So I’ve been in the mood to talk about manufactured spending a bit lately. Perhaps it’s just the engineer in me, but I really love the idea of points and miles being a “game”. Or maybe it’s been this way because as it’s the start of a new month, I am reviewing my cards and finding out that I need to put some spending down on some of them to make sure I get my bonuses.

So I’ve been in the mood to talk about manufactured spending a bit lately. Perhaps it’s just the engineer in me, but I really love the idea of points and miles being a “game”. Or maybe it’s been this way because as it’s the start of a new month, I am reviewing my cards and finding out that I need to put some spending down on some of them to make sure I get my bonuses.

Anyways, I’ve talked about Kiva before when talking about meeting spending requirements on credit cards, but basically Kiva is a non-profit microfinance site where you can give loans to (mostly) third-world entrepreneurs. There is a risk that you don’t get paid, but you can mitigate that by being smart about the loans that you pick – from what I’ve seen, the default rates are typically pretty low. I’ve made a few loans with Kiva and have not been defaulted on yet, though that’s a pretty small sample size. If you sign up through my link, you will get a free $25 to loan (and I’ll get $25 to loan also).

Obviously if you’re doing this to meet credit card spend, you’ll want to pick loans with shorter time periods, and you’ll need to be able to float the extra cash until you get repaid. Since the interest rates you’re getting on savings accounts are microscopic, maybe you can use some of that money as capital to meet credit card spend, with the expectation that you will get it back over the course of the next few months.

Cycling loans to multiple people

An interesting part about Kiva is that you cycle through the money, allowing the $25 that you lend can actually be lent to multiple different people. As you get repaid, you can then turn around and loan that money to a different person.

Now if you were TRULY maximizing your credit card spend, when you get a repayment, you would withdraw that money to your bank account, then turn around and fund another loan with your credit card.

And while I choose to stick it to Kiva by not adding their $3.25 “support” fee on top of a $25 loan, I have not yet stooped so low as to stick it to them with extra credit card processing fees 😛

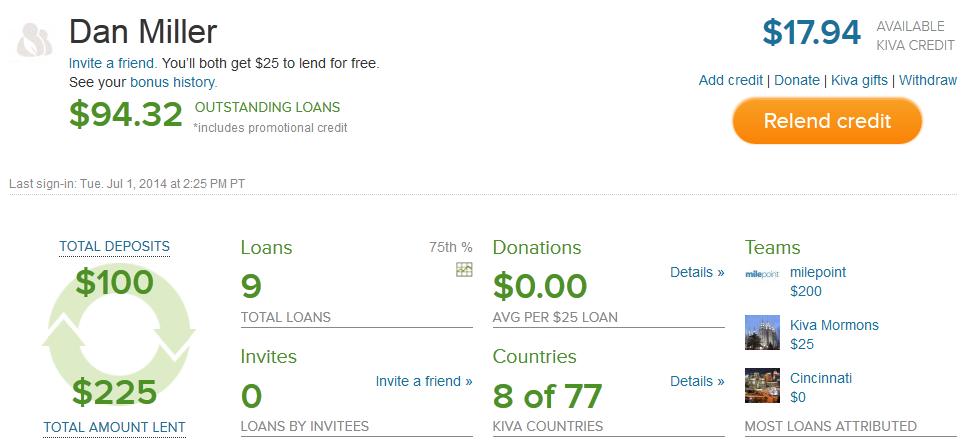

Here is an excerpt of my portfolio page

As you can see, I have deposited $100 total, yet have made 9 loans (at $25 each – a $225 total). You can see also that I have 8 out of the 77 countries that Kiva currently lends to (a nice little feature for someone like me who likes to cross things off his list)

As you can see, I have deposited $100 total, yet have made 9 loans (at $25 each – a $225 total). You can see also that I have 8 out of the 77 countries that Kiva currently lends to (a nice little feature for someone like me who likes to cross things off his list)

KivaLens

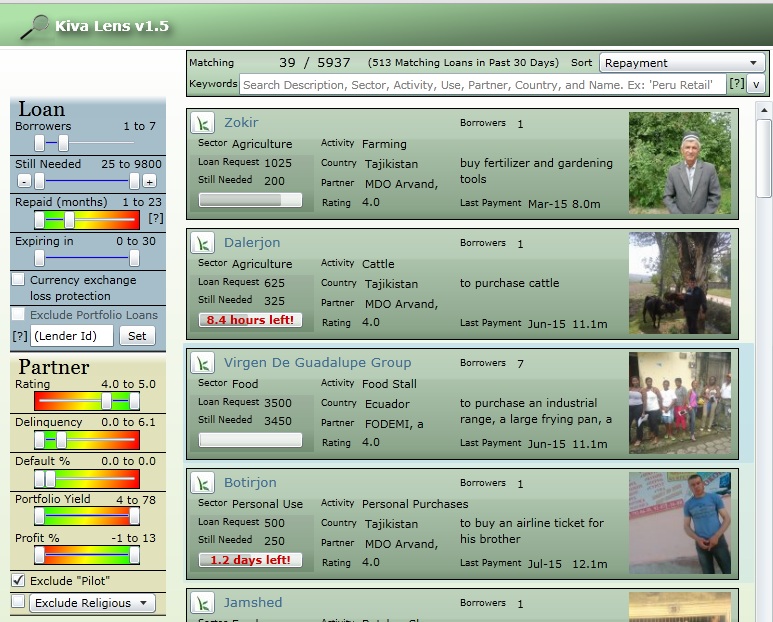

EDIT: Mark from Palmer Law reminded me in the comments of an app called KivaLens. Kiva is great, but the interface for searching through loans is not particuarly good. KivaLens allows you to set specific filters to help you find a particular loan that you’re looking for

So you can put thresholds on the partner rating, or delinquency / default percentages. You can also filter by the country of the borrower, or the sector you’re looking to lend in, or several different filters.

So you can put thresholds on the partner rating, or delinquency / default percentages. You can also filter by the country of the borrower, or the sector you’re looking to lend in, or several different filters.

Buyer Beware

Loans have some risk, buyer beware, caveat emptor, blah blah blah blah, right? 😛 You can definitely run into default, delinquency, or even currency exchange loss (some loans are protected against currency exchange loss but others have not).

Checking my stats, I have currently had no defaults or delinquency, but I have lost 24 cents from currency fluctuations.

All in all, I think Kiva is a great arrow to have in one’s quiver – what about you? Have you ever made a loan with Kiva?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Call it luck, fortune or selecting my loans with a bit more care, I’ve been fortunate to hold a 0.00% default rate for a few years with a loans total in the six figures. Kivalens has been a great help too!

Thanks Mark – I forgot about KivaLens – I will edit the post and add a section in on that. It is a great tool for picking loans.