Here we go folks, we’re in business! Yesterday, the Bonvoy program went live, and released their 3 new credit cards too.

We’ve been covering a lot on the Bonvoy updates. Check out the full series here:

- Announcement

- Changes to AmEx’s card portfolio

- Chase Marriott card changes

- 3 New offers and thoughts on opening the new cards

3 New Bonvoy Cards for the Program

As of today, Chase and AmEx have worked together to bring 3 new options to the Bonvoy cobranded card portfolio. (Though they’re getting rid of a bunch of the former Chase options.)

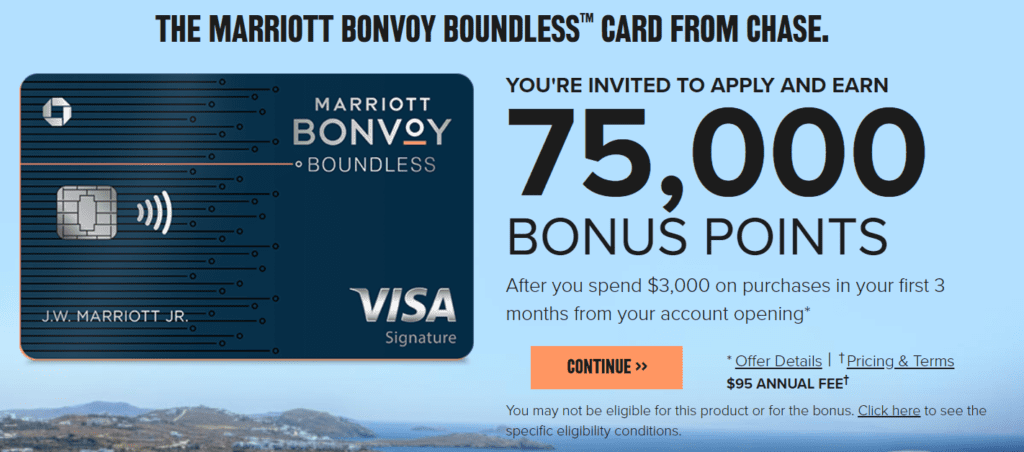

First up, let’s look at the new Chase offering – the new Bonvoy Boundless card from Chase. This is really just a rebranding of the previous Marriott Rewards Premier Plus card. As the screenshot shows, Chase is offering 75,000 points for $3,000 in spend within your first 3 months of card ownership. But don’t forget the eligibility requirements for the welcome offer! If you’ve gotten the bonus on any Marriott or SPG card in the past 24 months, tread lightly.

Chase will also be introducing a personal, no fee Bonvoy card in the near future, but we don’t have any details on it yet. Rumor has that it will be released this summer, maybe just in time for your summer getaway!

Next up, the Bonvoy Business credit card from American Express. This card is replacing the former Starwood Preferred Guest Business AmEx, and comes with a slightly higher welcome offer: 100,000 Bonvoy points after $5,000 in spend in the first 3 months.

(SEE ALSO – I’m Cancelling my SPG Business Card – And You Should Too)

Last but not least, the Marriott Bonvoy Brilliant American Express Card! The Brilliant card has launched with the exact same offer is the Bonvoy Business card. $5,000 spend in the first 3 months will earn you 100,000 Bonvoy bonus points. The Brilliant is the new version of the Starwood Luxury card, with the $450 “luxury” annual fee to match. For that steep price, you have a few benefits over the personal cards, including a $300 hotel credit, $100 credit at Ritz-Carlton and St. Regis properties, and the ability to spend up to Platinum Elite status.

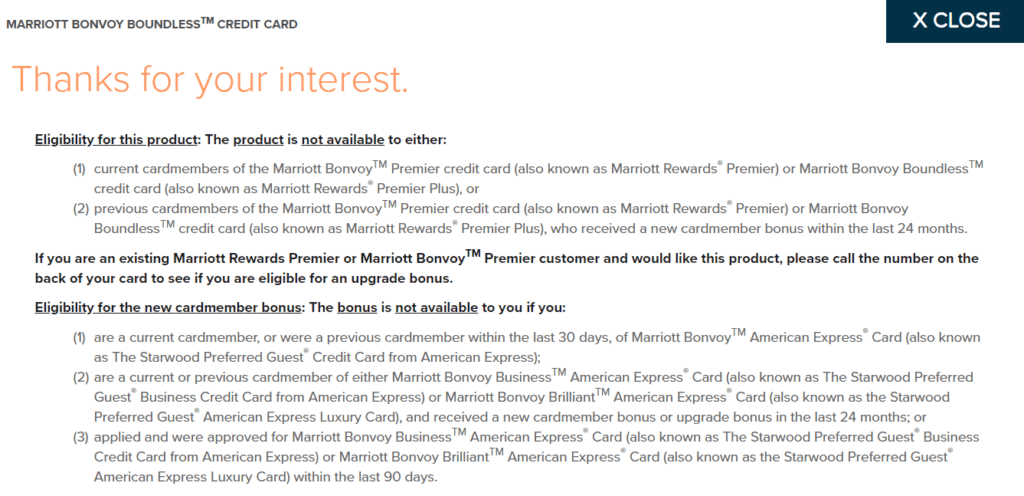

Remember, Chase and American Express have gotten pretty strict on the welcome bonuses for these cards. Here’s the terms for the Chase Bonvoy Boundless:

Should you apply?

I’ll say what I always say about a new credit card offer. It has to be worth it to you, otherwise don’t apply! I’d say these new offers are about average, certainly nothing to be impressed by. In a few circumstances, it might make sense? I can see the case made for Marriott/SPG loyalists or road warriors. Maybe someone that really needs an annual free night for a particular redemption coming up. Other than that, I’ll avoid these products for now.

Keep an eye out for a few more posts on these cards, as I’ll dive into the details a bit more int eh next few days!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments