KEY LINK – card_name – bonus_miles_full. annual_fees

A few weeks ago, I wrote about filing a Capital One Venture X trip delay insurance claim. This was due to my son’s misconnect in Charlotte. He was scheduled to fly from Cincinnati to Baltimore via Charlotte on American Airlines, but his flight from CVG to Charlotte was delayed, causing him to misconnect in Charlotte. He was not able to make his connecting flight from Charlotte to Baltimore, though it’s possible if we hadn’t been proactive, he might have saved the trip!

(SEE ALSO: Capital One Venture X Review – the best premium credit card)

Capital One Venture X Trip Delay Insurance Details

Here are a few details on the Capital One Venture X trip delay insurance:

- You must pay for your trip with your Capital One Venture X card (paying the taxes and fees on an award ticket counts!)

- If you have a delay of more than six hours (or an overnight stay), then the insurance kicks in

- It can cover up to $500 for each purchased ticket

- Only “reasonable expenses” will be reimbursed. This can include meals, lodging, toiletries, clothing

- You, Your spouse and Your dependent children under twenty-two (22) years of age are automatically covered

Information Needed For A Capital One Venture X Trip Delay Claim

You can file and manage your claim over the phone, or online at https://www.eclaimsline.com/

I wrote in more detail about filing a Capital One Venture X trip delay claim earlier, but the basic information you’ll need is:

- A copy of the detailed original and updated travel itinerary and/or the Common Carrier tickets

- A copy of Your monthly billing statement (showing the last four [4] digits of the Account number) confirming the Common Carrier ticket was charged to the

- A statement from the Common Carrier explaining the reason for the delay

- Copies of itemized receipts for Your claimed expenses. For food expenses, receipts are required, however itemized receipts are only required for bills of fifty dollars ($50.00) or more per covered traveler.

- Any other documentation deemed necessary by the Benefit Administrator to substantiate the claim

As far as I could tell from reading the insurance documentation, you do NOT need to pay for your incidentals / hotel / expenses with your Capital One Venture X card (just the original trip).

There was a question in the comments of the original post asking “how do you get a letter from the airline that explains the reason for the delay?” I didn’t know at the time, but it turned out that at least in my case, there was no need for any statement from the airline. I submitted screenshots of the AA app showing that he had missed the flight and needed to rebook, as well as screenshots from FlightAware

(SEE ALSO: The #1 trick to tell if your flight is going to be delayed)

Capital One Venture X Trip Delay Insurance Resolution

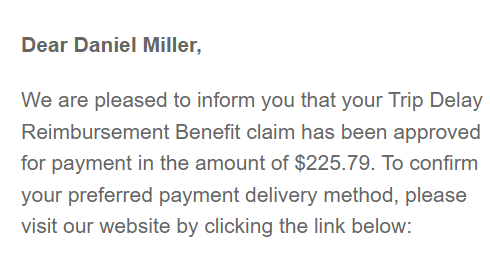

And that was apparently sufficient. It took about 3 weeks, but I got a Capital One Venture X trip delay insurance resolution via email

And that was that. I went online, put in my ACH information and the money was in my account a few days later. I also got a phone call from the claims people letting me know that my claim was approved. The additional call was unnecessary but a nice touch.

The Bottom Line

KEY LINK – card_name – bonus_miles_full. annual_fees

Capital One Venture X trip delay insurance is one of the reasons I think the Venture X card is the best premium / luxury card out there. As long as you pay for the trip with your Venture X card, you’re covered for up to $500 per ticket for meals, lodging and other incidental travel expenses if your flight is delayed by more than 6 hours or you require an overnight stay. I just submitted my first Capital One trip delay insurance claim and am hopeful to be reimbursed for the extra meals and hotel I booked for my son.

Have you used Capital One Venture X trip delay insurance before? What was your experience like? Leave it in the comments below

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Capital One. What’s in your wallet …. Well I hope for you NOT Capital One. Worst customer claim support. I got scammed by a hotel and not even denying a fraud charge for Mexico returned. WORST credit card.

so he missed the flight or there was a delay/cancellation from the airline?

What was your reason of delay? I think c1 accepts only a couple of reasons for the insurance to kick in. Mine was “operational” reason provided by the airline and c1 rejected my claim and cited their terms and conditions, which I find very limited. I think chase is more generous so I started using the Hyatt card because Hyatt card seems to provide better insurance than c1

I don’t remember specifically but it was something related to the fact that his initial flight was delayed which made him miss his connection. It wasn’t anything special. It surprises me that Capital One would reject a claim like you said. What were the details of what happened?

So the airline said the delay was due to operational reason on the letter they provided, which I had to submit as a part of the process. Then c1 replied and said the terms and conditions allow for reasons only for equipment failure, inclement weather, strike or hijacking. They quoted the guide to benefits as it lists these three as the only delay reasons. So I amd surprised that they didn’t ask for the reason in your case.

Please check page 16, covered hazard on guide to benefits. It lists only these as covered