Following up on my recent post on the complete guide to credit card retention offers, I want to share some of my recent successful calls with you. I’ve had annual fees come up on four of my cards recently. Here’s how I fared.

ThankYou for the Points Citi!

The first card on my call list was my Citi AT&T Access More card. I originally opened a Citi AAdvantage Platinum Select a few years ago, and product changed over to the AT&T Access More once I held the card for a year. This card fits into my wallet really nicely, and with triple ThankYou Points on online spending, it’s a great way for me to rack up some transferable currency. So, I called.

Following my script from the previous post, I explained that I wasn’t sure whether or not to keep the card open, and asked if they had any retention offers that might sway my decision. Sure enough, the first service rep transferred me over, and my second representative explained some of the details of the card, trying to distract me from my ultimate goal: more points. I countered with the fact that I already have two other cards at Citi that I like, and I didn’t really feel the need to keep all three. The second rep then offered me 10,000 ThankYou Points after $3,000 spend in the next 6 months.

I was planning on keeping the card anyway, so I happily accepted the offer. What if you weren’t planning on keeping the card? I value ThankYou Points at a conservative 1.5-1.8 cents per point. At the lower end of that scale, 10,000 ThankYou Points are worth around $150 in value. If you’re going to put that $3,000 spend on the card anyway, keep it open! If you want to close it, and redirect that spend to a more lucrative offer, maybe a new card with a great sign-up bonus, it may be time to retire this one. I put some large transactions on this particular card every month, so my choice was an easy one.

AmEx, won’t you share with me?

The AmEx Premier Rewards Gold card comes with a $195 annual fee and duplicates some of the benefits of other cards I have. It’s often sock-drawered in favor of higher earning cards or new cards I need to put spend on for a sign-up bonus. As such, it’s a prime example of what I’m looking for when I call. A card I’m not afraid to lose, but one I could be swayed to keep if I get a good offer.

The first time I called last week, I got nothing. Nada. I really tried, but the rep just did not want to transfer me over to the retention department. I thanked the rep, explained that I would need some time to think about it, and went along with my day.

A few days later, I got the urge to try again. This time, the first rep swapped me over to retention easily. The retention department proceeded to outline the benefits of the card, and asked if I’d like to keep it open. To this, I politely asked again for an offer if I were to keep my PRG open, and they relented. Here’s the deal: 5,000 Membership Rewards with no strings attached, then another 10,000 Membership Rewards after I spend $3,000 in 3 months. I value MR at 1.25 cents per point, because I hold a Platinum Schwab card and regularly cash out my points through the Invest with Rewards option.

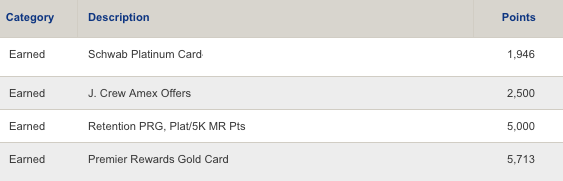

5,000 Membership Rewards, just like they said! I also got a similar offer on my Schwab card a few months ago, notice it’s referred to as “Retention PRG, Plat”.

All in, I’ll be earning 15,000 Membership Rewards. At 1.25 cpp, those are worth $187.50 almost entirely covering the annual fee. Between the extra points, the card’s AmEx Offers, and the $100 airline credit, I think my PRG earned it’s keep, what do you think?

Better still, I got this same exact offer on my Schwab Platinum car a few months ago! Now, with a higher annual fee, the same points obviously don’t help quite as much. I like to keep a Platinum card open for other reasons – Priority Pass Select membership and 5x on airfare are the big draws for me. I book a lot of cash flights for family and friends, so that 5x (essentially 6.25% cashback) on flights really adds up. Thanks to the retention offers, I’ll be keeping both of these cards from American Express.

C’mon Citi, everyone has plenty of AAdvantage miles. What else can you do?

As just about anyone in this hobby will tell you, the Citi AAdvantage card offers users a particularly lucrative position. Citi is often very happy to give them out, and I’ve taken (a)advantage of a few. Typically, I’ll close these cards when the annual fee hits, but I decided to see what Citi had to offer me on this card.

I called in on Sunday night, and sure enough, they transferred me over to a “Senior Account Specialist.” The specialist was very nice on the phone, and reviewed some of the benefits with me. Just as I was getting ready to reiterate my request, she commented on my great “card history” with Citi, and how they’d hate to lose me as a customer. Hmmm, go on…

The specialist continues – “I can’t waive the annual fee, but I could offer you a statement credit. How about a $95 statement credit after spending $1,000 in the next 3 months?”

Perfect, that sounds like a great offer! I appreciate the help today.

She confirmed the offer again and added it to my account. After a bit more conversation, we parted ways, and I’ll be $95 richer in about a month. All in, it only took me about 15 minutes on the phone – not a bad way to multitask while I’m folding laundry!

(Fear annual fees no more! Check out some great offers on cards with benefits to offset their fees over here.)

At the end of my phone calls, I was batting a thousand – 4 phone calls, 4 retention offers, one happy dude. This was a good run for me, as I’m not always successful. In my experience, Citi and AmEx are fairly generous, while I haven’t had any luck with Chase or Bank of America yet. As for my current cards with Discover and US Bank, no annual fees in sight.

Next time you see CARD MEMBERSHIP FEE on your statement, try the number on the back of your card. You might just get what you need!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I think a good plan with the Citi and Barclay AAdvantage cards is just to rotate them every 24 months since the benefits almost mirror each other. Is there a flaw with this thinking?

Not at all, I think that’s a great idea if you only need one at a time!

whoah, didn’t know AMEX PRG had retention offers! why didn’t I call this year! Thanks for the reminder.

Give it a shot next time and let me know how it goes!

This is great. But do you think it’s better to call before the annual fee hits (like maybe a month earlier) or after? Thanks

This came up on my last post too, I always call after the annual fee hits, and I’ve heard others get better luck doing the same. Personally, I’d recommend calling after the fee posts.

You got lucky… I have been getting half that for the PRG… 2500 MR upfront and 5000 MR after $1k in spend… still not a bad deal. I’ve 5 AUs (the maximum they’ll allow without additional fees) on my PRG which really helps me scale some of those more lucrative Amex offers.

Absolutely! My AmEx Offers have been dry lately, but it only takes a few real good ones to make up for it.

Why is Chase so cheap? I closed my British Airways account because they wouldn’t give me any points. But you are right about AMEX they do give me goodies if I ask

The million dollar question! I don’t eve try with Chase anymore, I’d rather fly under the radar, if you know what I mean..

Nice article with hot tips, Cam, thanks. I wonder how much card activity counts for retention offers, at least with Amex? I had an Amex Ameriprise Gold and did a lot of Amex Offers plus some other spend, maybe $5k in a year and two retention calls got nothing. They both said I didn’t have enough activity to warrant a retention offer.

Good question Mark, I’m not sure how much they use as a guideline, but I put a lot of spend on my PRG and my Plat – the Platinum is awesome for booking flights for family and friends with that 5x multiplier!

I cannot believe you didn’t include your Barclay’s Aviator on the list. There are a ton of data points about getting the annual fee waived.

Sorry Joseph, I’ve never had the Aviator! My only experiences with Barclay are the Arrival, Arrival+, and JetBlue Plus