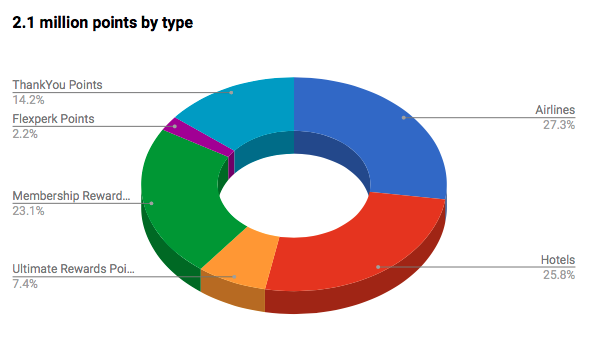

I started keeping track of my points earning progress in early 2017 when I decided to tally up the points I earned in 2016. Much to my surprise, I earned over 1.6 million points that year. So throughout 2017, I kept track of my points on a monthly basis. Now that the year is over, result is in. I earned 2.1 million points in 2017!

[SEE ALSO: How I earned 1.6 million points in 2016 ]

[SEE ALSO: I got a million points, and you can too! ]

Over 2.1 million points earned in 2017

Points earned from sign-up bonus and credit card charges contributed to about 70% of the total points i earned in 2017.

I also purchased about 433,000 hotel points last year and they were not included in the 2.1 million points I earned. The hotel points I purchased include Hilton, IHG and Choice points. I used up my Choice points (purchased at 0.5 cents each) for Saturday visits to Napa Valley. Instead of paying cash rates were well over $300 a night, I used 30,000 points per night, a saving of 50%!

[SEE ALSO: 4 best uses of Choice Points, 5 best uses of Hilton Points, 6 best use of IHG Points ]

595K points from credit card sign-up bonus

I started collecting points and miles seriously at the beginning of 2012. By 2017, I had gone through many of the cards out there. I became more selective about new cards. I don’t take Amtrak nor do I fly Southwest, so their cards do not interest me much (even though that might change in the future). I focused on cards either with big sign-up bonus or cards that would help me with upcoming trips. In 2017 I got the following cards and sign-up bonus:

[List of best travel credit cards]

- 25,000 Membership Rewards points with Amex Green Card

- 20,000 Membership Rewards points with Amex Blue Business Card

- 50,000 Membership Rewards points for upgrade from Business Rewards Gold to Amex Business Platinum Card

- 100,000 Hilton points for Upgrading my no-fee Hilton cards to Hilton Surpass

- 80,000 Hilton points for a friend’s no-fee-Hilton card which I did all the minimum spending and transferred the points to myself

- 120,000 AA miles through one Citi AA personal and one Citi AA business card

- 30,000 Alaska miles with BofA Alaska Business Visa

- 50,000 Delta Skymiles with my daughter’s Amex Delta Gold

- 30,000 TrueBlue points with Barclay’s JetBlue Plus card, sadly I applied right before the highest offer of 60,000 TrueBlue points came out.

- 30,000 Flexpoints with US Bank Amex Flexperks Gold

- 2 free nights with Chase Hyatt Visa. I counted it as 60,000 points as I will be using the two free nights for Park Hyatt New York.

In 2016, my husband applied for two cards which earned us 200,000 points. I knew it was a one-time deal back then as he didn’t apply for any cards in 2017. But luckily, our oldest daughter turned 18 last year. With a credit score of about 750, I was able to apply two cards for her with instant approval. In additional to 50,000 Delta miles earned in December 2017, she also got 60,000 AA miles just this month which will counted for 2018 points.

[I’m way over 5/24… I applied for a new Chase Ink card anyways]

225K points from credit card anniversary, threshold and referral bonus

In 2017 I earned about 50,000 points from credit card anniversary bonus and 70,000 points from reaching spending thresholds. I also earned about 105,000 points from referral bonus which sadly would not be repeated in 2018.

250K points from various promotions

These points came from transfer bonus, retention offers, promotions such as Alaska Airlines “Dash for Miles”, and Marriott NFL tweets, etc. Also included here are Amex Offers that offers bonus points instead of statement credit. I paid close attention to all the promotions available and try to maximize if I can. As an example, I got over 40,000 points from Amex offers for Dell computer, telecom, AT&T, Boxed and more.

