So I got the (relatively) new American Express EveryDay Preferred card as part of a churn a few months ago. And of course by “I”, I mean “my wife” (which actually turned out to be somewhat of a hassle, as I will explain later)

So I got the (relatively) new American Express EveryDay Preferred card as part of a churn a few months ago. And of course by “I”, I mean “my wife” (which actually turned out to be somewhat of a hassle, as I will explain later)

I like the card and it’s currently our goto card at grocery stores (earning 3% there). Well, at least the stores that we shop at that TAKE American Express (which is generally just Kroger or Meijer here).

One of the more unique things about this card is that if you use the card to make 30 or more purchases in a month, you get a 50% bonus on your card. So at grocery stores, this could mean you get 4.5% on your spend (though the category bonus is limited to the first $6500 of spend).

Buying gift cards at Kroger

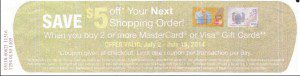

Anyways, back in early July, Kroger ran a promotion where you got a $5 coupon off of your next order if you bought 2 Visa or Mastercard orders with a limit of 1 per day. Early on we figured out that you didn’t need to buy 2 cards, and there was no limit enforced.

Anyways, back in early July, Kroger ran a promotion where you got a $5 coupon off of your next order if you bought 2 Visa or Mastercard orders with a limit of 1 per day. Early on we figured out that you didn’t need to buy 2 cards, and there was no limit enforced.

My plan early on was to get 12 $500 cards, which should get 18,000 American Express points (12 * 500 * 3), which should make 27,000 Membership Rewards points after the 50% bonus.

You’ll pay 12 * $5.95 or $71.40 in activation fees, but you will also get $60 back in grocery coupons. Add in a few extra dollars if you cash out with money orders instead of Bluebird, but your total cost should be under $20. Not bad for Amex points that conservatively are valued at least $500.

The rub…

I think I ended up with 5 or 6 of them before stopping. One problem that I had was that the card was in my wife’s name, and Kroger seemed to have a pretty strict policy about making sure that the card matched your ID. One cashier let me do it with my name and her card, but a couple of other ones would not. Since she’s usually dealing with “the crew” of kids, she often does not want to deal with me sending her in to do things like this. I’ve learned to tread carefully here 🙂

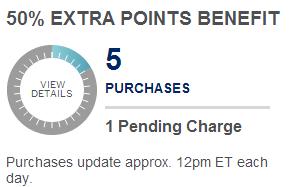

When you log in to your account, it shows you how many transactions you’ve made so far, as such.

Anyways, so midway through the month, I had about 17 of my 30 transactions done when I logged into my account to find that my transaction count had been reset!!

It was then that I learned that the transaction count is based on your STATEMENT DATES, not a calendar month. It makes sense when you think about it. In fact, looking at the official terms, and even my earlier post about the card, it clearly does say it’s based per statement period, but it was a shock to me.

I even used my trick to always get a live chat with an Amex agent (several times), but nobody was able to help me

The moral of the story

Well the obvious moral of this (and many other stories…. ) is that I’m an idiot 🙂

The other one is to make sure to read the fine print, and for these cards, make sure if you’re trying to hit your 30 transactions to get a 50% bonus, that you do it based on your STATEMENT beginning and end dates.

My mistake cost me about ~6,000 American Express points, but it doesn’t have to happen to you! I guess after they gave me 50,000 points I wasn’t expecting, I’m still in the black with them 😛

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments