This is it!

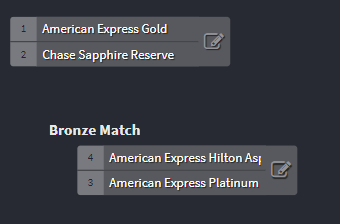

64 cards, 62 games, 14 posts, and only 1 card can win now. The AmEx Gold and the CSR will move onto the final round.

Which card will take home the Card Madness 2019 Gold Medal?

Loving the Card Madness 2019 series? Follow along here:

- Pick the Best Credit Card of the Year with Card Madness 2019!

- Card Madness 2019 Bracket is up! Check the 64 Cards and Vote Now

- Vote for Your Favorite Round 1 Cards!

- AmEx and Chase Dominate the Competition!

- Two Games go into Overtime!

- Ultimate Rewards are Undefeated in Round 1!

- Flexible Points Lead the Pack, Goodbye Airline Cards!

- Hotel Cards for the Win, and Ultimate Rewards Finally Lose!

- PWaC Readers Must Like Paying Annual Fees!

- Barclays Narrowly Stays in the Tournament with its Last Card!

- A Major Win for AmEx! (and a Major Loss for Chase…)

- Vote for Your Elite Status Eight Teams Here!

- Welcome to the Financial Four – Card Madness 2019 Heats Up!

Game 61: American Express Gold (89 votes) vs. American Express Hilton Aspire Card (50 votes)

The AmEx Gold topples the AmEx Hilton Aspire, and moves onto the final round! In my opinion, the Gold card’s new suite of benefits, as well as the increasing value of American Express Membership Rewards points, set the Gold a half step above the Hilton Aspire. As far as hotel cards go though, you’d be hard-pressed to find a better one than the Aspire at the moment.

Game 62: Chase Sapphire Reserve (113) vs. American Express Platinum (44)

The Sapphire Reserve will face off against the American Express Gold in the finals! The CSR beat the Platinum by a wide margin, over double the number of votes! From the beginning of Card Madness 2019, we knew the Reserve would be a crowd favorite. The card was originally seeded number 2, just behind the AmEx Gold. Now, the CSR and Gold card are up against each other for all the marbles!

(Interested in either of these cards? Check out the latest offers on our Top Credit Cards Page!)

Follow the Challonge bracket here!

Card Madness 2019 Finals

You guys will have all weekend to vote on the final two games. We’ll close polls Sunday night, so there’s plenty of time to decide. On Monday April 8th (to line up with our basketball tournament namesake), we’ll announce the winners!

1st Place Matchup: American Express Gold vs. Chase Sapphire Reserve

This is the match up we’ve all been waiting for…the number 1 and number 2 seed! You guys must have picked some great cards, I find it really cool that the top 4 cards are the original top 4 seeds!

In one corner, weighing in at a $250 annual fee, we have the American Express Gold Card! With 4x Membership Rewards on restaurants and up to $25,000 spent at grocery stores, and 3x on airfare booked with airlines or on the AmEx Travel site, the Gold card is a serious contender. Cardholders will also get a $100 annual airline credit and a $10 monthly dining credit at select locations. So far, the Gold card has taken down the AmEx Business Lowe’s Card, the US Bank FlexPerks Travel Rewards Visa, the Chase Freedom, the Chase Ink Cash, and the AmEx Hilton Aspire.

In the other corner, the heavyweight champ, the Chase Sapphire Reserve! For a $450 annual fee, the Reserve will get you triple Ultimate Rewards on travel and dining, and offers a $300 annual travel credit. Reserve holders also get a 50% bonus on the value of their points when redeemed through the portal – making UR virtually unmatched for flexibility. The Chase Sapphire Reserve has reigned supreme over the Synchrony Sam’s Club Card, the MileagePlus Explorer, the Platinum Delta SkyMiles AmEx, the ThankYou Prestige, and the American Express Platinum (two of its closest competitors!).

Any of these cards can get you a great room at the Hilton! Either with Hilton points, AmEx Travel, AmEx Offers, or the Chase Travel Portal.

3rd Place Matchup: American Express Hilton Aspire Card vs. American Express Platinum

Two luxury travel cards from AmEx will duke it out for the bronze medal in this match! (I’m sure the Bonvoy Brilliant feels a bit left out…

First up, the American Express Hilton Aspire! The Aspire earns 14x Hilton points on Hilton stays, 7x Hilton points on airfare, car rentals, and restaurants, and 3x on everything else you pay for with the card. The card also has some great benefits to offset its annual fee: Cardholders get an annual $250 airline credit, a $250 resort credit, one free weekend night automatically, and another after $60k spend on the card in a calendar year, and automatic Hilton Diamond Status. Before losing to the AmEx Gold in the last round, the Aspire had defeated Wells Fargo Propel Card, the Chase Freedom Unlimited, the Chase Sapphire Preferred, and Bank of America Alaska Visa.

The American Express Platinum comes in a bit higher, at a $550 annual fee. Cardholders earn 5x Membership Rewards on airfare and AmEx Travel bookings when they use their Platinum card. A lot of folks get some great value out of an annual $200 airline credit, $200 in monthly Uber credits, and access to the AmEx concierge. Plus, Platinum cardholders received Priority Pass Select Membership and access to the American Express Centurion Lounges. For weary travelers, that lounge access is clutch. The AmEx Platinum won against the FNBO TravElite Card, the Chase IHG Premier Card, the Hilton Ascend, and the Chase World of Hyatt, before the Chase Sapphire Reserve sent it packing.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

PWAC ran this tournament 2 years ago and CSR did not just win, it demolished every card it was matched against. If someone had told me they were going to run this again, I would’ve bet PWAC that CSR would win again. Sure enough, CSR voters have wiped out every card it has been matched up against.

The CSR cult is real. After all, what other card got its own Businessweek cover? 🙂

What surprises me is how close this last match currently is. Voting isn’t closed, but when I checked, it was about 56%/44%.

Another comment: I have coworkers who got the CSR during all the hype when it was released. Pretty much all of them have stated “I really need to do something with my points one of these days”.

*head explodes*

It’s been 2.5 years.

Funny, at least UR points do not expire. I used my 100,000 points to go to Spring Training. Hotels that would’ve been $250-$500. I do not see how Chase thought they could make money that way.

When CSR won 2 year ago, it was right after that 100,000 sign up offer. I remember because I was staying in a Country Inn during that March Madness. I thought by this time maybe the CSR fanfare had faded.

All hail the CSR cult!

(I’m an AmEx fan trying to infiltrate it…darn 5/24)

You know, the more I think about this it comes down to the user. For me, it’s the CSR. But, if I’m looking at it from the perspective of ALL credit card users, it changes.

To get full value out the CSR you need some savvy and a business card to go with it. But to your average consumer that doesn’t mess with all of that, Amex Gold is the better bet. 4x MRs on grocery and restaurants gets more every day use than anything else.

Definitely. CSR is great if you know how to use it and can get value out of the portal and Priority Pass, but I think the Gold is the better card personally.

I think that’s what we saw with the other UR cars in this tournament too: UR cards are great, but only if you know how to use them and have 2 or 3 to take advantage of bonus categories. A CFU on its own though? Not a fantastic option..