38K points from online purchases

One advantage of having three girls is that we do shop a lot! I did most of my shopping online by going through various airline or cash back shopping portals. I usually started at Cash Back Monitor to find the portal with the highest earn rate. I also took advantage of the various portal offers. As an example, we need lotions and makeup, and the prices are usually the same at Sephora or Sakes or Nordstrom and Macy’s. But each store pays out differently when you shop through a portal. I buy when Sephora is paying 12x or when Saks is paying 15x, and skip the 3x at Macy’s or 1x at Nordstrom! I buy girls’ backpacks or our luggage from eBags which often pays 12x or 15x, and I stack it with Amex Offer to save even more.

114K points from flights and hotel stays

Usually I didn’t earn much i this category because most of our flights were either booked using miles or flexible points that earned us miles. Our hotel stays in 2017 were mostly booked using points plus two weeks in timeshare resorts exchanged through our timeshare week.

844K points from credit card charges including bonus

No I did not charge $844,000 on my credit cards! But living in Silicon Valley means we do have lots of expenses every year, and in 2017 we added college expenses. Luckily, the my daughter’s university does not charge any fees when paying by credit card! I always try my best to maximize all the bonus points I could earn.

- Online purchases that earns 3x points with Citi AT&T Access More. This is by far my favorite cards for online purchases as well as mortgage payments and property taxes.

- Make at least 30 transactions every month on Amex Everyday Preferred card to trigger 50% bonus on all purchases. (It is easier than you think!)

- Max out on Chase Freedom quarterly category bonus

- 50% bonus on charges over $5,000 on Amex Business Platinum.

- 2x points with Amex Blue Business card.

- 4.5x on grocery purchases (5x during Q2) including gift cards

- 3x travel and dining

- 3x on gas (5x during Q1)

- 2x on entertainment

- 1.5x on everything else

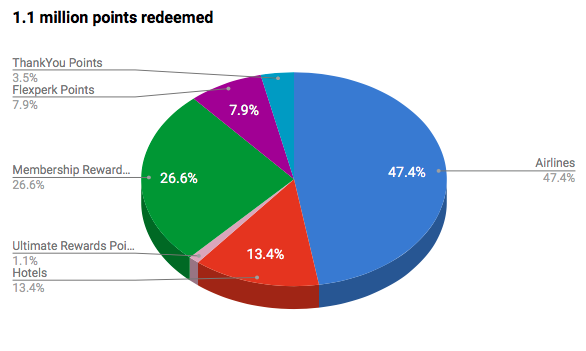

1.1 million points redeemed

I know “earn ’em burn ’em” is really the name of the game. But with limited vacation days, 3 kids to raise and a suddenly increased responsibility at work, I just couldn’t earn and burn at the same rate. However, I did redeem 1.0 million points during 2017. Most redemptions were for 2017 trips and some for my three trips in 2018. I also spent some points helping friends and family.

When I redeem my points, I paid close attention to which program would give me the most value. For example, instead of using all points for a Hyatt stay, I would combine points and cash, or something I would pay cash and keep the points. Or when booking a Delta flight, instead of booking directly with Delta using miles, I booked it through Amex Travel and paid with membership rewards points to take advantage of the 50% point rebate benefit from the Amex Business Platinum Card. Sadly, the rebate is reduced to 35% now. I think from this point forward, my Amex points will be used to transfer directly to airlines. Towards the end of 2017, I also cashed out all my US bank Flexpoints at 2 cents per point before its redemption value dropped to 1.5 cents per point.

The points aren’t completely free

Yes there were cost involved in earning those 2.1 million points. Obviously I paid a good amount of credit card fees each year. My rule has always been: 1) only pay annual fee on a credit card if I can get more value out of it; 2) only pay a fee to charge a purchase if points earned can be redeemed for a value higher than cost. I never carry credit card balances and always pay off each statement balance every month.

Free travel has never been my goal of collecting points and miles. Instead, they helped me to lower the cost of my family’s travel. By redeeming points, I was able to save on flights and hotels, therefore able to spend more on activities and food. Recently, during our Christmas trip to Florida, we took the girls for an incredible evening of fine dining experience at the award-wining Victoria & Albert’s restaurant located inside Disney’s Grand Floridian Resort. It was by far the most expensive dinner we ever had, much more than our $1,000 dinner for two at French Laundry, and it was worth every penny!

Strategy for 2018

I have reached a good combination of cards that I am planning to keep going forward, and I will be canceling some cards as well. I love my Citi AT&T Access More for the 3x earning and I hope to convert a Citi AA card to another AT&T Access More for more credit line access. I doubt I will be signing up as many cards this year as I did in 2017 and 2016, Nonetheless, I will continue to look for cards with big bonus and offers targeted to me personally.

