If you are a credit card churner, then you probably know the feeling you get when you apply for a credit card, only to get a message saying something along the lines of:

If you are a credit card churner, then you probably know the feeling you get when you apply for a credit card, only to get a message saying something along the lines of:

Thank you for applying! We need to review your account before we can make a final decision on your application

It’s the dreaded…. PENDING… review. Sometimes they give you a phone number to call in, or sometimes the bank / credit card issuer will just tell you they’ll get back to you in the next few days / weeks.

(SEE ALSO: Citi reconsideration phone number and website)

(SEE ALSO: Bank of America reconsideration phone number and website)

Generally I DON’T call the reconsideration line

For awhile, it was pretty straight forward that you almost always wanted to just call into the bank, answer a few questions and you would generally be approved. But recently, banks and credit card issuers have started really clamping down on credit card churners (people who open / close lots of accounts in a short amount of time). Chase has implemented something called the 5/24 rule, where any applicants that have applied for more than 5 cards in the past 24 months will NOT be approved for the Chase Sapphire or Chase Freedom cards. Soon the Chase Ink will also be included in the 5/24 rule!

So many of these reconsideration line phone calls have proven to be pretty tough. When I posted about a letter I received for a recent Chase Marriott business card application, one commenter suggested

“Send docs and avoid call at all costs. I didn’t wait for that option and called. Worst recon call ever. I finally got approved after 25 min. of grilling about why so many apps, credit cards, etc. Same qs over and over, put on hold about 3 or 4 times”

For that reason, my general rule of thumb is to NOT call the reconsideration line and just wait for the application process to play itself out. I’ve found that usually you’ll get approved after a few weeks and get a surprise credit card in the mail!

(SEE ALSO: Not calling the reconsideration line works again!)

This time though, I DID call

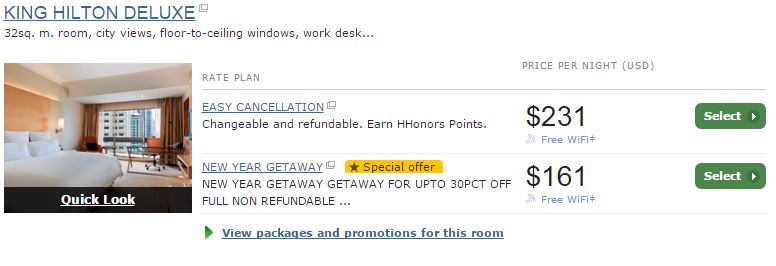

I recently applied for a Citi Hilton Reserve card, which gives 2 free weekend nights after meeting the minimum spend. The $95 annual fee is NOT waived the first year, but in exchange for the $95, I will save nearly $500 for a 2 night stay

Well, really I’m saving 120,000 Hilton points since I’d probably have used that, but still plenty worth it IMO

For my last few Citibank applications, I have gotten the pending message and in the end, it was just due to reaching the maximum available credit limit that Citi wanted to give me. I have 5 existing Citi cards, so my total credit is pretty substantial. So I called in – and this time it was no different. When I called in, after a few pleasant questions, the agent said she could give me a $4,000 limit on my Reserve card, and we agreed to transfer $5,000 over, and I was approved over the phone

If you would like to apply for this Citi Hilton Reserve card (or any other cards) and support Points With a Crew, I appreciate it!

Readers what say you? Any tips for when or when NOT to call the reconsideration line?

Points With a Crew has partnered with CardRatings for our coverage of credit card products. Points With a Crew and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I had a similar experience with Citi Sunday night. It was for my 4th Citi card and 3rd AAdvantage Platinum. I had previously lowered my credit lines on the other AA cards. When I called in, we small talked while she pulled up my info. She then thanked me for having a Prestige and two AAdvantage Platinums. Then it was “I can approve you for $6,900, or we can move some credit around” I told her that $6,900 was plenty for what I needed. I was on hold for a while, then she informed me it would be here within 7-10 days.

In my experience, it is fine to call Citibank, or if you don’t call them, they will call you. It is Chase that you want to avoid talking to.

I called Chase on Monday, and am glad I did. I applied for the IHG card, and it went Pending. The CSA said they were concerned about granting me an additional credit, since they’ve issued me the Sapphire & Marriott cards within the past 9 months. I told her I wanted the card, not necessarily additional credit. So she reduced the limit on my Marriott card, and approved me for the IHG. Problem solved. I’m consistently impressed with Chase’s customer service.

I know this will sound crazy, but I’ve always had amazing experiences calling chase back end. I’ve been approved for thousands of dollars of CLI with only a soft pull and no income verification. Really happy with their service, always keep low utilization and a credit score about 750.