As most of the comments on Reddit agree, Marriott chose some interesting names for this update…

We all knew it was coming. Marriott has hinted at a rebranding for its loyalty program since the SPG merger. Last week, Marriott confirmed that that the program would be renamed to Bonvoy, and today we’ve received details from Marriott Bonvoy on the new cobranded credit cards.

Changes to the Marriott Credit Cards

You can check out the details on the announcement at these links. I’ve also broken them down in the sections below. (After removing all the fluff from the announcement..)

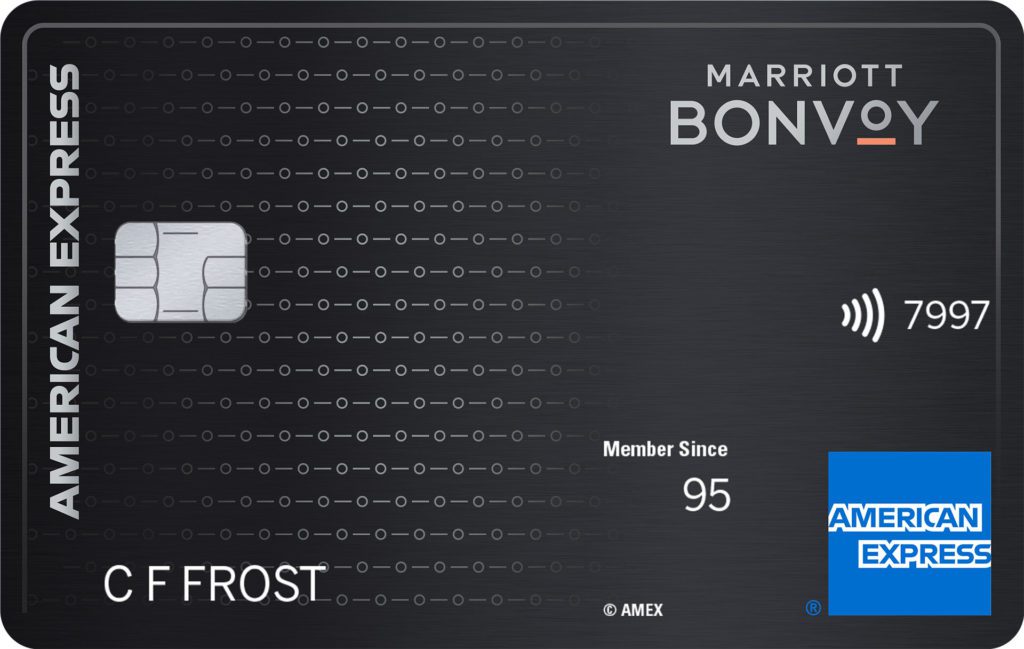

The new Marriott Bonvoy Boundless from American Express! This card will be replacing the current SPG Luxury offering. Image courtesy of American Express.

Marriott Credit Card Name Changes

Here’s the AmEx lineup:

- the Starwood Luxury AmEx will be the Marriott Bonvoy Brilliant American Express Card

- the Starwood personal AmEx (see current offers on this card) will the Marriott Bonvoy American Express Card

- the Starwood business AmEx (see current offers on this card) will the Marriott Bonvoy Business American Express Card

All of these changes will be effective starting February 13, 2019. Bonvoy, Bonvoy Business, and Bonvoy Brilliant. Interesting choices…

Ok, did Chase do any better?

- the Marriott Premier Plus Credit Card will be the Marriott Bonvoy Boundless Credit Card from Chase

- the Marriott Premier Rewards Credit Card will be the Marriott Bonvoy Premier Credit Card from Chase (no longer available to new applicants)

- the Marriott Rewards Premier Plus Business Credit Card will be the Marriott Bonvoy Premier Plus Business Credit Card from Chase (which will not be open for new applications after February 12th, 2019)

- the Marriott Rewards Signature Credit Card will be the Marriott Bonvoy Credit Card from Chase (no longer available to new applicants)

- the Marriott Rewards Business Credit Card will be the Marriott Bonvoy Business Credit Card from Chase (no longer available to new applicants)

- The Ritz-Carlton Rewards Credit Card will be The Ritz-Carlton Credit Card from JPMorgan (no longer available to new applicants)

Bonvoy. Bonvoy Brilliant. Bonvoy Boundless. Bonvoy Business. Lots of Bs. It looks like Marriott is making good on its arrangement with American Express and Chase. Namely, that American Express would get the top-tier card (SPG Luxury turned Bonvoy Brilliant) and the business cards (SPG Business turned Bonvoy Business). Chase Marriott business cardholders and Ritz card holders will be grandfathered in, but those cards will be closed to new applicants. Ultimately, we’re looking at a new portfolio of 5 “new” cards:

- Marriott Bonvoy Brilliant American Express Card (luxury card)

- Marriott Bonvoy American Express Card

- Marriott Bonvoy Business American Express Card

- Marriott Bonvoy Boundless Credit Card from Chase

- A new, no annual fee personal card that Chase will launch this summer. No details on that yet.

So, what do you think?

I’m working on a few more posts with details on all changes – they’ll be up soon! There’s a lot to cram into this post, and I didn’t want to hit you guys with a wall of text.

As plenty of you know, the points and miles game changes constantly. The Marriott and SPG merge was huge news last year, so we knew something was going to be happening. I must agree with some of the other bloggers out there though, that it would have been nice to see Marriott focusing on its infrastructure and IT before prioritizing new card offerings.

I currently hold the SPG Business card from AmEx. What should I do with it?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

After reading this, it seems like if you want a marriot/bonvoy/whatever card, the amex card is the one to go with. Same annual fee with more benefits.

I currently hold the SPG Business card from AmEx. What should I do with it? Anyone have an answer?