The rest won’t change, it has become a habit of mine that is impossible to break – paying attention to promotions and category bonus, shopping through online portals, keeping track of threshold spending.

Thanks to miles and points, my family were able to take some incredible trips in the past and made unforgettable memories. I have about 4.9 million points and miles remaining at the end of 2017 but have only three trips planned for 2018. I am in the process of booking a Christmas trip to China with my youngest daughter. Other than that, we have no family trips planned this year, So I expect my point balance will grow by year’s end. Perhaps I need to look beyond 2018 to plan an epic trip and burn some serious points!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

oh no, the SiVal 1%er only was able to get 844K through spend? LMAO However will they be able to winter in Gstaad on such lowly incomes?

Yeah, even at an average of 3x on all spending, that’s something like $281K spending…

Thanks for sharing your strategies.

I share your strategies and mindsets. I am in the points and miles game to drastically reduce travel costs and be able to enjoy luxury travel at pennies on the dollar. It’s not about cost as much as it is about what we get for our time and money. Like you, I’m not looking for freebees but great deals and experiences.

By the way, 4.9M in points and miles? You are assuming a big risk by hanging on to so many points and miles. I’m only hanging on to 1.5M ( full disclosure: I take 4 international vacations a year so I am constantly earning and burning. )

I know I am taking the risk of devaluation. But our travel window is limited due to work and school schedule, and add that to the difficulty of finding 5 award seats on the same plane, it is not as really that easy plan a trip for my family of five.

Yeah, but you have so many miles that even if you had to purchase standard award tickets for a vacation it would be worth it cause you could all fly, you’d use a good amount of points, hedging against devaluation, anddd if I’m correct you’d earn miles on those standard awards so not to bad for a family of 5.

My biggest challenge is actually scheduling, especially now with my oldest daughter in college. Yes I would consider paying standard mileage or split up in two groups (we did that last time all five of us flew CX first class in two different dates), but I have to get the schedule work for everyone first. I don’t think you earn miles on standard awards.

What, no points from opening bank accounts?

No, that is one area I don’t touch. I draw a hard line there years ago.

We are in pretty much exactly the same spot as you. Our 2017 earn is about 2.2 million (the lowest annual total for us since we started in 2013) and we currently have about 4.9 million points and miles.

@Jay, certainly for one or two people, 4.9 million points might be a very high total, but for 5 or 6, it is really not that much. Our trip to Europe (8 people) cost 1.8 million, to Egypt, Greece, Turkey and Jordan (6 people) cost 1.4 million, and to Japan, Hong Kong and China (6 people), 2.2 million, so 4.9 million really doesn’t go as far as you might expect.

Having enough points in more than one program (to allow flexibility) to move around and house that many requires a very high total.

Wow thank you! You totally understand my position! 🙂

*privilege alert*

I am bit like you in that I do not fly Southwest and due to the wife teaching we cannot go anytime there are good saver flights. Often there are family things to do, and we have to work flights around those. I use the Barkley Arrival card to pay for alot of things that just tip over $100. I would rather stay at a Marriott and pay the $135 on the Arrival card, get the Marriott points/stay. I figure those stays cost me about 20% of the actual cost. I will take that 80% savings anytime. Got a stay coming up at a Choice hotel for a wedding. The room, tax and all is 98.67. I will charge a bag of chips to the room and make it over $100. The Arrival card will pay for the room, I get a Choice night stay/points and did not waste any Choice points.

I have a question that’s personal so feel free to ignore it. Do you carry a balance on any of your credit cards and have you checked your credit reports? As someone who looks at credit reports to help guide clients, having many credit card accounts doesn’t help.

No I never carry a penny of balance. One rule in this points/miles game is that you should always pay the balance off every month. Yes I do check my credit reports, and my scores have always been around 800.

The Chase Hyatt comment is not correct. The two free nights are only for category 1-4 hotels – and the Park Hyatt in New York is much higher I believe…

Not the free nights that were the sign up bonus until about 6 months ago when they were switched to 40,000 points. Those were for pretty much any Hyatt.

The annual free night is for cat 1-4

I got the Hyatt card when the offer was two free nights anywhere. So I booked them for Park Hyatt NYC which is 30K per night.

Thanks for laying this all out Sharon. Really helpful. Even if we all spend at different amounts, it’s the strategy & opportunities that matter.

One question: How do you track all the promotions and special bonuses?

Excel spreadsheet or Google sheets 😉