The Chase “Pay Yourself Back” feature has been live since May 3t. In the past, I have always cashed in my Ultimate Rewards Points through my Chase Sapphire Reserve card and used them for travel to maximize my redemption value. This new feature has changed the equation for those Ultimate Rewards points and I recently took advantage.

What is “Pay Yourself Back?”

The Pay Yourself Back feature within Ultimate Rewards provides cardholders the option to apply points to pay for all or a portion of existing purchases in select categories. When doing this, cardholders will get paid back with a statement credit. It launched for Sapphire Reserve and Preferred cardmembers on May 31st. Points are worth 50% or 25% more, respectively when redeemed for everyday purchases in the initial categories. These include grocery stores, home improvement stores, and dining. Dining is a broad category that includes restaurants, takeout, and eligible delivery services. An interesting note on the press release states that “Chase will introduce other cards that earn Ultimate Rewards points to the Pay Yourself Back feature over time”. Hopefully, this means the Freedom and Ink cards will be added down the road.

How Does it Work?

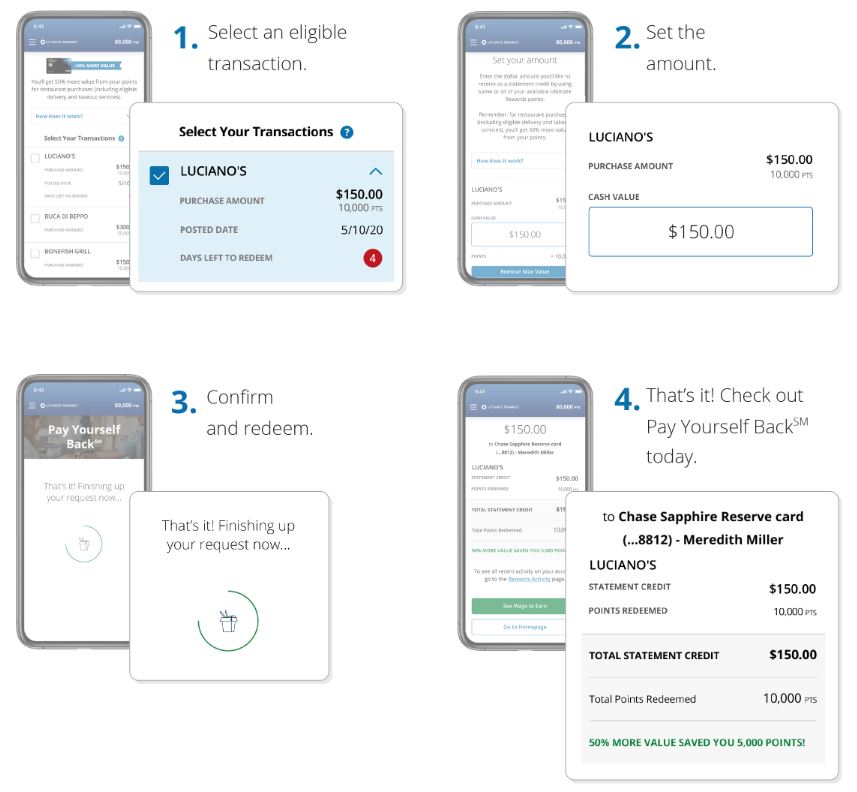

The process is extremely simple and can be done in 4 easy steps. Here is what you have to do.

Should I Do This?

Given that the value of redeeming points in the Pay Yourself Back categories are now equal to travel redemptions, it makes more sense than ever to use this new option. We recently booked a family trip to Nicaragua. The accommodations were not able to be paid for with points. However, in a roundabout way, we were able to cover the cost of our rental. We used Ultimate Rewards Points and the Pay Yourself Back feature to cover recent grocery purchases that were equal to the cost of the home. Therefore, we were able to funnel cash that would normally be spent on groceries to covering the cost of our rental! I think I will probably continue to use this option in the future to maximize the redemption value of my Ultimate Rewards points.

Chase Continues to Lead

Anytime a rewards program offers flexibility and increased value it is a big win for consumers. Chase is already the premier rewards program for points and miles enthusiasts and this new program addition increases their lead. Let’s hope some other programs add some new benefits to compete.

Are you planning to take advantage of the new Pay Yourself Back feature? Let us know in the comments below!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Just transferred the points from my Chase Ink Cash to the Reserve and paid off some of the groceries purchased this month. It really is a cool feature and since travel is out for now for us then this is a good replacement.

It’s definitely a great option to have for flexibility on redemptions!

Nicaragua? That’s an interesting travel destination. Never been there and curious what the allure would be from your perspective.

Hey Steve, our family loves Central America so much! The main draw is surfing for me but the beaches, jungles, people and in Nicaragua cities like Granada have a lot to offer for the rest of the fam as well!

Do I need to be a cus if Chases Bank

Hi Nelda, you would have to have the Chase Sapphire Preferred or Sapphire Reserve card for this to work!

what app are you using, I’m logged into Chase but can’t find anything that matches the screen shots you have above. thx

Hi Tee, the screenshots from the article are from the Chase press release and do not match the app. To access Pay Yourself Back on the app go to “Ultimate Rewards” for your Sapphire card. Then click the “Menu” or “hamburger” option and it will be in the drop down. Let us know if that works for you!

Thanks!