Choice Privileges is one of the oft-overlooked major hotel chains. You may not realize it, but their hotels are prolific across the U.S. and in other pockets of the world. Due to the fact that they don’t have many upscale properties or aspirational redemption opportunities, they tend to get overlooked in favor of the likes of Hyatt and Hilton.

The Choice Privileges credit card also tends to fly under the radar. But with its best-ever current sign up offer, it may make sense to pick up.

Choice Privileges 64,000 point offer

The typical Choice Privileges credit card offer is for 32,000 bonus points after $1,000 in the first 90 days. This offer is double the standard offer, but with an increased spend. Here are the details of the offer and the card in general:

- 32,000 bonus Choice Privileges points after $1,000 in spend inthe first 90 days

- 32,000 additional Choice Privileges points after $2,000 additional spend within the first 180 days ($3,000 in spend total)

- Earns 5x points per $1 spent on Choice Hotel stays and purchases of Choice Hotel gift cards (but beware the gift cards…I’ve had issues using them)

- Earns 2x Choice Privileges points per $1 spent on all other purchases

- Enjoy Choice Hotels Gold status

- No annual fee

Given that you can maximize this offer for 5-8 nights at some decent hotels in select locations, this is actually a really good bonus offer.

Link to offer (I will not receive a commission if you apply for a card through this link). Check terms, which should detail the 64,000 point bonus.

Maximizing Choice Privileges points

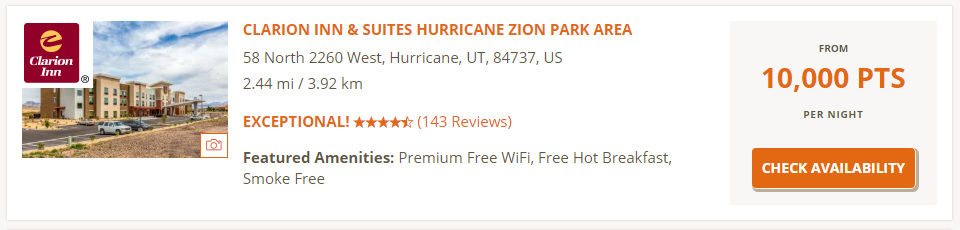

Choice Privileges doesn’t publish an award chart. Their properties start at 6,000 points per night at the most budget places, and award costs can reach upwards of 35,000 points. Award rates also fluctuate. Most of their properties in the U.S. are budget to midscale, including brands like Rodeway Inn and Comfort Inn and Suites. They are nothing to write home about in terms of quality or aspirational experience, but if you’re simply looking for a place to stay while you visit a National Park, they may be just the thing. Coverage in the U.S. is generally exceptional. Consider this hotel near Zion National Park in Utah:

Either $123+tax cash, or 10,000 points. I’d go points on this one. Getting more than 1 cent per point on Choice points is good value.

Beyond that, specific instances that make sense overseas include Japan, where you can get Tokyo and Osaka hotels for a mere 8,000 points per night. No matter how you slice it, that is good value. You can also find some phenomenal redemption opportunities in Scandinavia. I was considering this Copenhagen Airport hotel which was asking ~$350 per night cash.

The cash and points deal in this case represents the best return per point. But it also means spending cash. Dan had good luck at the Clarion Hotel Sign in Stockholm where he used 10,000 Choice points instead of nearly USD$200.

Conclusion

As one of the most underrated hotel chains with one of the most overlooked hotel cards, I hope this 64,000 points Choice Privileges Visa card offer from Barclays is enough to turn your head (but don’t sign up for a credit card just because some guy on the internet says you should. 😉 ) Consider your 5/24 strategy, and the fact that Barclays can be stingy with application approvals. They just denied me a business credit card last month, otherwise I’d be applying for this myself.

H/T: Miles to Memories

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The card is overlooked by the old timers because the program long ago devalued. Choice makes the Hilton program look good.

As you said above, I’m sure there are a few good places to cash out. YMMV.

I’m considering this card. I am trying to see what points it would cost for a stay, but they wont even let you see how many points it takes if you don’t have enough points?! Is that right? I’ve never seen that in a program before. I can see cash price, then when I click points i get “You do not have enough points to make this reservation using points. Please choose another rate.” Anyone care to post how many points are needed for

THE CAPITOL HOTEL DOWNTOWN, AN ASCEND HOTEL COLLECTION MEMBER

711 Union Street, Nashville, TN. December 26 2018.

Thanks!

Couple things that could be going on:

You could be looking too far out. Choice Requires you to book fairly close in. It’s also possible there truly is no availability. Lastly, award night prices aren’t static. I’ve seen some go for 8,000 points sometimes be upped to 20,000 over other dates.

The Choice app shows 20,000 pts or 6,000pts+$105 for this hotel for Dec26,2018 . Also, to see the points needed for weekdays vs weekends, most Choice hotels show their points info if you click on “Hotel Details” and scroll to the very end of the details. However, for this hotel, it currently only shows points info thru Nov.30,2018; some show longer month intervals, some show no points info at all. (And this might be different around a holiday or special event.) Also, Choice allows bookings for points only up to 100 days into the future, for all levels of elite status (used to be only for top tier, but now all levels enjoy the 100 day booking window). HTH!

Any idea how long this offer will be available?

Nope. Didn’t see it in the terms or on the offer page.