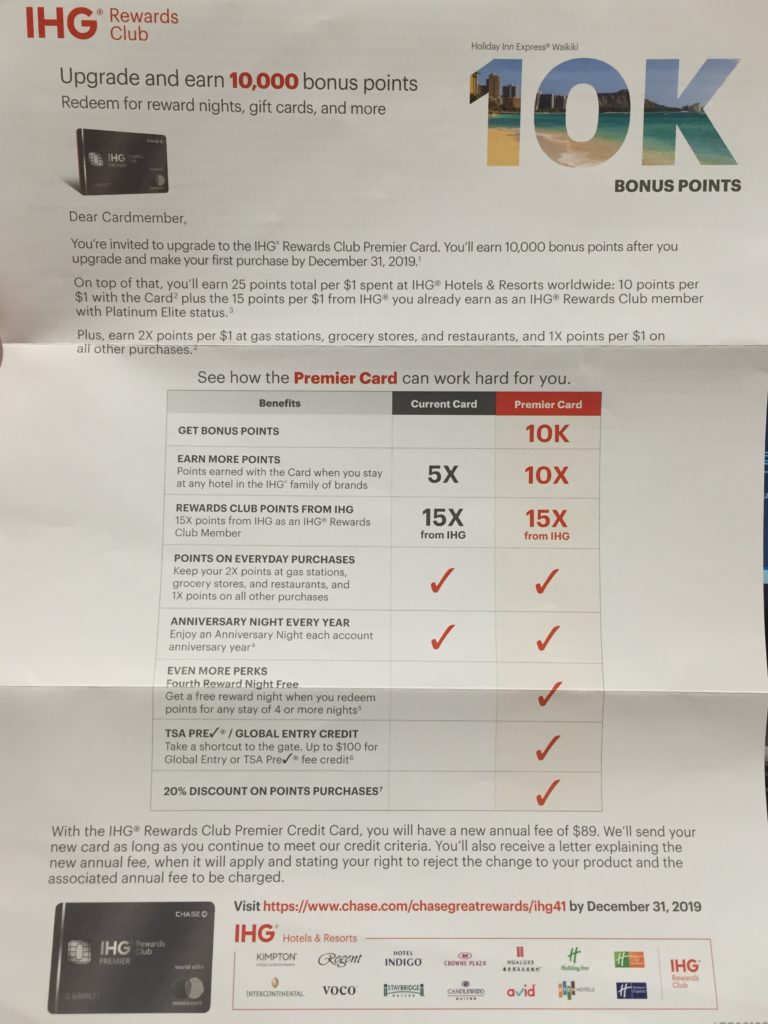

The Offer

Here is the letter that was sent inviting me to upgrade to the IHG Reward Club Premier Card. Is this a worthwhile move? Thankfully IHG included a handy chart to help weigh out the added benefits of an upgrade.

What new benefits do I get for this annual fee increase?

- 10k bonus points- This is available after an upgrade and one purchase. It’s always nice to get free points but as I’ll discuss below there is a way to get 80k points with this card as long as you are under 5/24.

- 10x points over 5x points on IHG purchases- If you stay at IHG properties frequently this may make a difference but for me IHG points aren’t overly valuable.

- 4th Reward Night Free- This is a great benefit if you are flush with IHG points. If you are not it may be tough to take advantage. This is where the 80k points I had discussed above may come in handy.

- TSA PreCheck or Global Entry Credit- Everyone should have TSA PreCheck and/or Global Entry. If you have children it’s even more valuable. With that being said the odds are that most travelers have another card that offers this credit as well. I have a few cards that offer this credit so for me this benefit would have no additional value. For travelers who need a card to cover TSA PreCheck or Global Entry this does offer a value.

- 20% Discount on Points Purchases- Buying points almost never makes sense. Receiving a 20% discount on IHG points purchases will move the needle for just about no one.

What are the downsides of upgrading?

- Annual fee would increase from $49 to $89

- Lose the 10% points booking rebate that the Select card gives on every redemption

Conclusion

After reviewing the offer to “upgrade” (and close out the IHG Rewards Club Select Credit Card), I doubt most people should do this with one exception. If you are a frequent traveler who prefers IHG properties and are over 5/24. With that being said I could also make an argument to add the IHG Rewards Club Premier Card to your wallet while ALSO keeping the IHG Rewards Club Select Credit Card.

The current offer for the Premier card is for 80k bonus points after $2,000 in spend in the first three months. You can compare that card to the IHG Rewards Club Traveler card here (click through to Apply Now to the Traveler card and it will compare the two)

By keeping the Select Card you will receive a rebate of 8k points when you spend the 80k points earned from the Premier. By keeping both cards, you will also have 2 anniversary nights that you can book for a cost of $138 yearly. While the value at $89 for a free night is not as attractive with the Premier, it will not be difficult for most people to find a hotel that has a higher price point than that. Overall, while the IHG Rewards Club Premier Card has some decent benefits, I don’t believe it is worth upgrading from the IHG Rewards Club Select Credit Card if you are lucky enough to still have this card.

Have you received this offer? Did you upgrade? Is it worth it? Or do you plan to hold both cards…or neither? Let us know in the comments below!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I agree. Better to just apply for the new card even if you don’t keep the old version. I guess the credit pull might be softer but can’t imagine any other advantage.

It’s definitely not a great offer.

I got this mailer as well. At first I misread it and thought they were offering 100k points. That might have made things interesting.

I would never consider the 10k offer.

I agree at 100k points you have to consider the offer, but 10k is laughable.

I also received this letter and thought about it. I called IHG and after discussing the benefits It seemEd better to stick with my $49 annual fee. If they had offered 4x points on every day purchases I may have considered it. I agree about the caping at 40 K for the annual night made me want to cancel my card. I wish they would just give us 40 K points every year and let us spend that on whatever hotel you want it. For $89 and the Few perks they give us it doesn’t seem worth the extra money I’ll stick with what I’ve got

I like that idea about the 40k points instead of a free night but would be surprised to see that happen. I think you made the right call by sticking with the $49 annual fee!

My wife and I each have both cards the old Select and the Premier so we get 4 free nights (40K cap) annually and get the 10% points redemption rebate (Select) and the points booking 3 for 4 (Premier) benefit.

That’s a really great combo!

I love that strategy. I think we may do that once we get back under 5/24.

Not sure if you can help…I am an IHG Rewards Club Select card holder (or at least was on Monday) and responded to request to upgrade to their Platinum card (mainly to get the Buy 3 Rewards nights,

Get one Free)

Now I’m reading this article and other articles (two of them) about if you hold onto that card you can combine the 10% Rebate with 4th Night Free. Should have read first then decided what to do.

I should be receiving a letter with the right to reject the change to my product…

Do you think I’d have any chance of rejecting the change, keeping my Select Card (for 10% rebate) AND applying and receiving the new Platinum card after all that!?!

Thank you!

Trying to plan an end of March trip using the 4th Night Free reward…